Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E2-10 (Static) Analyzing Accounting Equation Effects, Recording Journal Entries, and Summarizing Financial Statement Impact [LO 2-2, LO 2-3, LO 2-4] [The following information applies to

E2-10 (Static) Analyzing Accounting Equation Effects, Recording Journal Entries, and Summarizing Financial Statement Impact [LO 2-2, LO 2-3, LO 2-4]

[The following information applies to the questions displayed below.] Rawlco Communications operates 15 radio stations. The following events occurred during September.

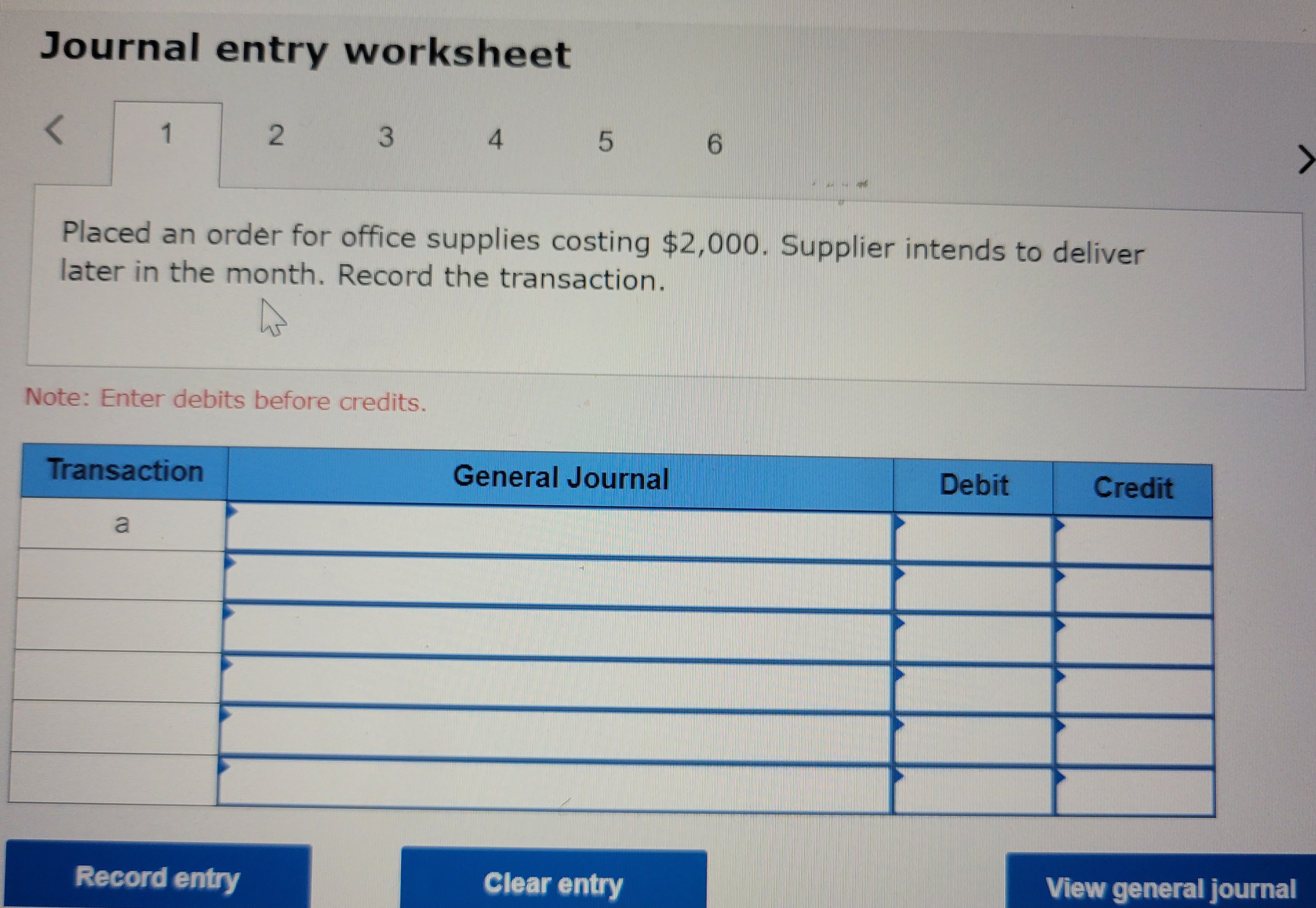

- Placed an order for office supplies costing $2,000. Supplier intends to deliver later in the month.

- Purchased equipment that cost $30,000; paid $10,000 cash and signed a promissory note to pay $20,000 in one month.

