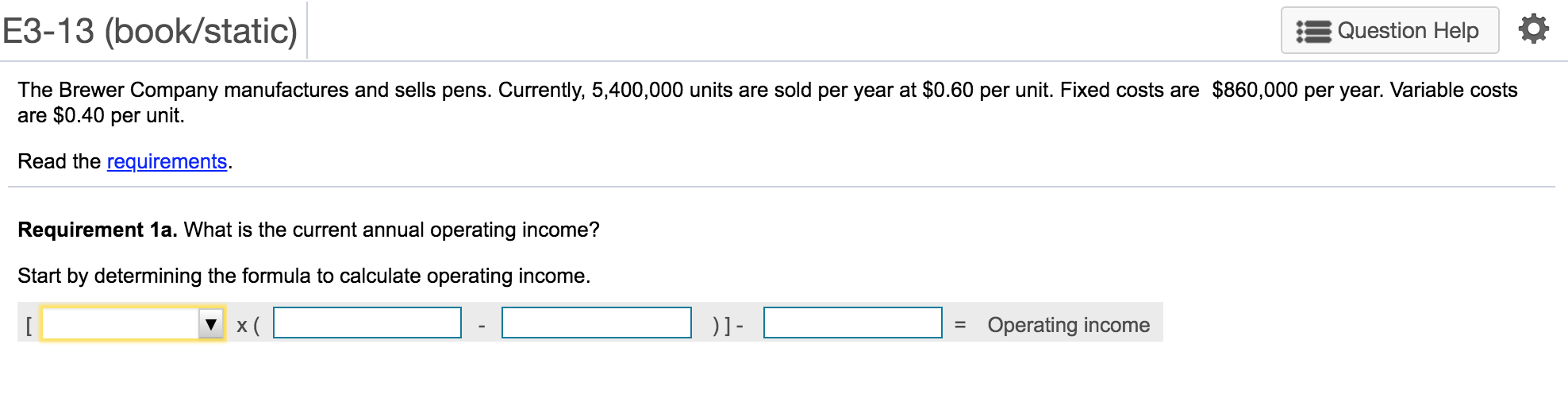

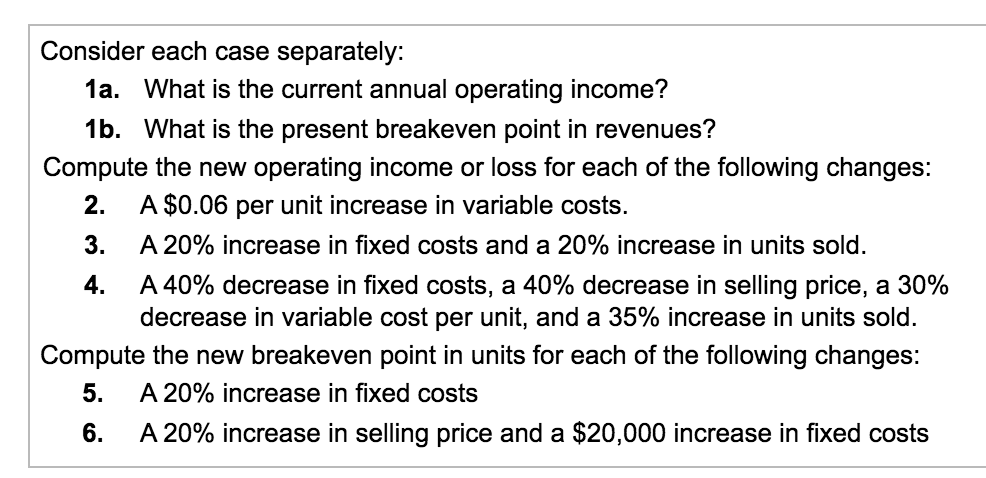

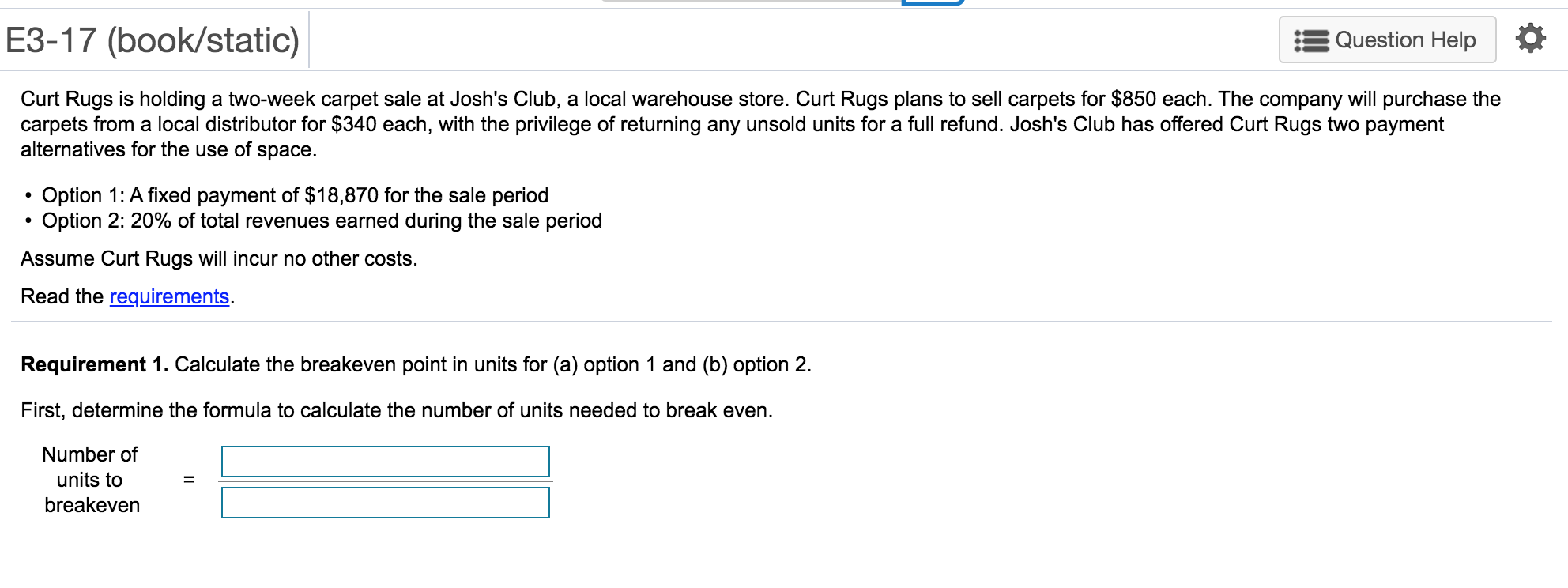

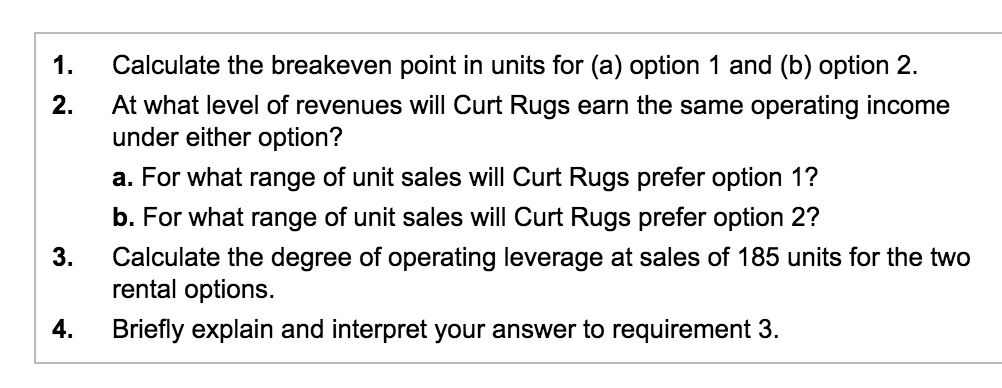

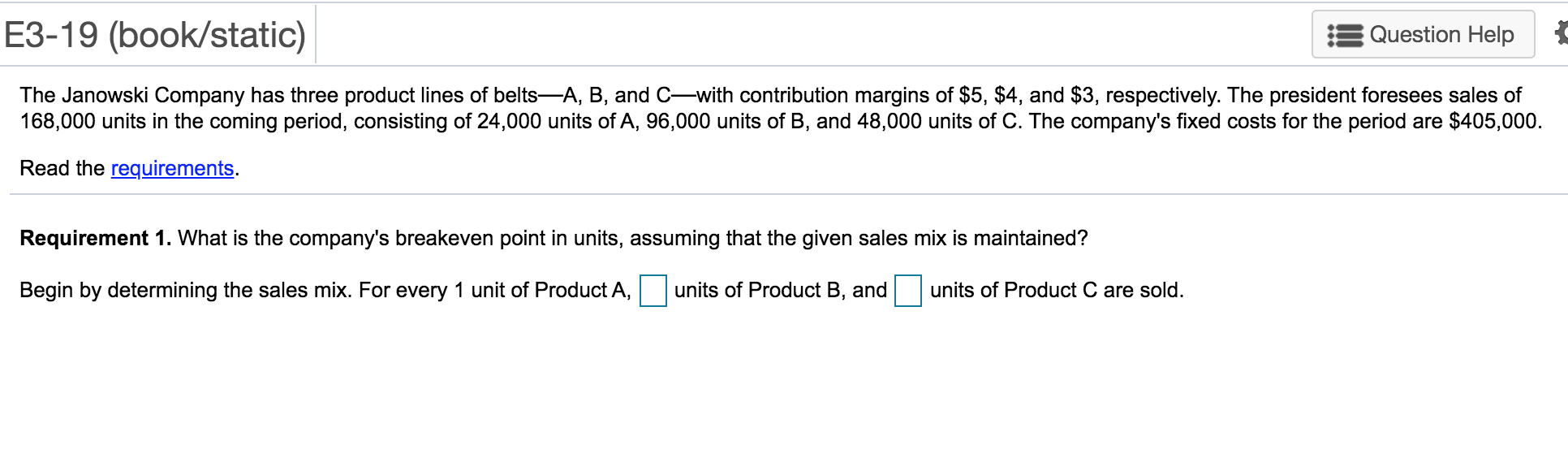

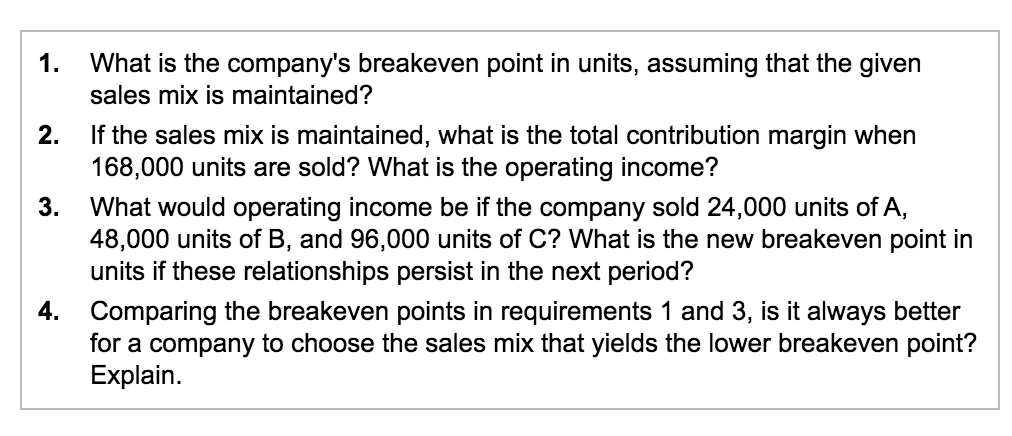

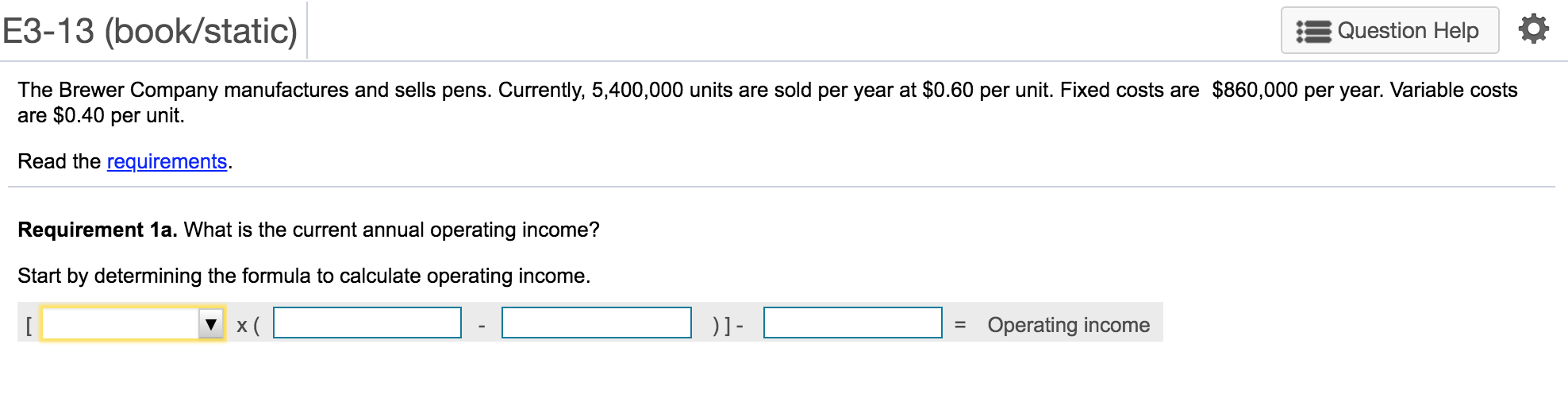

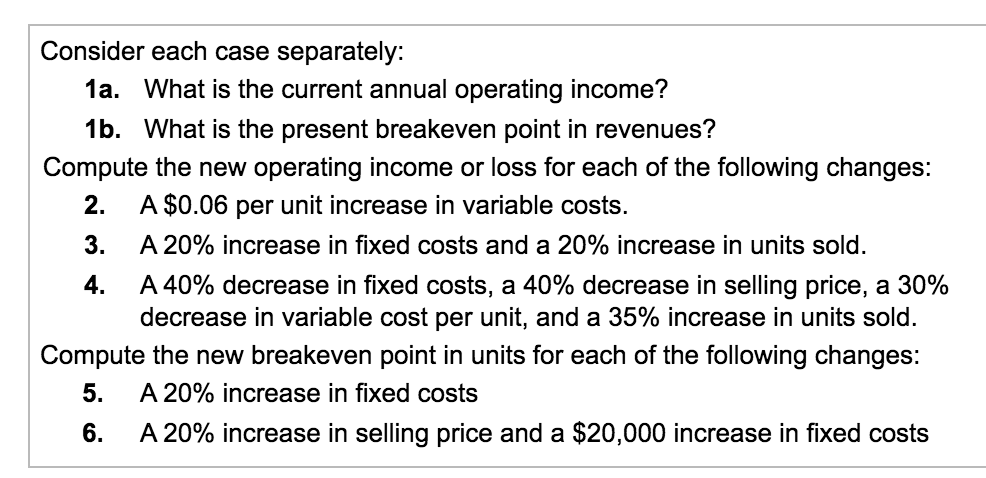

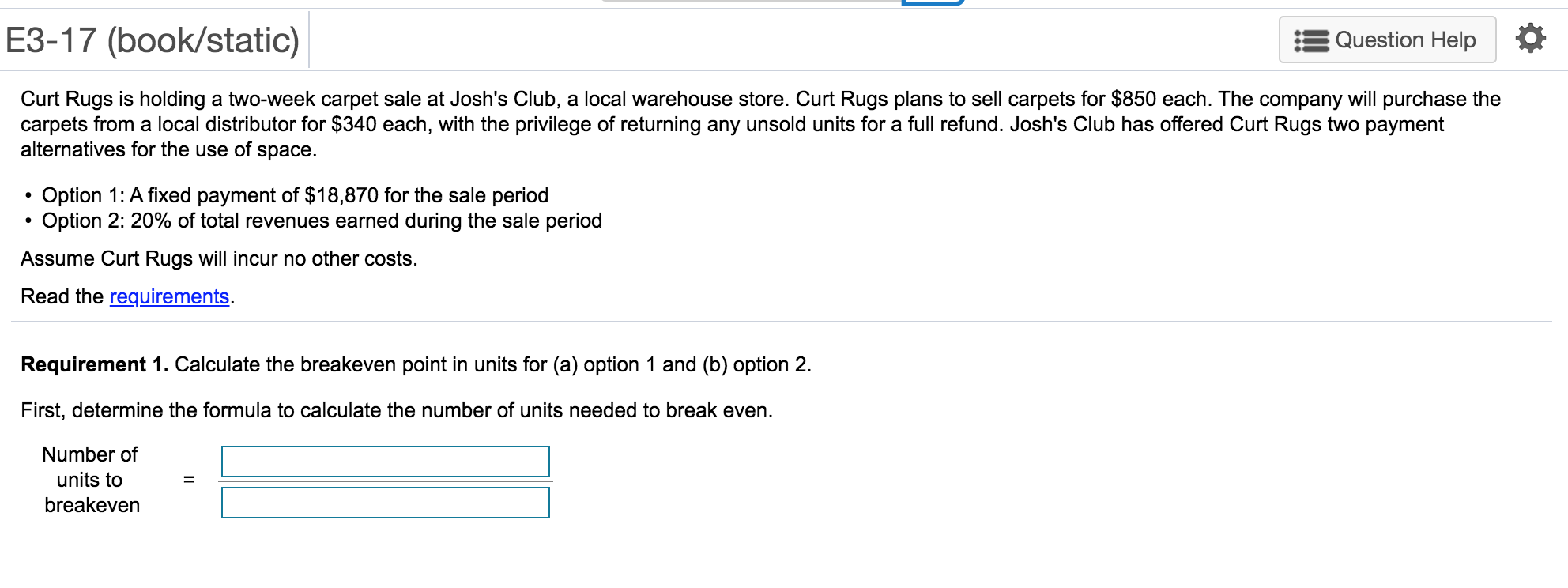

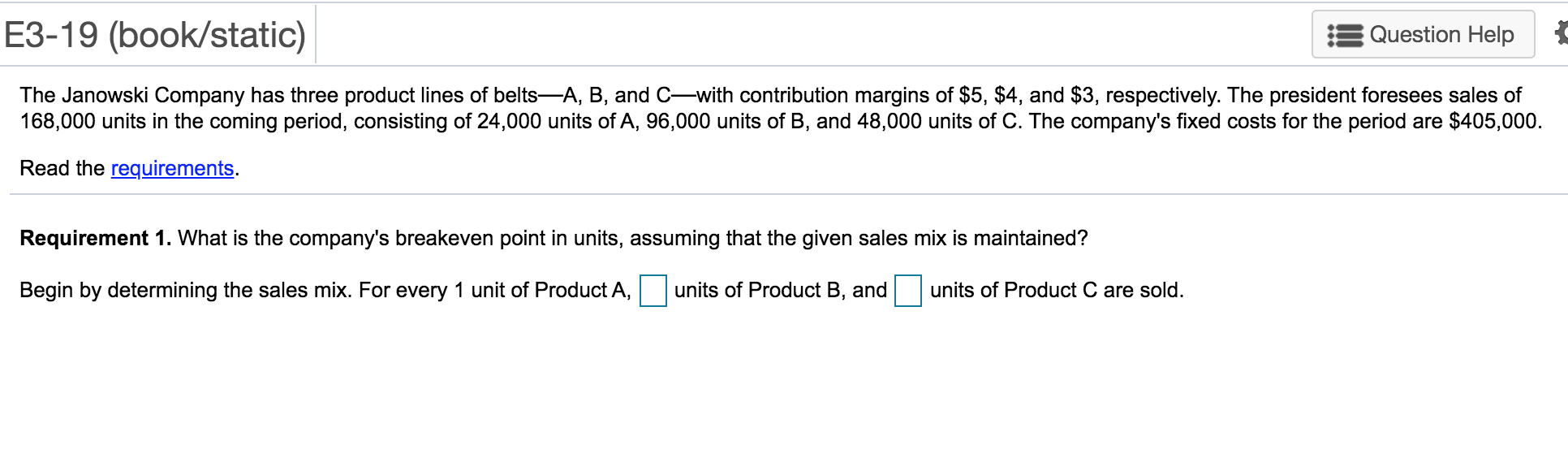

E3-13 (book/static) Question Help The Brewer Company manufactures and sells pens. Currently, 5,400,000 units are sold per year at $0.60 per unit. Fixed costs are $860,000 per year. Variable costs are $0.40 per unit. Read the