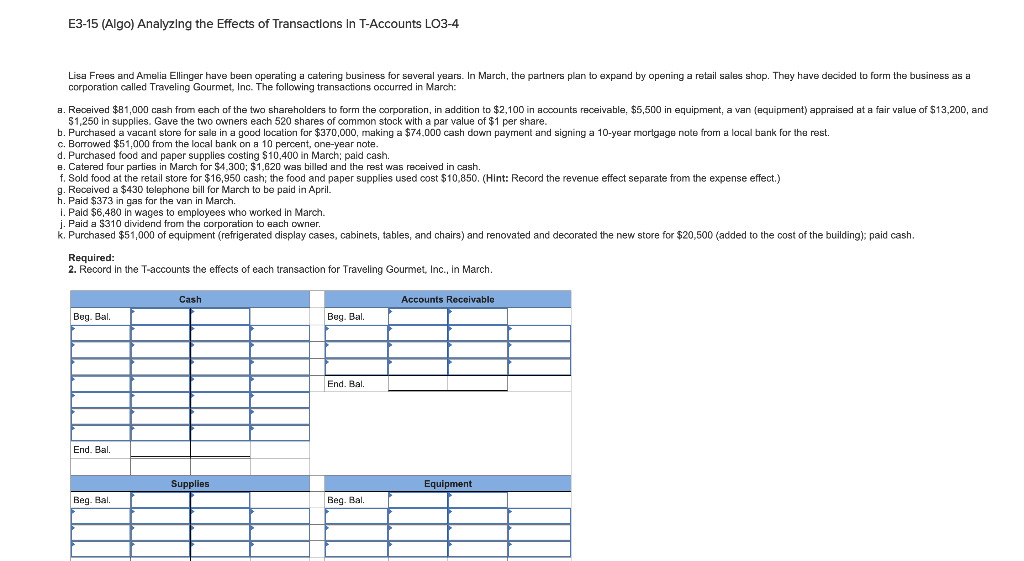

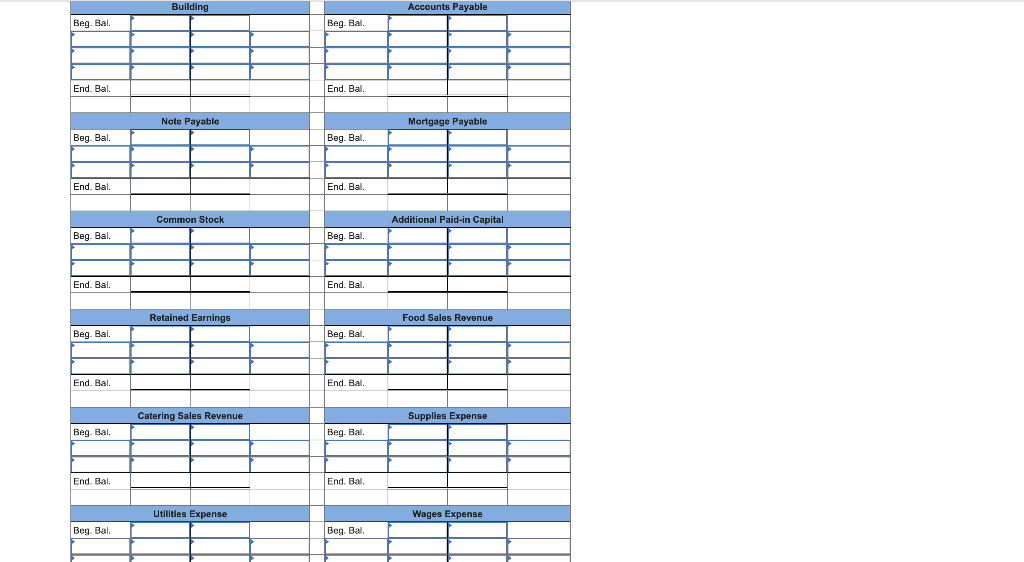

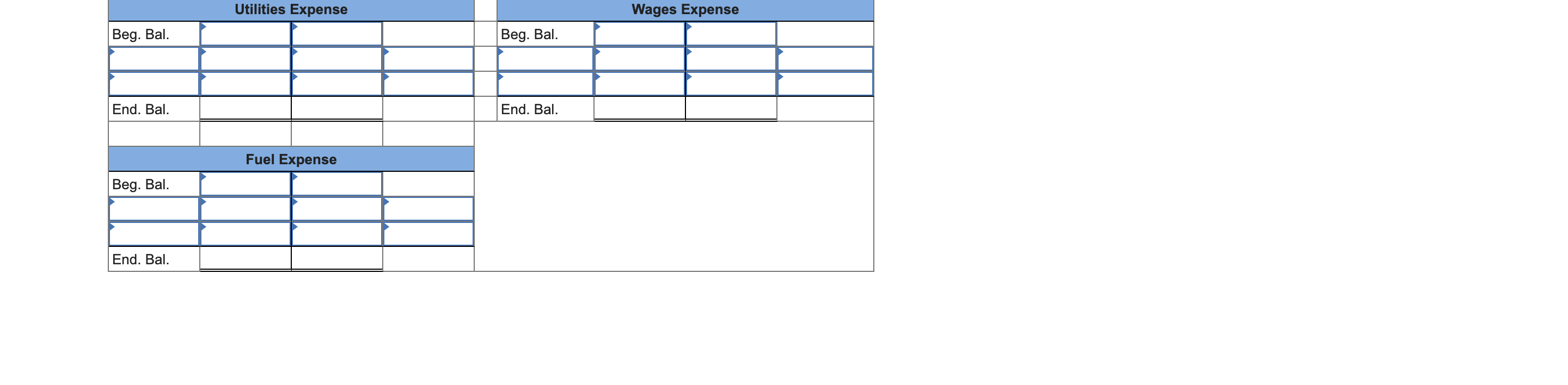

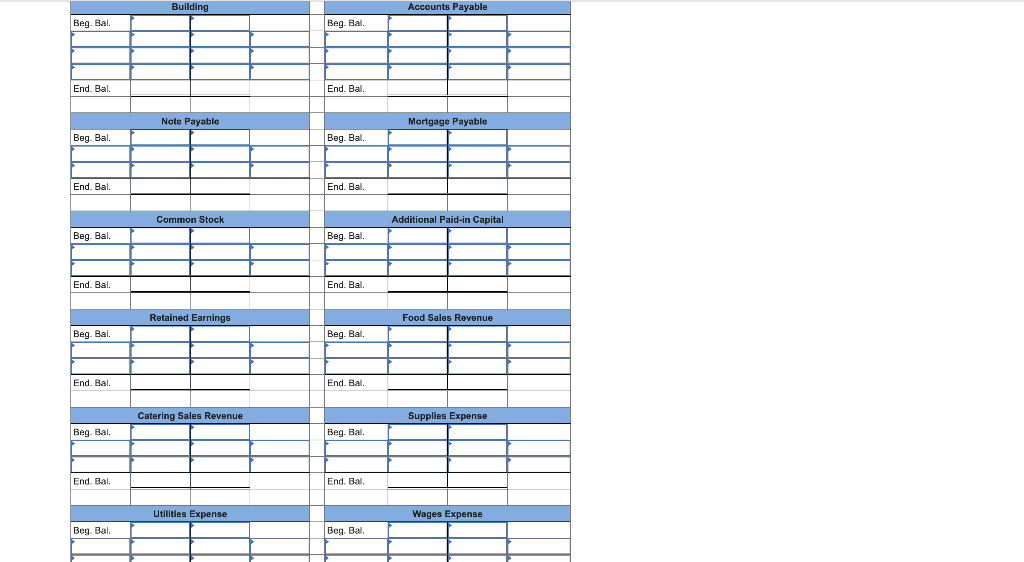

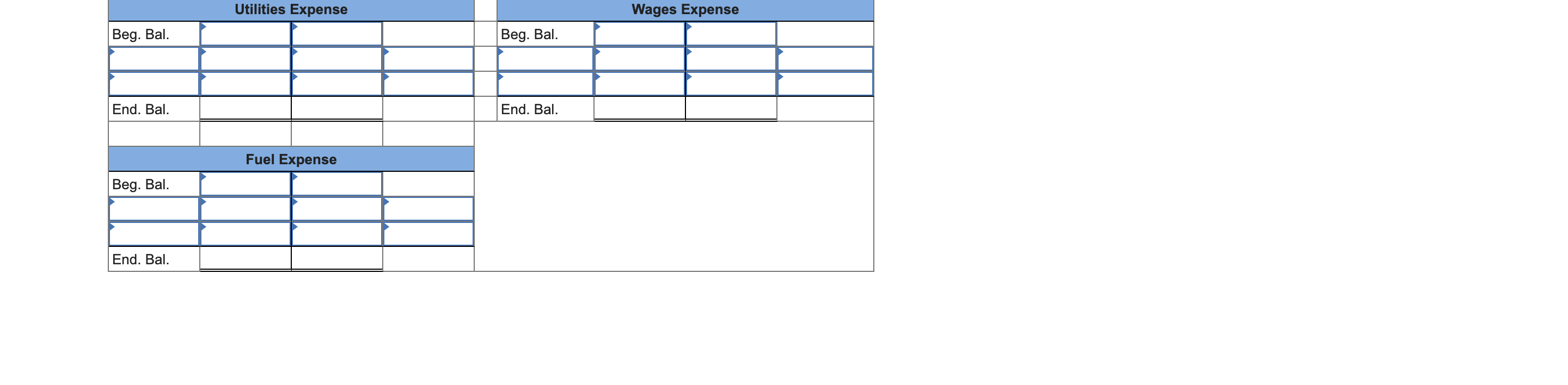

E3-15 (Algo) Analyzing the Effects of Transactions In T-Accounts LO3-4 Lisa Frees and Amelia Ellinger have been operating a catering business for several years. In March, the partners plan to expand by opening a retail sales shop. They have decided to form the business as a corporation called Traveling Gourmet, Inc. The following transactions occurred in March: a. Received $81,000 cash from each of the two shareholders to form the corporation, in addition to $2,100 in accounts receivable, $5,500 in equipment, a van (equipment) appraised at a fair value of $13,200, and $1,250 in supplies. Gave the two owners each 520 shares of common stock with a par value