Answered step by step

Verified Expert Solution

Question

1 Approved Answer

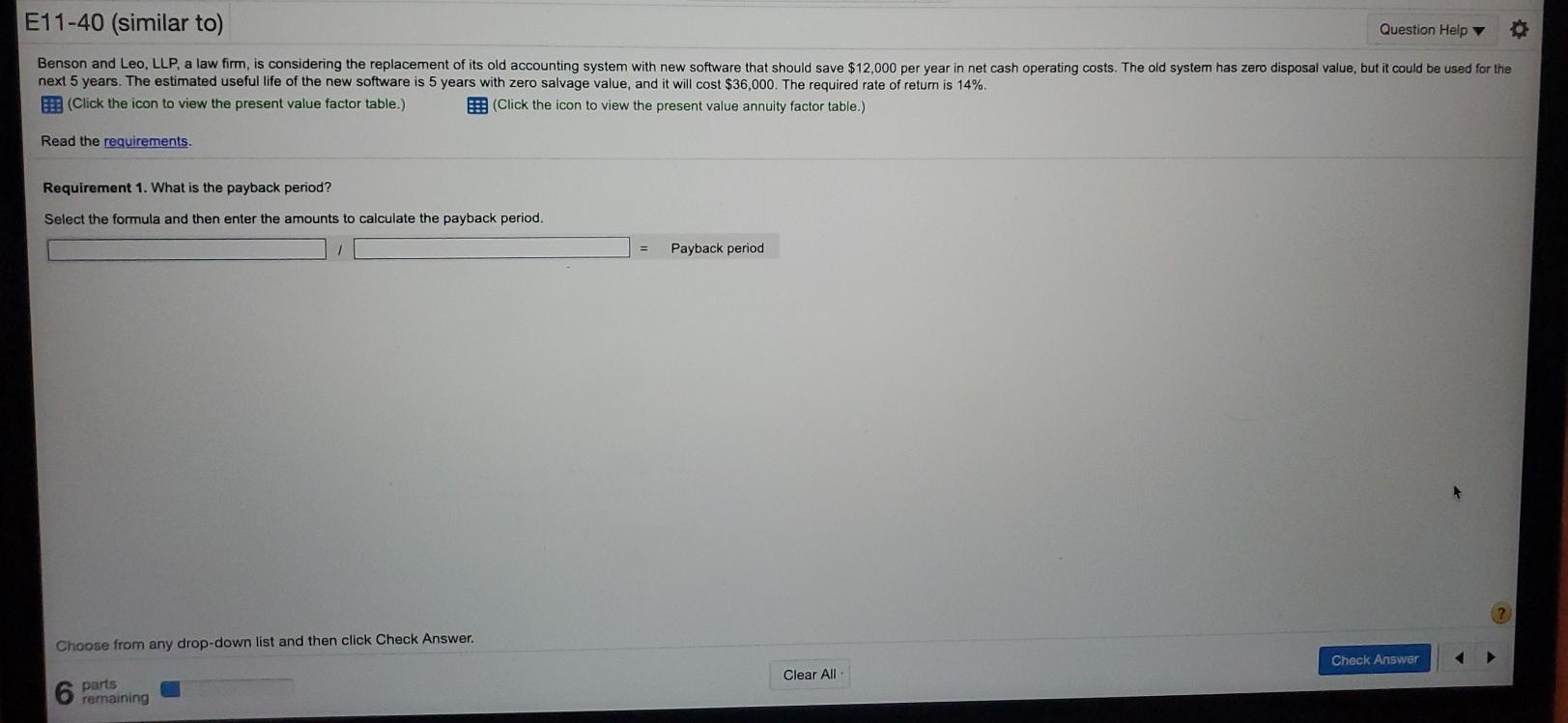

E11-40 (similar to) Question Help Benson and Leo, LLP, a law firm, is considering the replacement of its old accounting system with new software that

