Question

E22.11 Premium Doors Inc. purchased equipment on January 1, 2018, for $250,000. At that time it was estimated that the equipment would have a 5-year

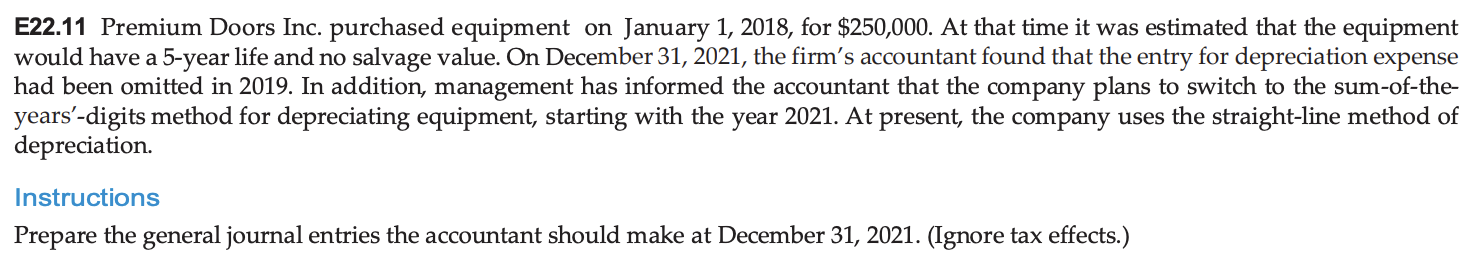

E22.11 Premium Doors Inc. purchased equipment on January 1, 2018, for $250,000. At that time it was estimated that the equipment would have a 5-year life and no salvage value. On December 31, 2021, the firms accountant found that the entry for depreciation expense had been omitted in 2019. In addition, management has informed the accountant that the company plans to switch to the sum-of-the-years-digits method for depreciating equipment, starting with the year 2021. At present, the company uses the straight-line method of depreciation.

Instructions Prepare the general journal entries the accountant should make at December 31, 2021. (Ignore tax effects.)

PLEASE TAKE NOTE OF THE DATES THANK YOU.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started