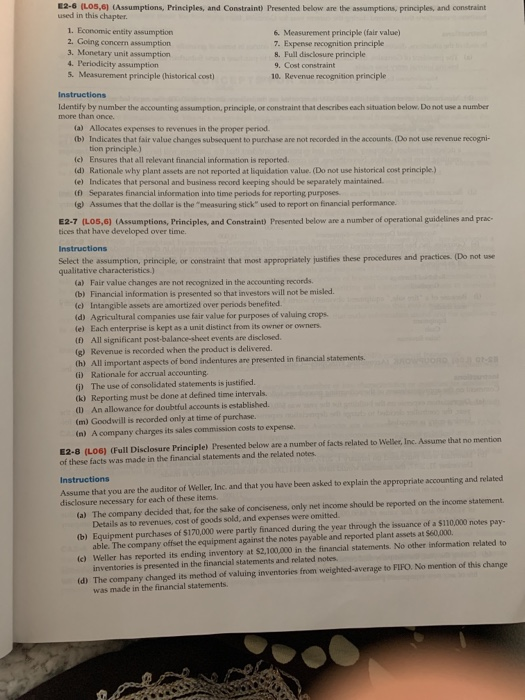

E2-6 (L05,6) (Assumptions, Principles, and Constraint Presented below are the assumptions, principles, and constraint used in this chapter. 1. Economic entity assumption 6. Measurement principle (fair value) 2. Going concern assumption 7. Expense recognition principle 3. Monetary unit assumption 8. Full disclosure principle 4. Periodicity assumption 9. Cost constraint 5. Measurement principle (historical cost) 10. Revenue recognition principle Instructions Identify by number the accounting assumption, principle or constraint that describes each situation below. Do not use a number more than once. (a) Allocates expenses to revenues in the proper period. (b) Indicates that fair value changes subsequent to purchase are not recorded in the accounts. (Do not use revenue recogni- tion principle) (c) Ensures that all relevant financial information is reported. (d) Rationale why plant assets are not reported at liquidation value (Do not use historical cost principle) le) Indicates that personal and business record keeping should be separately maintained Separates financial information into time periods for reporting purposes (g) Assumes that the dollar is the measuring stick" used to report on financial performance E2-7 (LO5,6) Assumptions, Principles and Constraint Presented below are a number of operational guidelines and prac tices that have developed over time. Instructions Select the assumption, principle, or constraint that most appropriately justifies these procedures and practices. (Do not use qualitative characteristics.) (a) Fair value changes are not recognized in the accounting records. (b) Financial information is presented so that investors will not be misled. tel Intangible assets are amortized over periods benefited. (d) Agricultural companies use fair value for purposes of valuing crops. le) Each enterprise is kept as a unit distinct from its owner or owners. All significant post-balance sheet events are disclosed. (g) Revenue is recorded when the product is delivered. th) All important aspects of bond indentures are presented in financial statements. (i) Rationale for accrual accounting (i) The use of consolidated statements is justified. (k) Reporting must be done at defined time intervals. ( An allowance for doubtful accounts is established. (m) Goodwill is recorded only at time of purchase. (n) A company changes its sales commission costs to expense. E2.0 (L06) Full Disclosure Principle) Presented below are a number of facts related to Weller, Inc. Assume that no mention of these facts was made in the financial statements and the related notes Instructions Assume that you are the auditor of Weller, Inc. and that you have been asked to explain the appropriate accounting and related disclosure necessary for each of these items. a) The company decided that, for the sake of conciseness, only net income should be reported on the income statement Details as to revenues, cost of goods sold, and expenses were omitted (b) Equipment purchases of $170,000 were partly financed during the year through the issuance of a $110,000 notes pay- able. The company offset the equipment against the notes payable and reported plant assets at $60,000. Id Weller has reported its ending inventory at $2,100,000 in the financial statements. No other information related to inventories is presented in the financial statements and related notes (d) The company changed its method of valuing inventories from weighted average to FIFO. No mention of this change was made in the financial statements