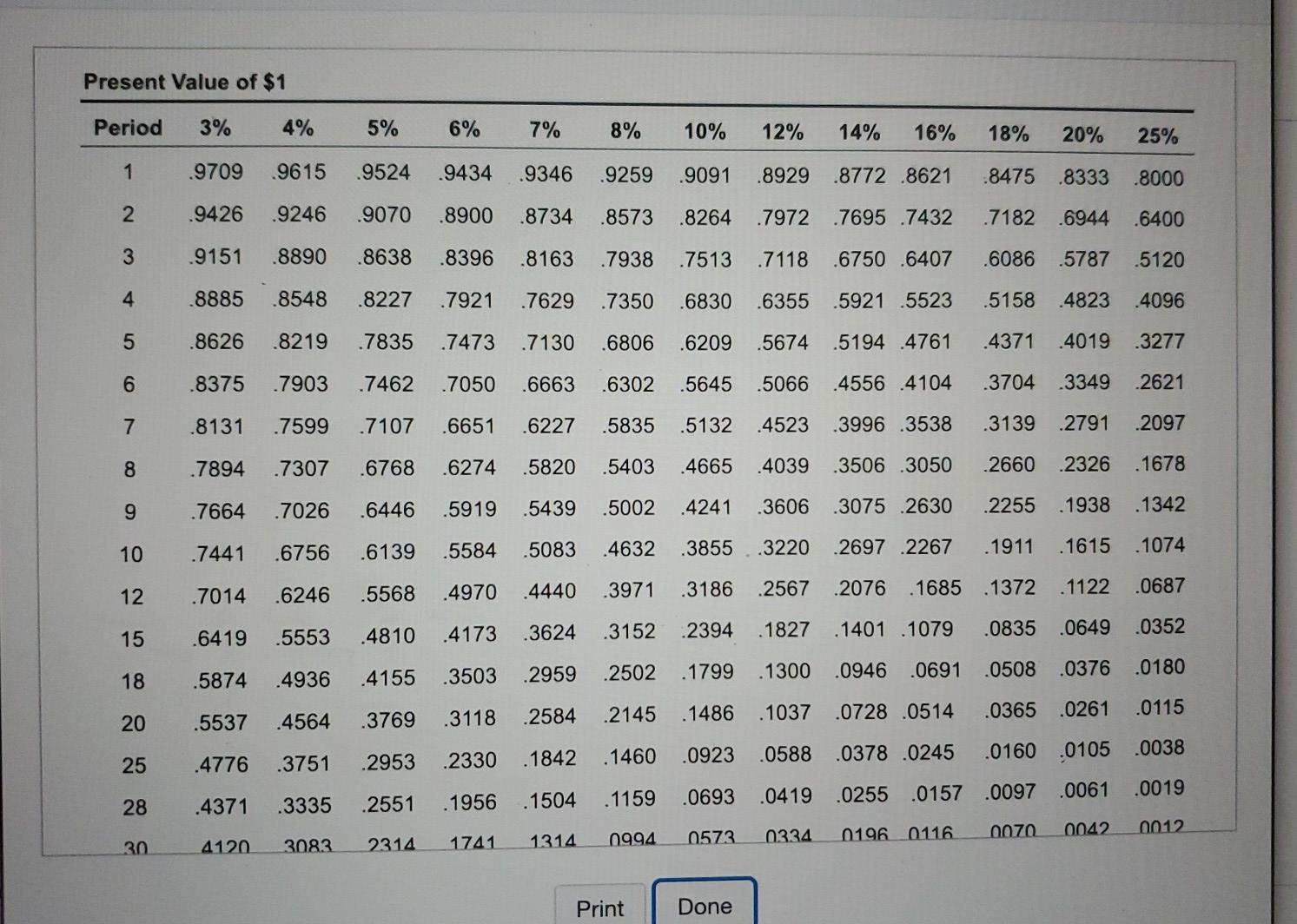

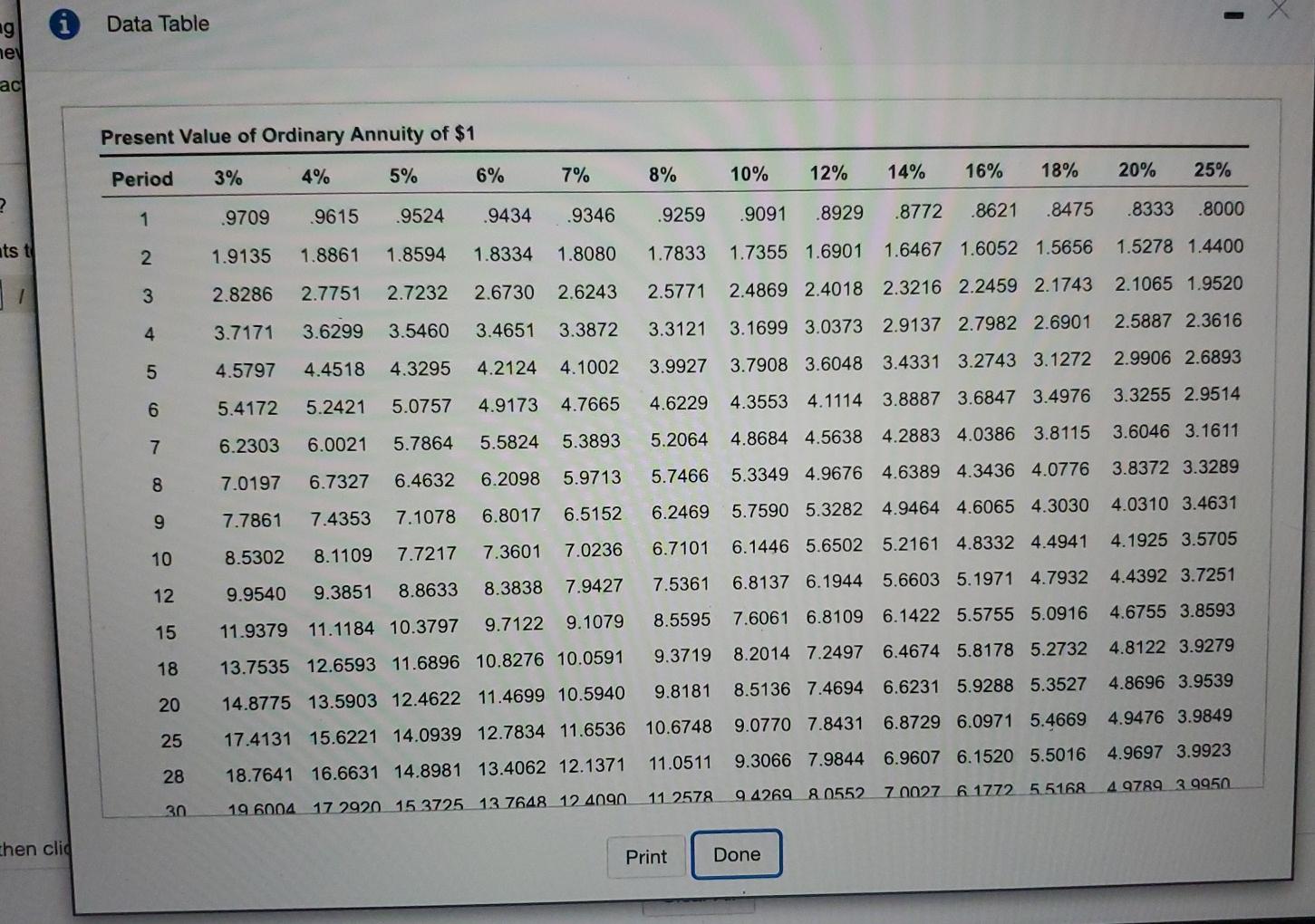

E11-40 (similar to) Question Help Benson and Leo, LLP, a law firm, is considering the replacement of its old accounting system with new software that should save $12,000 per year in net cash operating costs. The old system has zero disposal value, but it could be used for the next 5 years. The estimated useful life of the new software is 5 years with zero salvage value, and it will cost $36,000. The required rate of return is 14%. E (Click the icon to view the present value factor table.) (Click the icon to view the present value annuity factor table.) Read the requirements. Requirement 1. What is the payback period? Select the formula and then enter the amounts to calculate the payback period. Payback period ? Choose from any drop-down list and then click Check Answer. Check Answer Clear All parts remaining i Requirements - x 1. What is the payback period? 2. Compute the NPV. 3. Management is unsure about the useful life. What would be the NPV if the useful life were (a) 3 years instead of 5 or (b) 10 years instead of 5? 4. Suppose the life will be 5 years, but the savings will be $10,000 per year instead of $12,000. What would be the NPV? 5. Suppose the annual savings will be $11,000 for 4 years. What would be the NPV? Print Done Present Value of $1 Period 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 25% 1 .9709 .9615 .9524 .9434 .9346 .9259 .9091 .8929 .8772 .8621 .8475 .8333 .8000 2 .9426 .9246 .9070 .8900 .8734 .8573 .8264 .7972 7695 .7432 .7182 .6944 .6400 3 .9151 .8890 .8638 .8396 .8163 .7938 .7513 .7118 .6750 .6407 .6086 .5787 .5120 4 .8885 .8548 .8227 .7921 .7629 .7350 .6830 .6355 .5921 .5523 .5158 4823 4096 5 .8626 .8219 .7835 .7473 .7130 .6806 .6209 .5674 .5194 4761 .4371 4019 3277 6 .8375 .7903 .7462 .7050 .6663 .6302 5645 5066 .4556 4104 .3704 .3349 .2621 7 .8131 .7599 .7107 .6651 .6227 .5835 .5132 .4523 3996 .3538 .3139 .2791 .2097 8 .7894 .7307 .6768 .6274 .5820 .5403 4665 .4039 .3506 3050 .2660 2326 .1678 9 .7664 .7026 .6446 .5919 .5439 .5002 4241 .3606 .3075 2630 .2255 .1938 .1342 10 .7441 .6756 .6139 .5584 .5083 4632 .3855 .3220 .1911 .2697 2267 .1615 . 1074 12 .7014 .6246 .5568 .4970 4440 .3971 .0687 .3186 2567 .2076 .1685 1372 1122 15 .6419 .5553 .4810 4173 .3624 .3152 .0352 .0835 .0649 .2394 1827 .1401 .1079 18 .5874 .4936 4155 .3503 .2959 20 .5537 .4564 .3769 .3118 .2584 .2502 .1799.1300 .0946 0691 .0508 0376 .0180 .2145 .1486 1037 .0728 .0514 0365 0261 .0115 .1460.0923 .0588 0378 .0245 .0160.0105 0038 .1159 .0693 .0419 .0255 .0157 .0097 .0061 .0019 25 .4776 .3751 .2953 .2330 .1842 28 .4371 .3335 .2551 .1956 ..1504 0012 0334 0196 0070 0042 0573 0116 0994 30 4120 3083 1314 2314 1741 Print Done Data Table ag nel ac Present Value of Ordinary Annuity of $1 Period 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 25% 2 .9709 .9524 1 9615 .9434 .9259 .9346 .9091 .8333 .8929 .8000 .8772 .8621 .8475 its t 2 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.5278 