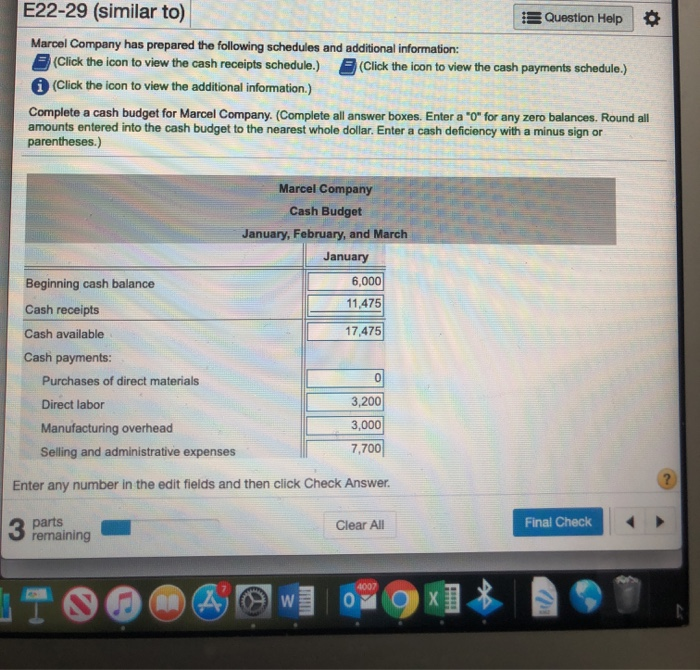

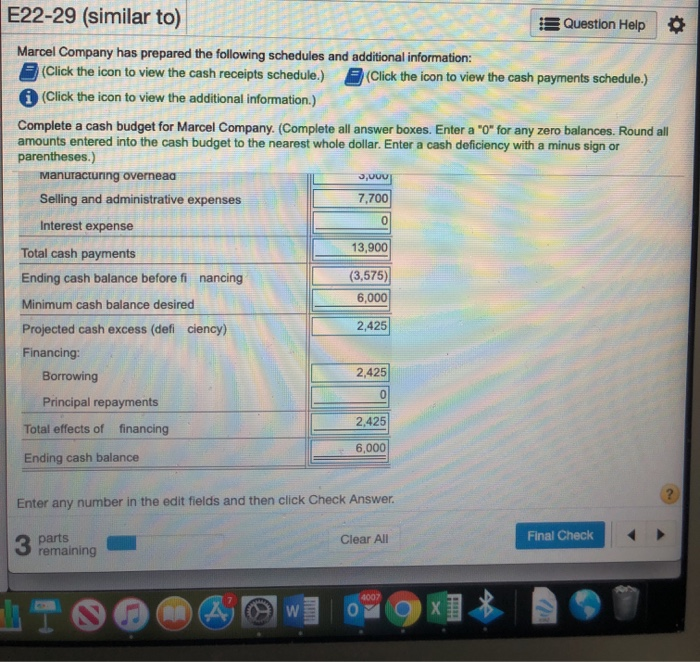

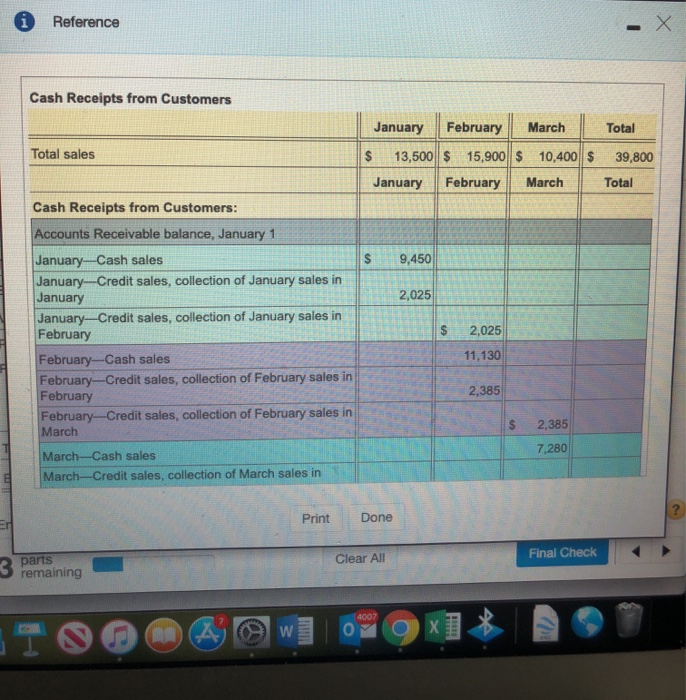

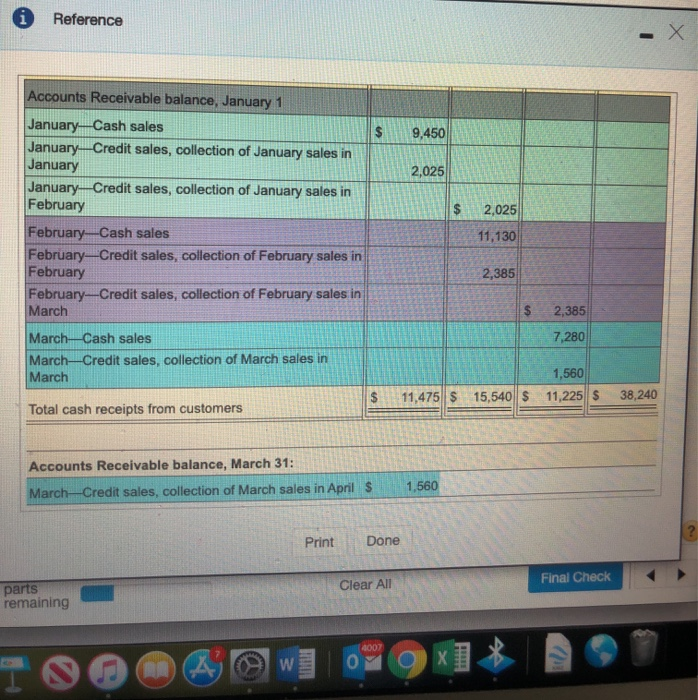

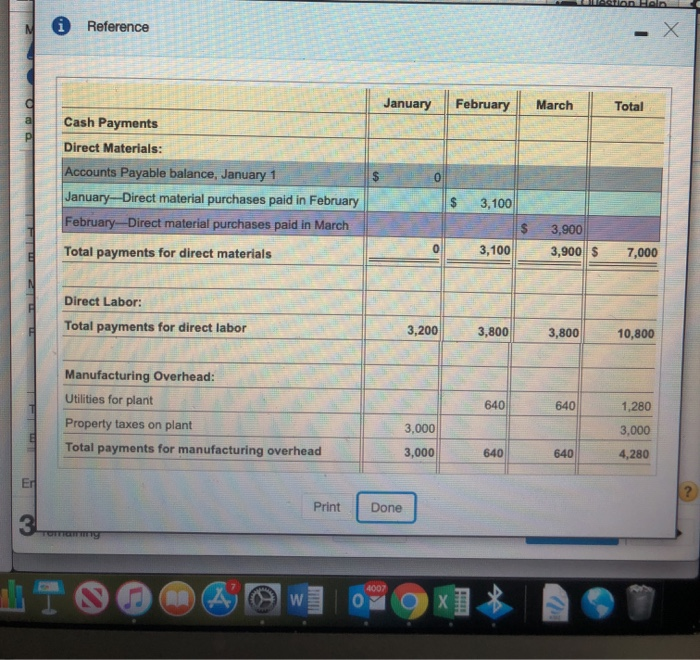

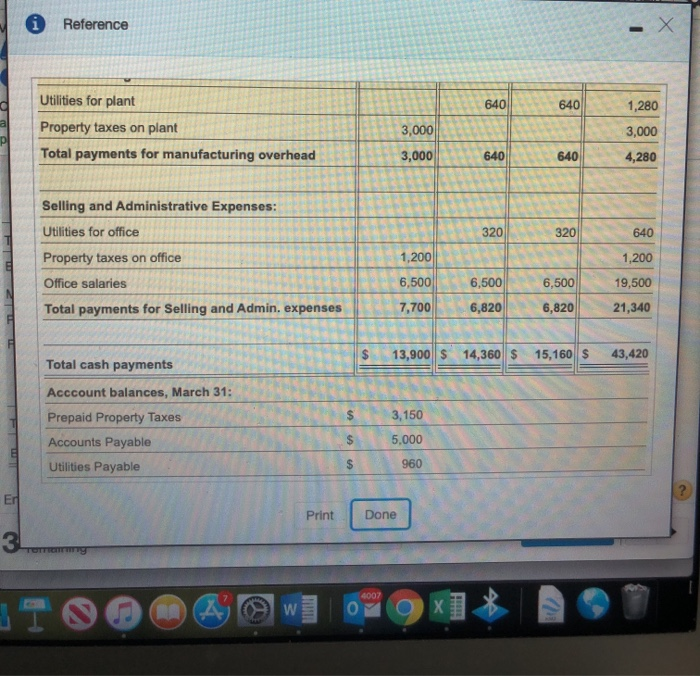

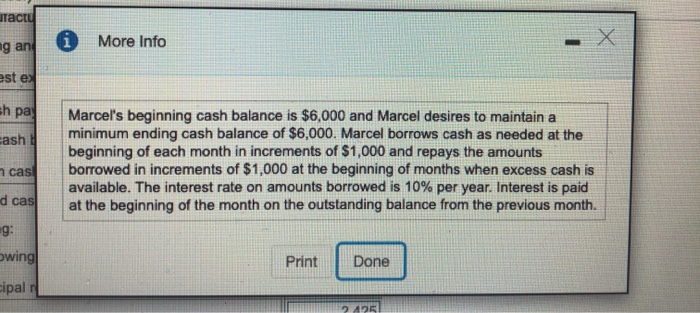

E22-29 (similar to) Question Help Marcel Company has prepared the following schedules and additional information: (Click the icon to view the cash receipts schedule.) (Click the icon to view the cash payments schedule.) Click the icon to view the additional information.) Complete a cash budget for Marcel Company. (Complete all answer boxes. Enter a "O" for any zero balances. Round all amounts entered into the cash budget to the nearest whole dollar. Enter a cash deficiency with a minus sign or parentheses.) Marcel Company Cash Budget January, February, and March January 6,000 11,475 17,475 Beginning cash balance Cash receipts Cash available Cash payments: Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses 0 3,200 3,000 7,700 Enter any number in the edit fields and then click Check Answer 3 Final Check parts remaining Clear All 4007 CAN 40 W 0 9x] M E22-29 (similar to) Question Help Marcel Company has prepared the following schedules and additional information: (Click the icon to view the cash receipts schedule.) (Click the icon to view the cash payments schedule.) (Click the icon to view the additional information.) Complete a cash budget for Marcel Company. (Complete all answer boxes. Enter a "O" for any zero balances. Round all amounts entered into the cash budget to the nearest whole dollar. Enter a cash deficiency with a minus sign or parentheses.) Manufacturing