Answered step by step

Verified Expert Solution

Question

1 Approved Answer

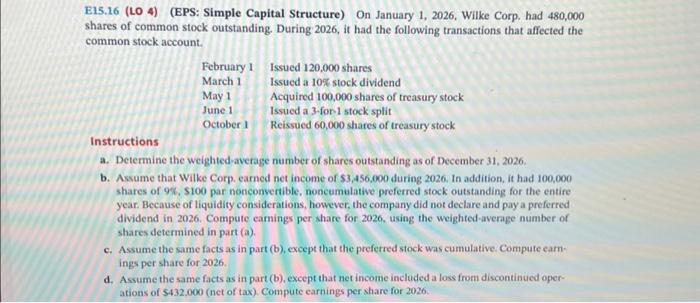

E15.16 (LO 4) (EPS: Simple Capital Structure) On January 1, 2026, Wilke Corp. had 480,000 shares of common stock outstanding. During 2026, it had the

E15.16 (LO 4) (EPS: Simple Capital Structure) On January 1, 2026, Wilke Corp. had 480,000 shares of common stock outstanding. During 2026, it had the following transactions that affected the common stock account. February 1 March 1 May 1 June 1 October 1 Issued 120,000 shares Issued a 10% stock dividend Acquired 100,000 shares of treasury stock Issued a 3-for-1 stock split Reissued 60,000 shares of treasury stock Instructions a. Determine the weighted-average number of shares outstanding as of December 31, 2026. b. Assume that Wilke Corp. earned net income of $3,456,000 during 2026. In addition, it had 100,000 shares of 9%, $100 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2026. Compute earnings per share for 2026, using the weighted-average number of shares determined in part (a). c. Assume the same facts as in part (b), except that the preferred stock was cumulative. Compute earn- ings per share for 2026. d. Assume the same facts as in part (b), except that net income included a loss from discontinued oper- ations of $432,000 (net of tax). Compute earnings per share for 2026.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started