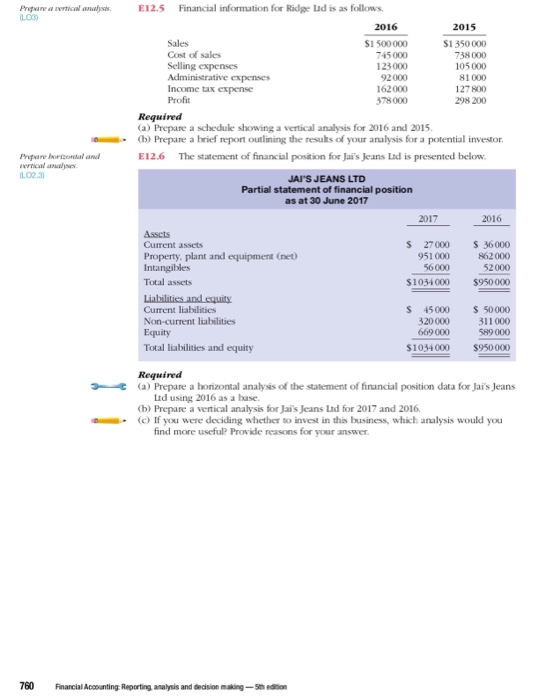

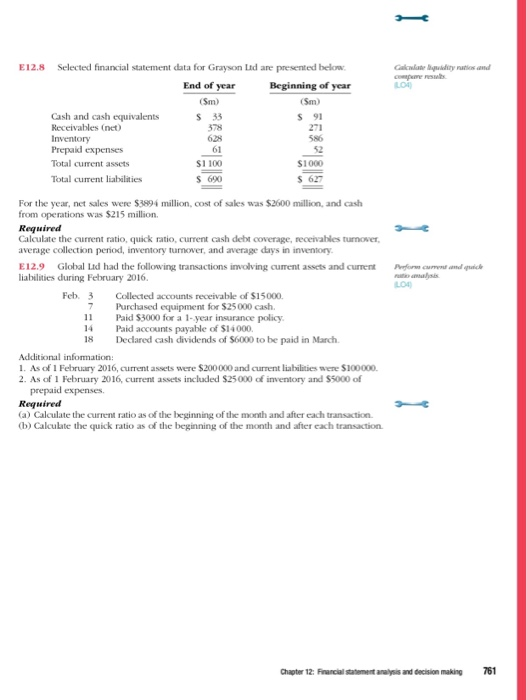

E12.5 Financial information for Ridge Lad is as follows. Prpare a vertical anahysis LO3) 2016 2015 $1 350000 Sales $1 500000 Cost of sales 745000 738000 Selling expenses Administrative expenses Income tax expense Profit 123000 92000 162000 378000 105000 81000 127800 298 200 Required (a) Prepare a schedule showing a vertical analysis for 2016 and 2015. (b) Prepare a brief report outlining the results of your analysis for a potential investor. Propare borizotal and eertical analyses E12.6 The statement of financial position for Jai's Jeans Ltd is presented below LO2,3 JAI'S JEANS LTD Partial statement of financial position as at 30 June 2017 2017 2016 Asscts Current assets S 27000 951 000 $ 36000 Property, plant and equipment (net) Intangibles 862000 56000 52000 Total assets $950000 $1034000 Liabilitics and equity Current liabilities S 45000 S 50000 Non-current liabilities 320000 311 000 669000 589 000 Equity Total liabilities and equity $950000 $1034000 Required (a) Prepare a horizontal analysis of the statement of financial position data for Jai's Jeans Ld using 2016 as a base. (b) Prepare a vertical analysis for Jai's Jeans Ltd for 2017 and 2016. (c) If you were deciding whether to invest in this business, which analysis would you find more useful? Provide reasons for your answer 760 Finarcial Accounting Reporting analysis and decision making-5h edition Selected financial statement data for Grayson Ltd are presented below E12.8 Calulate qidity ratios and compeme resb LO4 End of year Beginning of year (Sm) (Sm) s 33 S 91 Cash and cash equivalents Receivables (net) 378 271 Inventory Prepaid expenses 628 586 61 52 Total current assets S1 100 $1000 S 690 S 627 Total current liabilities For the year, net sales were $3894 million, cost of sales was $2600 million, and cash from operations was $215 million. Required Calculate the current ratio, quick ratio, current cash debt coverage, receivables turnover average collection period, inventory turnover, and average days in inventory Global Ltd had the following transactions involving curent assets and current E12.9 Pform cument and quick analsis LO4 liabilities during February 2016 Feb. 3 Collected accounts receivable of $15000. Purchased equipment for $25000 cash. Paid $3000 for a 1-year insurance policy Paid accounts payable of $14000. Decared cash dividends of $6000 to be paid in March. 7 11 14 18 Additional infomation 1. As of 1 February 2016, current assets were $200000 and current liabilities were $100000. 2. As of 1 February 2016, current assets included $25000 of inventory and $5000 of prepaid expenses. Required (a) Calculate the current ratio as of the beginning of the month and after each transaction. (b) Calculate the quick ratio as of the beginning of the month and after each transaction Chapter 12: Financial statement analysis and decision making 761