Question

E14.2 (LO 1, 2) Video Finance (Information Related to Various Bond Issues) Anaconda Inc. has issued three types of debt on 2023, the start of

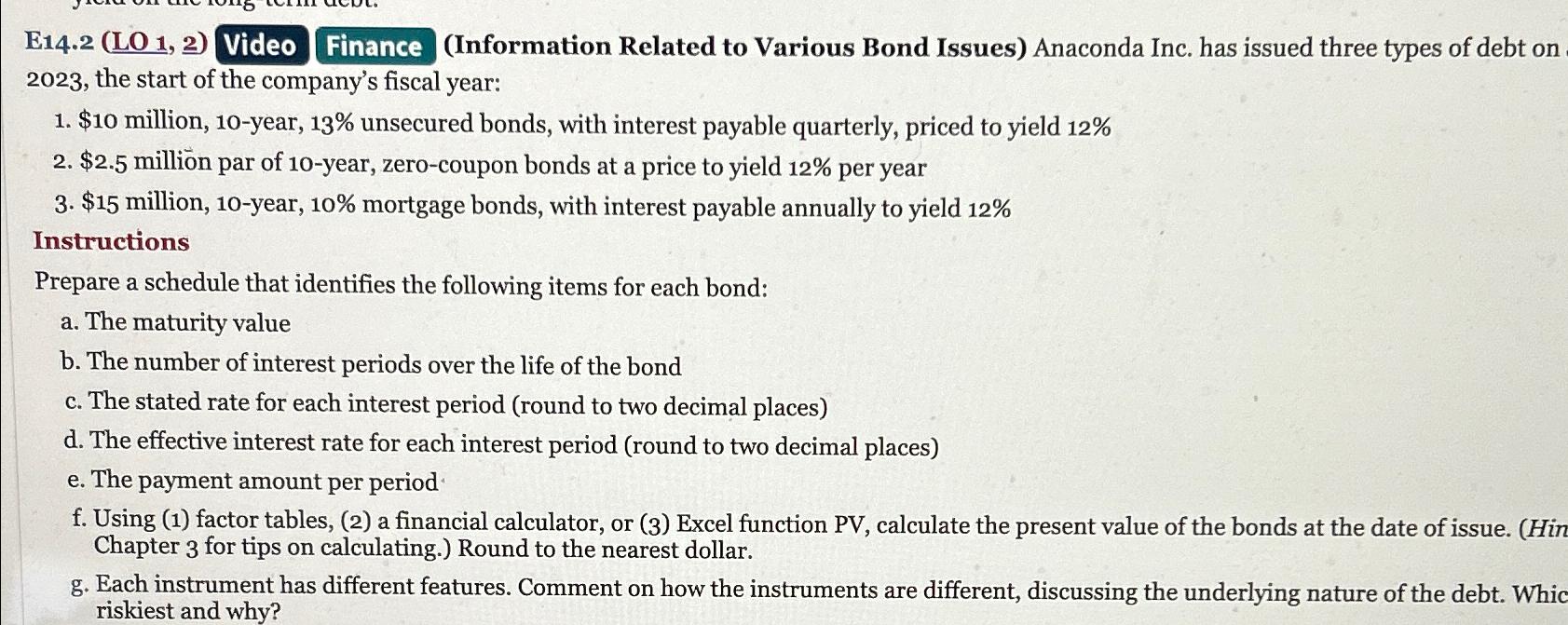

E14.2 (LO 1, 2) Video Finance (Information Related to Various Bond Issues) Anaconda Inc. has issued three types of debt on 2023, the start of the company's fiscal year:\ $10 million, 10-year,

13%unsecured bonds, with interest payable quarterly, priced to yield

12%\ $2.5 million par of 10-year, zero-coupon bonds at a price to yield

12%per year\ $15 million, 10-year,

10%mortgage bonds, with interest payable annually to yield

12%\ Instructions\ Prepare a schedule that identifies the following items for each bond:\ a. The maturity value\ b. The number of interest periods over the life of the bond\ c. The stated rate for each interest period (round to two decimal places)\ d. The effective interest rate for each interest period (round to two decimal places)\ e. The payment amount per period.\ f. Using (1) factor tables, (2) a financial calculator, or (3) Excel function PV, calculate the present value of the bonds at the date of issue. (Hin Chapter 3 for tips on calculating.) Round to the nearest dollar.\ g. Each instrument has different features. Comment on how the instruments are different, discussing the underlying nature of the debt. Whic riskiest and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started