requirements Requirement 1a. What is the current annual operating income? Start by determining the formula to calculate operating income. Operating income Consider each case separately: 1a. What is the current annual operating income? 1b. What is the present breakeven point in revenues? Compute the new operating income or loss for each of the following changes: A $0.06 per unit increase in variable costs 2. A 20% increase in fixed costs and a 20% increase in units sold 3. 4. A 40% decrease in fixed costs, a 40% decrease in selling price, a 30% decrease in variable cost per unit, and a 35% increase in units sold Compute the new breakeven point in units for each of the following changes: 5. A 20% increase in fixed costs A 20% increase in selling price and a $20,000 increase in fixed costs 6. E3-17 (book/static) Question Help Curt Rugs is holding a two-week carpet sale at Josh's Club, a local warehouse store. Curt Rugs plans to sell carpets for $850 each. The company will purchase the carpets from a local distributor for $340 each, with the privilege of returning any unsold units for a full refund. Josh's Club has offered Curt Rugs two payment alternatives for the use of space Option 1: A fixed payment of $18,870 for the sale period Option 2: 20% of total revenues earned during the sale period Assume Curt Rugs will incur no other costs. Read the requirements Requirement 1. Calculate the breakeven point in units for (a) option 1 and (b) option 2. First, determine the formula to calculate the number of units needed to break even. Number of units to breakeven 1. Calculate the breakeven point in units for (a) option 1 and (b) option 2. 2. At what level of revenues will Curt Rugs earn the same operating income under either option? a. For what range of unit sales will Curt Rugs prefer option 1? b. For what range of unit sales will Curt Rugs prefer option 2? 3. Calculate the degree of operating leverage at sales of 185 units for the two rental options. 4. Briefly explain and interpret your answer to requirement 3. E3-19 (book/static) Question Help The Janowski Company has three product lines of belts-A, B, and C-with contribution margins of $5, $4, and $3, respectively. The president foresees sales of 168,000 units in the coming period, consisting of 24,000 units of A, 96,000 units of B, and 48,000 units of C. The company's fixed costs for the period are $405,000 Read the requirements Requirement 1. What is the company's breakeven point in units, assuming that the given sales mix is maintained? Begin by determining the sales mix. For every 1 unit of Product A, units of Product C are sold. units of Product B, and 1. What is the company's breakeven point in units, assuming that the given sales mix is maintained? 2. If the sales mix is maintained, what is the total contribution margin when 168,000 units are sold? What is the operating income? 3. What would operating income be if the company sold 24,000 units of A, 48,000 units of B, and 96,000 units of C? What is the new breakeven point in units if these relationships persist in the next period? 4. Comparing the breakeven points in requirements 1 and 3, is it always better for a company to choose the sales mix that yields the lower breakeven point? Explain