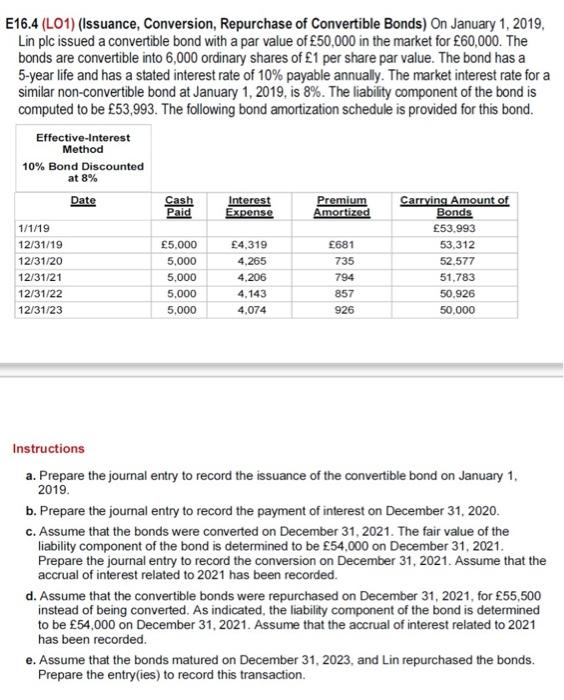

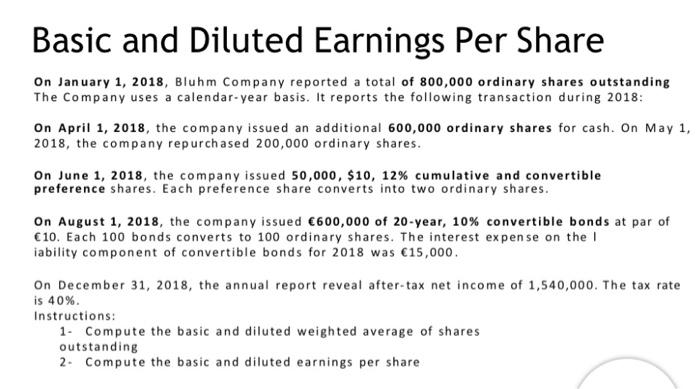

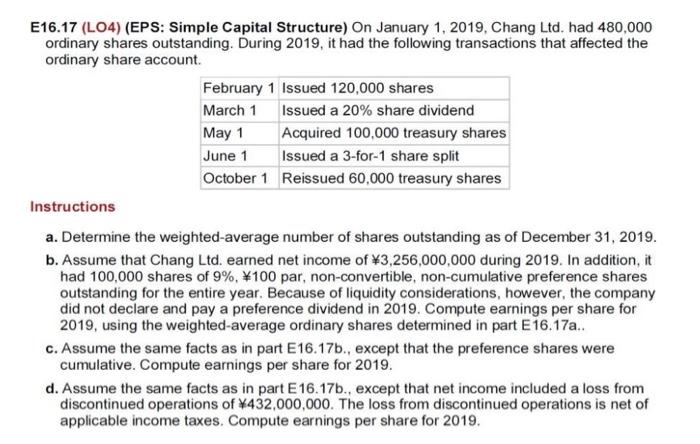

E16.4 (LO1) (Issuance, Conversion, Repurchase of Convertible Bonds) On January 1, 2019, Lin plc issued a convertible bond with a par value of 50,000 in the market for 60,000. The bonds are convertible into 6,000 ordinary shares of 1 per share par value. The bond has a 5 -year life and has a stated interest rate of 10% payable annually. The market interest rate for a similar non-convertible bond at January 1,2019, is 8%. The liability component of the bond is computed to be 53,993. The following bond amortization schedule is provided for this bond. Effective-Interest Method Instructions a. Prepare the journal entry to record the issuance of the convertible bond on January 1 . 2019. b. Prepare the journal entry to record the payment of interest on December 31, 2020. c. Assume that the bonds were converted on December 31, 2021. The fair value of the liability component of the bond is determined to be 54,000 on December 31,2021. Prepare the journal entry to record the conversion on December 31, 2021. Assume that the accrual of interest related to 2021 has been recorded. d. Assume that the convertible bonds were repurchased on December 31,2021 , for 55,500 instead of being converted. As indicated, the liability component of the bond is determined to be 54,000 on December 31,2021 . Assume that the accrual of interest related to 2021 has been recorded. e. Assume that the bonds matured on December 31, 2023, and Lin repurchased the bonds. Prepare the entry(ies) to record this transaction. Basic and Diluted Earnings Per Share On January 1, 2018, Bluhm Company reported a total of 800,000 ordinary shares outstanding The Company uses a calendar-year basis. It reports the following transaction during 2018: On April 1, 2018, the company issued an additional 600,000 ordinary shares for cash. On May 1 , 2018 , the company repurchased 200,000 ordinary shares. On June 1,2018 , the company issued 50,000,$10,12% cumulative and convertible preference shares. Each preference share converts into two ordinary shares. On August 1, 2018, the company issued 600,000 of 20 -year, 10% convertible bonds at par of 610. Each 100 bonds converts to 100 ordinary shares. The interest expense on the I iability component of convertible bonds for 2018 was 15,000. On December 31, 2018, the annual report reveal after-tax net income of 1,540,000. The tax rate is 40%. Instructions: 1- Compute the basic and diluted weighted average of shares outstanding 2. Compute the basic and diluted earnings per share E16.17 (LO4) (EPS: Simple Capital Structure) On January 1, 2019, Chang Ltd. had 480,000 ordinary shares outstanding. During 2019, it had the following transactions that affected the ordinary share account. Instructions a. Determine the weighted-average number of shares outstanding as of December 31, 2019. b. Assume that Chang Ltd. earned net income of 3,256,000,000 during 2019. In addition, it had 100,000 shares of 9%,=100 par, non-convertible, non-cumulative preference shares outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preference dividend in 2019. Compute earnings per share for 2019, using the weighted-average ordinary shares determined in part E16.17a.. c. Assume the same facts as in part E16.17b., except that the preference shares were cumulative. Compute earnings per share for 2019. d. Assume the same facts as in part E16.17b., except that net income included a loss from discontinued operations of 432,000,000. The loss from discontinued operations is net of applicable income taxes. Compute earnings per share for 2019