overnead Selling and administrative expenses 7,700 3,000 0 Interest expense 13,900 Total cash payments Ending cash balance before financing (3,575) 6,000 Minimum cash balance desired 2,425 Projected cash excess (deficiency) Financing: Borrowing Principal repayments Total effects of financing 2,425 0 2,425 6,000 Ending cash balance Enter any number in the edit fields and then click Check Answer. Clear All Final Check 3 parts remaining 4007 W 00x Reference Cash Receipts from Customers January February March Total Total sales $ 13,500 $ 15,900 $ 10,400$ 39,800 January February March Total $ 9,450 2,025 Cash Receipts from Customers: Accounts Receivable balance, January 1 January-Cash sales January Credit sales, collection of January sales in January January-Credit sales, collection of January sales in February February-Cash sales February-Credit sales, collection of February sales in February February-Credit sales, collection of February sales in March 2,025 11,130 2,385 2,385 7,280 March-Cash sales March-Credit sales, collection of March sales in ? Print Done Clear All Final Check 3 parts remaining 4007 TG w Reference - X $ 9,450 2,025 Accounts Receivable balance, January 1 January_Cash sales January_Credit sales, collection of January sales in January January-Credit sales, collection of January sales in February FebruaryCash sales February-Credit sales, collection of February sales in February February--Credit sales, collection of February sales in March $ 2,025 11,130 2,385 2,385 7,280 March-Cash sales March-Credit sales, collection of March sales in March 1,560 11,475 $ 15,540$ 11,225 38,240 Total cash receipts from customers Accounts Receivable