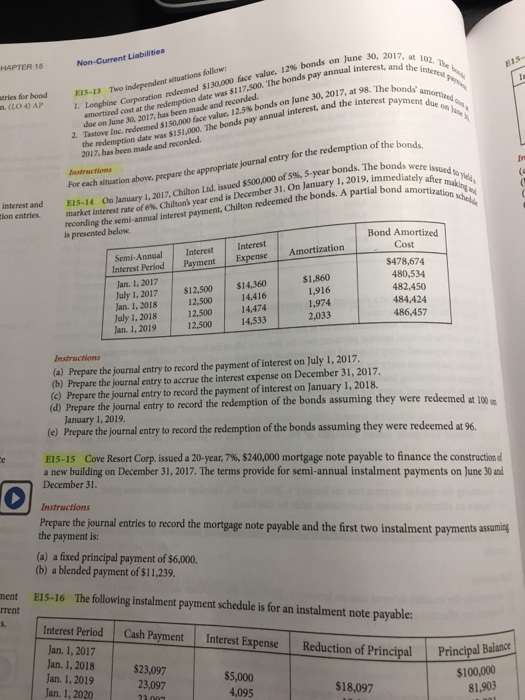

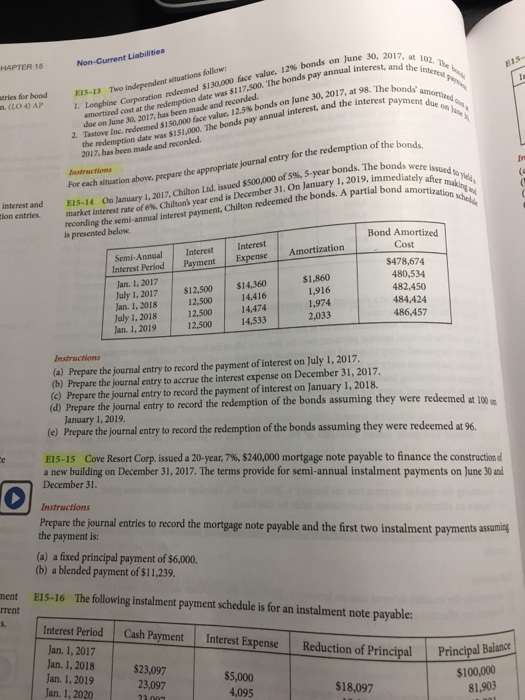

E15-14

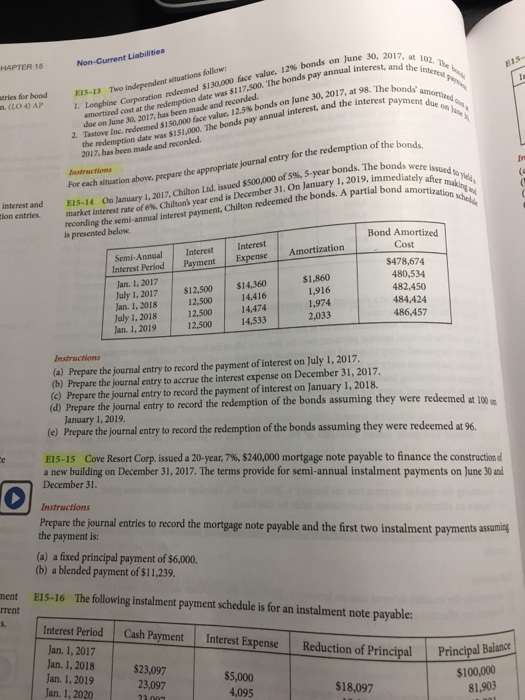

HAPTER 15 Non-Current Liabilities amortized cost at the redemption date was $117,500. The bonds pay annual interest, 2 due on June 30, 2017, has been made and recorded. and the int tries for boedES-13 Two Indgpendent si tries for bond 1. Longbine Corporation redeemed $130000 face value, 12% bonds on June 30, 20 The edemption date was $151,000. The bonds pay annual interest, and the interest pa 2017, has been made and recorded. 2. Tastove Inc. redeemed S 150,000 face value, 12.5% bonds on June 30, 2017, at 98. The n of the bonds. issued $500,000 of5% 5-year bonds. The bonds wer end is December 31. On January 1, 2019, immediatel In situation above, prepare the appropriate journal entry for the redemptio interest and EIS-14 On January 1, 2017, Chilton Ltd issued market interest rate of 6%. Chilton year recording the semi-annual interest payment, Chilton is presented below redeemed the bonds. A partial bonda Bond Amortized Cost $478,674 480,534 482,450 484,424 486,457 Semi-Annual Interest Interest ization Interest Period Payment Ex Jan. 1, 2017 July 1, 2017 $12,500 $14,360 $1,860 1,916 1,974 2,033 Jan. 1, 2018 12,500 14,416 July 1, 2018 12,50014,474 14,533 Jan. 1, 2019 12,500 (a) Prepare the journal entry to record the payment of interest on July 1, 2017. (b) Prepare the journal entry to accrue the interest expense on December 31, 2017 (c) Prepare the journal entry to record the payment of interest on January 1, 2018. (d) Prepare the journal entry to record the redemption of the bonds assuming they were redeemed at 100 January 1, 2019. e) Prepare the journal entry to record the redemption of the bonds assuming they were redeemed at 96. El 5-15 Cove Resort Corp. issued a 20-year, 7%, $240,000 mortgage note payable to finance the construction a new building on December 31, 2017. The terms provide for semi-annual instalment payments on June 30 and December 31 Instructions Prepare the journal entries to record the mortgage note payable and the first two instalment payments assaming the payment is: (a) a fixed principal payment of $6,000. (b) a blended payment of $11,239. nent E15-16 The following instalment payment schedule is for an instalment note payable rrent s. Interest Period Cash Payment Interest Expense Reduction of Principal Jan. 1, 2017 Jan. 1, 2018 Jan. 1, 2019 Jan. 1, 2020 Reduction of Principal $23,097 23,097 $5,000 4,095 Principal Balanse $100,000 81,903 $18,097