Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E2-5 (Algo) Determining Financial Statement Effects of Several Transactions LO2-1, 2-3 Nike, Incorporated, with headquarters in Beaverton, Oregon, is one of the world's leading manufacturers

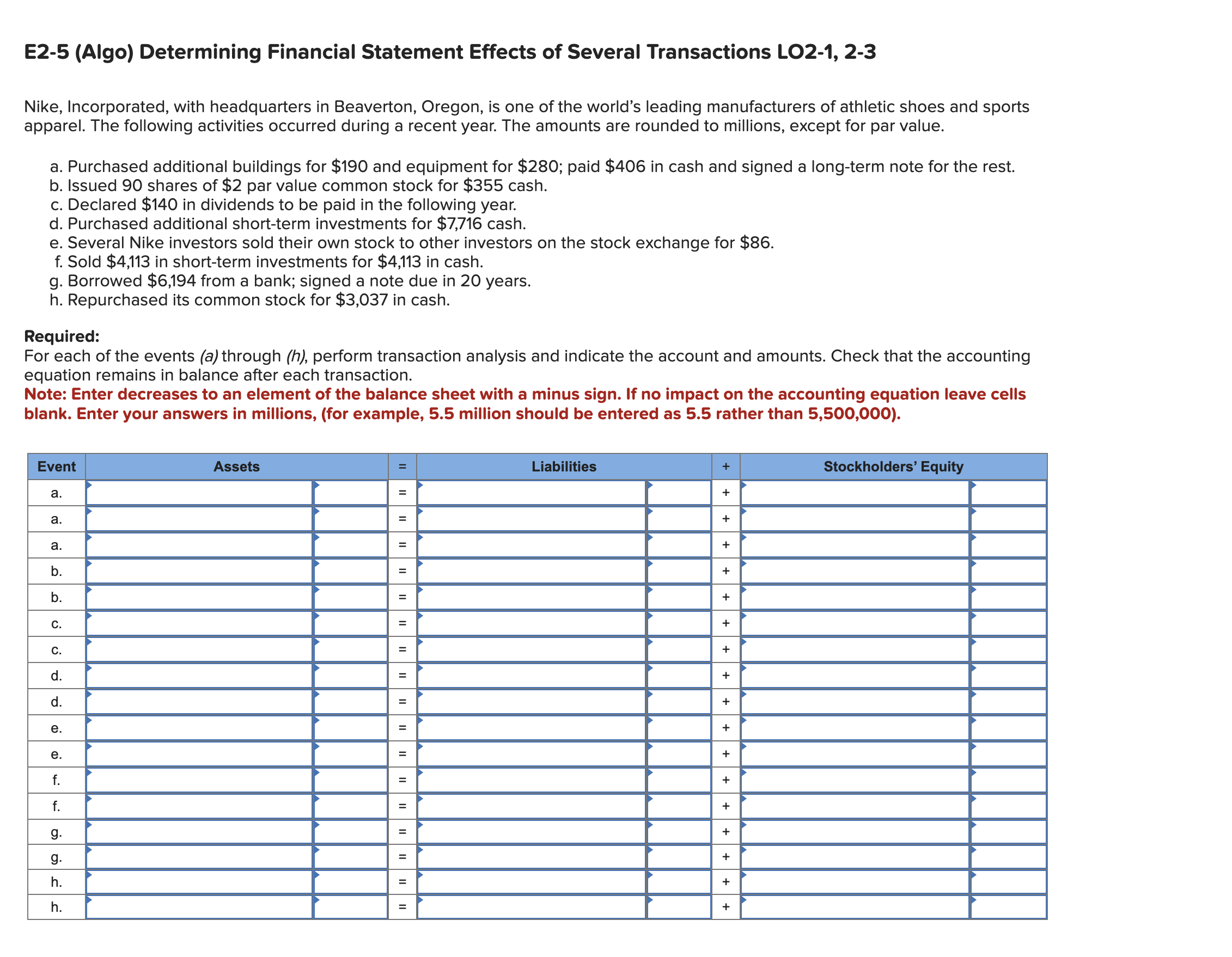

E2-5 (Algo) Determining Financial Statement Effects of Several Transactions LO2-1, 2-3 Nike, Incorporated, with headquarters in Beaverton, Oregon, is one of the world's leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions, except for par value. a. Purchased additional buildings for $190 and equipment for $280; paid $406 in cash and signed a long-term note for the rest. b. Issued 90 shares of $2 par value common stock for $355 cash. c. Declared $140 in dividends to be paid in the following year. d. Purchased additional short-term investments for $7,716 cash. e. Several Nike investors sold their own stock to other investors on the stock exchange for $86. f. Sold $4,113 in short-term investments for $4,113 in cash. g. Borrowed \$6,194 from a bank; signed a note due in 20 years. h. Repurchased its common stock for $3,037 in cash. Required: For each of the events (a) through (h), perform transaction analysis and indicate the account and amounts. Check that the accounting equation remains in balance after each transaction. Note: Enter decreases to an element of the balance sheet with a minus sign. If no impact on the accounting equation leave cells blank. Enter your answers in millions, (for example, 5.5 million should be entered as 5.5 rather than 5,500,000 )

E2-5 (Algo) Determining Financial Statement Effects of Several Transactions LO2-1, 2-3 Nike, Incorporated, with headquarters in Beaverton, Oregon, is one of the world's leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions, except for par value. a. Purchased additional buildings for $190 and equipment for $280; paid $406 in cash and signed a long-term note for the rest. b. Issued 90 shares of $2 par value common stock for $355 cash. c. Declared $140 in dividends to be paid in the following year. d. Purchased additional short-term investments for $7,716 cash. e. Several Nike investors sold their own stock to other investors on the stock exchange for $86. f. Sold $4,113 in short-term investments for $4,113 in cash. g. Borrowed \$6,194 from a bank; signed a note due in 20 years. h. Repurchased its common stock for $3,037 in cash. Required: For each of the events (a) through (h), perform transaction analysis and indicate the account and amounts. Check that the accounting equation remains in balance after each transaction. Note: Enter decreases to an element of the balance sheet with a minus sign. If no impact on the accounting equation leave cells blank. Enter your answers in millions, (for example, 5.5 million should be entered as 5.5 rather than 5,500,000 ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started