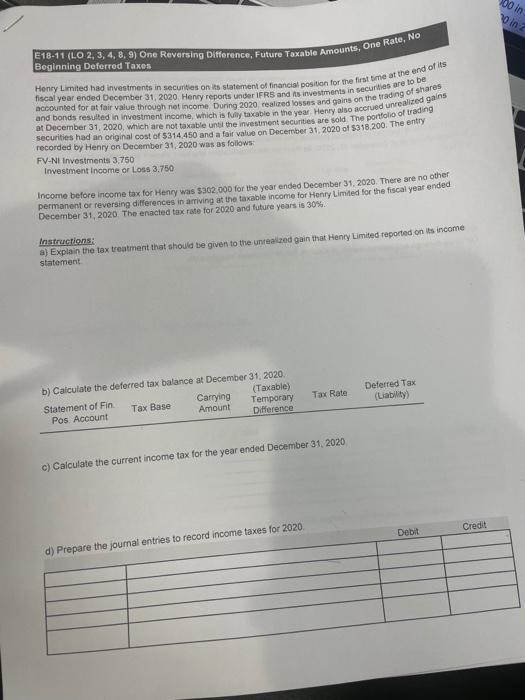

E18-11 (LO 2, 3,4, 8, 9) One Reversing Difference, Future Taxable Amounts, One Rate, No Beginning Deferred Taxes Hency L mited had investments in securites on its statement of financial position for the first tme at the end of its. fiscal year ended December 31,2020 . Henry reports under lFRS and ts investments in securthes are to be accounted for at fair yalue throwgh net income. During 2020 , realized losses and gains on the trading of shares and bonds resulted in imvestment income, which is fuily taxable in the year, Henry also accrued unrealized gains at December 31,2020 , which are not taxable until the investment securities are sold. The pontfolio of trading securities had an original cost of 5314,450 and a fair value on Decetrber 31, 2020 of $318.200. The entry recorded by Henry on December 31,2020 was as follows: FV-NI Investments 3,750 Investment income or Loss 3.750 Income before income tax for Henry was $302,000 for the year ended December 31, 2020. There are na other permanent of reversing differences in arriving at the taxable income for Honry Limned for the fiscal year ended December 31,2020 . The enacted tax rate for 2020 and future years is 30%. Instructions: a) Explain the tax troatment that should be given to the untealsed gain that Henty Limited reported on ths income statement c) Calculate the current income tax for the year ended December 31,2020 E18-11 (LO 2, 3,4, 8, 9) One Reversing Difference, Future Taxable Amounts, One Rate, No Beginning Deferred Taxes Hency L mited had investments in securites on its statement of financial position for the first tme at the end of its. fiscal year ended December 31,2020 . Henry reports under lFRS and ts investments in securthes are to be accounted for at fair yalue throwgh net income. During 2020 , realized losses and gains on the trading of shares and bonds resulted in imvestment income, which is fuily taxable in the year, Henry also accrued unrealized gains at December 31,2020 , which are not taxable until the investment securities are sold. The pontfolio of trading securities had an original cost of 5314,450 and a fair value on Decetrber 31, 2020 of $318.200. The entry recorded by Henry on December 31,2020 was as follows: FV-NI Investments 3,750 Investment income or Loss 3.750 Income before income tax for Henry was $302,000 for the year ended December 31, 2020. There are na other permanent of reversing differences in arriving at the taxable income for Honry Limned for the fiscal year ended December 31,2020 . The enacted tax rate for 2020 and future years is 30%. Instructions: a) Explain the tax troatment that should be given to the untealsed gain that Henty Limited reported on ths income statement c) Calculate the current income tax for the year ended December 31,2020