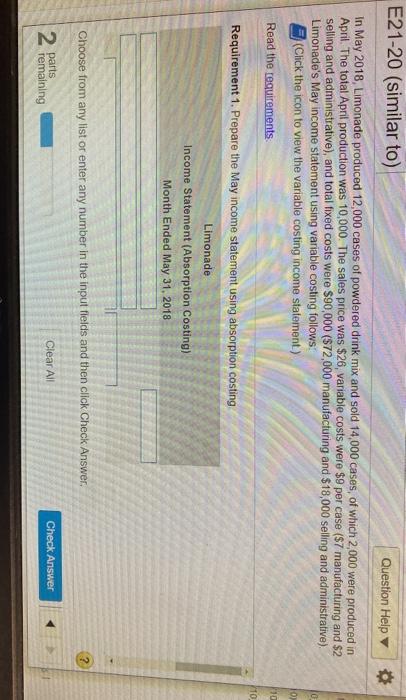

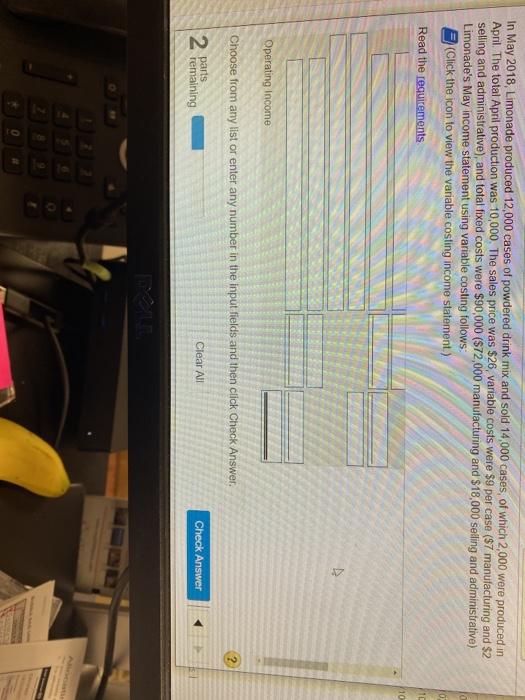

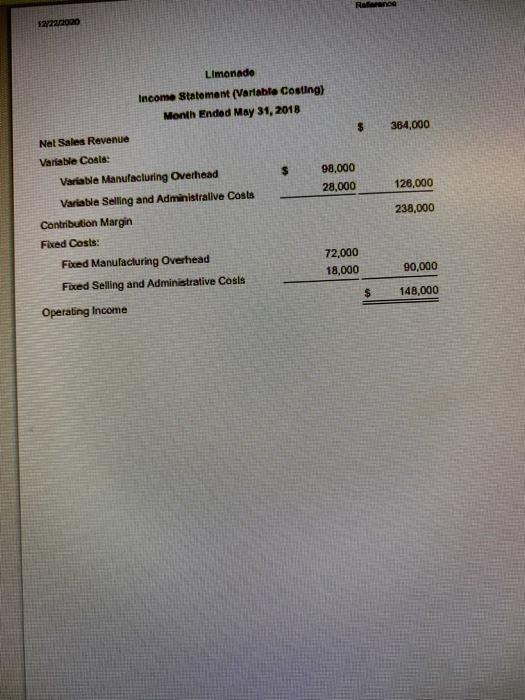

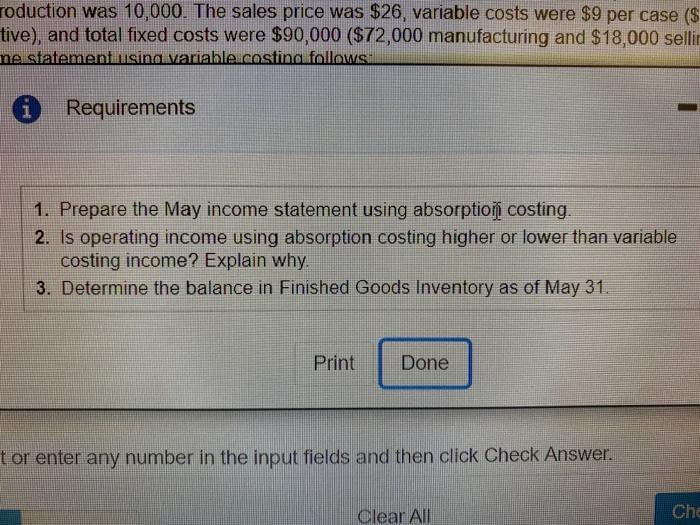

E21-20 (similar to) Question Help In May 2018, Limonade produced 12,000 cases of powdered drink mix and sold 14,000 cases, of which 2,000 were produced in April. The total April production was 10,000. The sales price was $26, variable costs were $9 per case ($7 manufacturing and $2 selling and administrative), and total fixed costs were $90,000 (72,000 manufacturing and $18,000 selling and administrative), Limonade's May income statement using variable costing follows: (Click the icon to view the variable costing income statement) Read the requirements 0 10 10 10 Requirement 1. Prepare the May income statement using absorption costing Limonade Income Statement (Absorption Costing) Month Ended May 31, 2018 Choose from any list or enter any number in the input fields and then click Check Answer. 2 Clear All Check Answer 2 parts remaining In May 2018, Limonade produced 12,000 cases of powdered drink mix and sold 14,000 cases, of which 2,000 were produced in Apnl. The total April production was 10,000. The sales price was $26, variable costs were $9 per case (37 manufacturing and $2 selling and administrative), and total fixed costs were $90,000 ($72,000 manufacturing and $18,000 selling and administrative) Limonade's May income statement using variable costing follows: (Click the icon to view the variable costing income statement) Read the requirements 10 10 Operating Income Choose from any list or enter any number in the input fields and then click Check Answer. 2 2 parts remaining Clear All Check Answer Reference 1272272020 384,000 126,000 Limonado Income Statement (Variable Costing) Month Ended May 31, 2018 Net Sales Revenue $ Variable Coals: Variable Manufacluring Overhead $ 98,000 Variable Selling and Administrallve Costs 28.000 Contribution Margin Fixed Costs: Fixed Manufacturing Overhead 72,000 Fixed Selling and Administrative Costs 18,000 Operating Income $ 238,000 90.000 148,000 roduction was 10,000. The sales price was $26, variable costs were $9 per case ($ tive), and total fixed costs were $90,000 ($72,000 manufacturing and $18,000 sellir me statement using variable casting follows. i Requirements 1. Prepare the May income statement using absorption costing. 2. Is operating income using absorption costing higher or lower than variable costing income? Explain why. 3. Determine the balance in Finished Goods Inventory as of May 31. Print Done for enter any number in the input fields and then click Check Answer. Clear All Che