- Negotiated and signed a one-year bank loan, and then deposited $5,000 cash in the companys checking account.

- Hired a new finance manager on the last day of the month.

- Received an investment of $10,000 cash from the companys owners in exchange for issuing common shares.

- Supplies [ordered in (a)] were received, along with a bill for $2,000.

E2-10 (Static) Analyzing Accounting Equation Effects, Recording Journal Entries, and Summarizing Financial Statement Impact [LO 2-2, LO 2-3, LO 2-4]

[The following information applies to the questions displayed below.] Rawlco Communications operates 15 radio stations. The following events occurred during September.

- Placed an order for office supplies costing $2,000. Supplier intends to deliver later in the month.

- Purchased equipment that cost $30,000; paid $10,000 cash and signed a promissory note to pay $20,000 in one month.

- Negotiated and signed a one-year bank loan, and then deposited $5,000 cash in the companys checking account.

- Hired a new finance manager on the last day of the month.

- Received an investment of $10,000 cash from the companys owners in exchange for issuing common shares.

- Supplies [ordered in (a)] were received, along with a bill for $2,000.

E2-10 (Static) Part 2

- Prepare journal entries to record each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

E2-10 (Static) Analyzing Accounting Equation Effects, Recording Journal Entries, and Summarizing Financial Statement Impact [LO 2-2, LO 2-3, LO 2-4]

[The following information applies to the questions displayed below.] Rawlco Communications operates 15 radio stations. The following events occurred during September.

- Placed an order for office supplies costing $2,000. Supplier intends to deliver later in the month.

- Purchased equipment that cost $30,000; paid $10,000 cash and signed a promissory note to pay $20,000 in one month.

- Negotiated and signed a one-year bank loan, and then deposited $5,000 cash in the companys checking account.

- Hired a new finance manager on the last day of the month.

- Received an investment of $10,000 cash from the companys owners in exchange for issuing common shares.

- Supplies [ordered in (a)] were received, along with a bill for $2,000.

- Rawlco began the month with $220,000 in total assets. What total assets would be reported on the balance sheet after events (a)(f)?

total assests ?

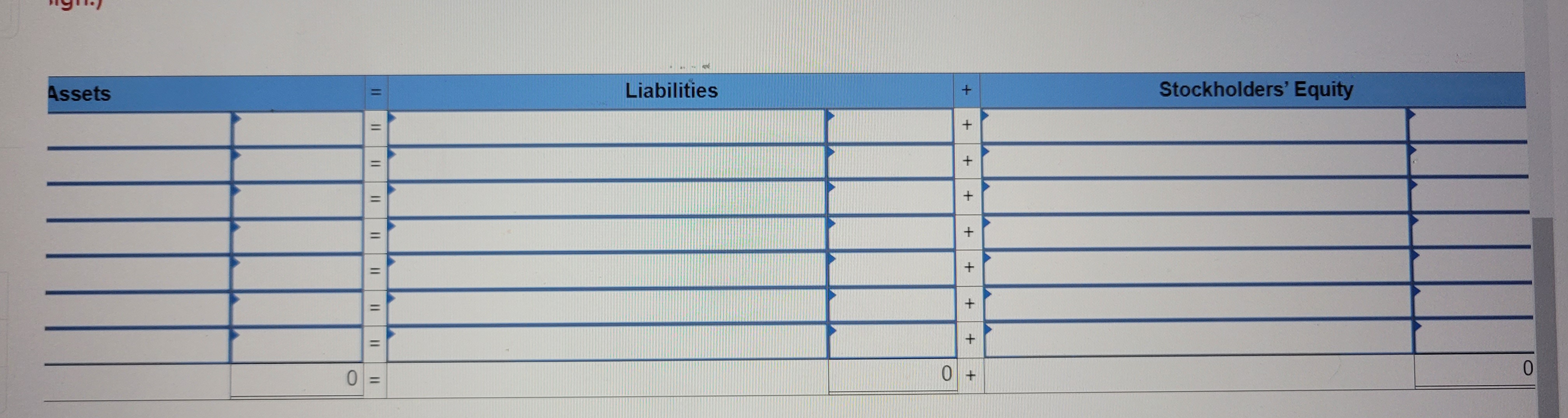

Required: 1. Indicate the specific account, amount, and direction of effects for each transaction on the radio station's accounting equation. If an event is not considered a transaction, leave the account, amount and direction of effects blank. (Enter any decreases to account balances with a minus sign.) Journal entry worksheet 2 Placed an order for office supplies costing $2,000. Supplier intends to deliver later in the month. Record the transaction. Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started