balance, March 31: MarchCredit sales, collection of March sales in April $ 1,560 Print Done Final Check Clear All parts remaining W A (2 0 9x1 * Irto 0 Reference - X January February March Total PI Cash Payments Direct Materials: Accounts Payable balance, January 1 January-Direct material purchases paid in February February-Direct material purchases paid in March 3,100 3,900 3,900 $ Total payments for direct materials 3,100 7,000 Direct Labor: Total payments for direct labor 3,200 3,800 3,800 10,800 640 640 Manufacturing Overhead: Utilities for plant Property taxes on plant Total payments for manufacturing overhead 1,280 3,000 3,000 3,000 640 640 4,280 ? Print Done 3 TOMTOM 4007 (AN GA W Til 09x] * Reference 640 640 1,280 Utilities for plant Property taxes on plant Total payments for manufacturing overhead 3,000 3,000 3,000 640 640 4,280 320 320 640 Selling and Administrative Expenses: Utilities for office Property taxes on office Office salaries Total payments for Selling and Admin. expenses 1,200 1,200 19,500 6,500 6,500 6,500 7,700 6,820 6,820 21,340 $ 13,900 $ 14,360 $ 15,160 $ 43,420 Total cash payments Acccount balances, March 31: Prepaid Property Taxes Accounts Payable $ 3,150 $ 5.000 Utilities Payable $ 960 Print Done 3 TOIT 4007 AN W MULA 0 x1 * O aract ng ang * More Info est es sh pa cash Marcel's beginning cash balance is $6,000 and Marcel desires to maintain a minimum ending cash balance of $6,000. Marcel borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The interest rate on amounts borrowed is 10% per year. Interest is paid at the beginning of the month on the outstanding balance from the previous month. cas d cas ag: wing Print Done cipal 2425