of $1 per share. b. Purchased a vacant store for sale in a good location for $370,000, making a $74,000 cash down payment and signing a 10-year mortgage note from a local bank for the rest. c. Borrowed $51,000 from the local bank on a 10 percent, one-year note. d. Purchased food and paper supplies costing $10.400 in March; paid cash. e. Catered four parties in March for $4,300; $1,620 was billed and the rest was received in cash. f. Sold food at the retail store for $16,950 cash; the food and paper supplies used cost $10,850. (Hint: Record the revenue effect separate from the expense effect.) g. Received a $430 telephone bill for March to be paid in April. h. Paid $373 in gas for the van in March. 1. Pald $6,480 in wages to employees who worked in March. j. Paid a $310 dividend from the corporation to each owner. k. Purchased $51,000 of equipment (refrigerated display cases, cabinets, tables, and chairs) and renovated and decorated the new store for $20,500 (added to the cost of the building); paid cash. Required: 2. Record in the T-accounts the effects of each transaction for Traveling Gourmet, Inc., In March. Cash Accounts Receivable Beg. Bal. Beg. Bal. End. Bal End. Bal. Supplies Equipment Beg. Bal. Beg. Bal. Building Accounts Payable Beg Bal. Beg. Bal End. Bal End. Bal. Note Payable Mortgage Payable Beg. Bal. Beg. Bal. End. Bal. End. Bal Common Stock Additional Paid-in Capital Beg. Bal. Beg. Bal End. Bal End. Bal Retained Earnings Food Sales Revenue Beg. Bal. Beg. Bal End. Bal End, Ba Catering Sales Revenue Supplies Expense Beg. Bal. Beg. Bal. End. Bal. End. Bal Utilities Expense Wages Expense Beg Bal Beg Bal Utilities Expense Wages Expense Beg. Bal. Beg. Bal. End. Bal. End. Bal. Fuel Expense Beg. Bal. End. Bal