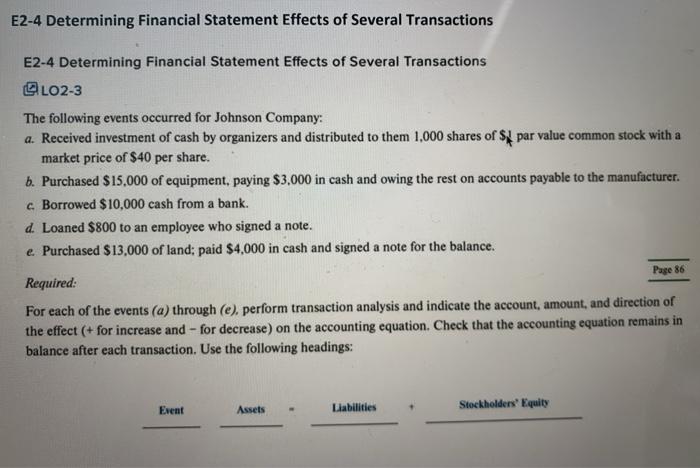

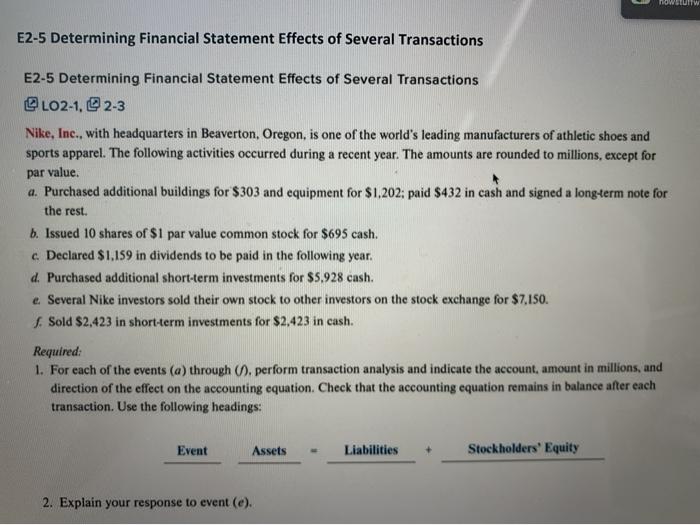

E2-4 Determining Financial Statement Effects of several Transactions E2-4 Determining Financial Statement Effects of Several Transactions LO2-3 The following events occurred for Johnson Company: a. Received investment of cash by organizers and distributed to them 1,000 shares of $4 par value common stock with a market price of $40 per share. b. Purchased $15,000 of equipment, paying $3.000 in cash and owing the rest on accounts payable to the manufacturer. c Borrowed $10,000 cash from a bank. d. Loaned $800 to an employee who signed a note. e Purchased $13,000 of land; paid $4,000 in cash and signed a note for the balance. Required: For each of the events (a) through (e), perform transaction analysis and indicate the account, amount, and direction of the effect (+ for increase and - for decrease) on the accounting equation. Check that the accounting equation remains in balance after each transaction. Use the following headings: Page 86 Event Assets Liabilities Stockholders' Equity E2-5 Determining Financial Statement Effects of Several Transactions E2-5 Determining Financial Statement Effects of Several Transactions @L02-1, 2-3 Nike, Inc., with headquarters in Beaverton, Oregon, is one of the world's leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions, except for par value. a. Purchased additional buildings for $303 and equipment for $1.202; paid $432 in cash and signed a long term note for the rest b. Issued 10 shares of $1 par value common stock for $695 cash. c Declared $1.159 in dividends to be paid in the following year. d. Purchased additional short-term investments for $5.928 cash. e Several Nike investors sold their own stock to other investors on the stock exchange for $7,150. Sold $2.423 in short-term investments for $2.423 in cash. Required: 1. For each of the events (a) through (). perform transaction analysis and indicate the account, amount in millions, and direction of the effect on the accounting equation. Check that the accounting equation remains in balance after each transaction. Use the following headings: Event Assets Liabilities Stockholders' Equity 2. Explain your response to event (e)