1.4400 1.7355 1.6901 1.6467 1.6052 1.5656 3 3 2.8286 2.7751 2.1065 1.9520 2.7232 2.6730 2.6243 2.5771 2.4869 2.4018 2.3216 2.2459 2.1743 4 3.7171 3.6299 2.5887 2.3616 3.5460 3.4651 3.3872 3.3121 3.1699 3.0373 2.9137 2.7982 2.6901 2.9906 2.6893 5 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 6 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 2.9514 6.2303 7 6.0021 5.7864 5.5824 5.3893 5.2064 4.8684 4.5638 4.2883 4.0386 3.8115 3.6046 3.1611 7.0197 8 6.7327 6.4632 6.2098 5.9713 5.7466 5.3349 4.9676 4.6389 4.3436 4.0776 3.8372 3.3289 7.4353 9 7.7861 7.1078 6.2469 6.8017 6.5152 8.1109 10 8.5302 7.7217 6.7101 7.3601 7.0236 5.7590 5.3282 4.9464 4.6065 4.3030 4.0310 3.4631 6.1446 5.6502 5.2161 4.8332 4.4941 4.1925 3.5705 6.8137 6.1944 5.6603 5.1971 4.7932 4.4392 3.7251 7.6061 6.8109 6.1422 5.5755 5.0916 4.6755 3.8593 12 9.9540 8.8633 7.5361 9.3851 8.3838 7.9427 8.5595 15 11.9379 9.7122 9.1079 11.1184 10.3797 9.3719 8.2014 7.2497 6.4674 5.8178 5.2732 4.8122 3.9279 18 13.7535 12.6593 11.6896 10.8276 10.0591 9.8181 8.5136 7.4694 6.6231 5.9288 5.3527 4.8696 3.9539 20 14.8775 13.5903 12.4622 11.4699 10.5940 10.6748 9.0770 7.8431 6.8729 6.0971 5.4669 4.9476 3.9849 25 17.4131 15.6221 14.0939 12.7834 11.6536 11.0511 9.3066 7.9844 6.9607 6.1520 5.5016 4.9697 3.9923 28 18.7641 16.6631 14.8981 13.4062 12.1371 11 2578 49789 39950 9.4269 80552 700276 1772 5.5168 30 19 6004 17 2920 15 3725 13 7648 12 4090 then clic Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started