Answered step by step

Verified Expert Solution

Question

1 Approved Answer

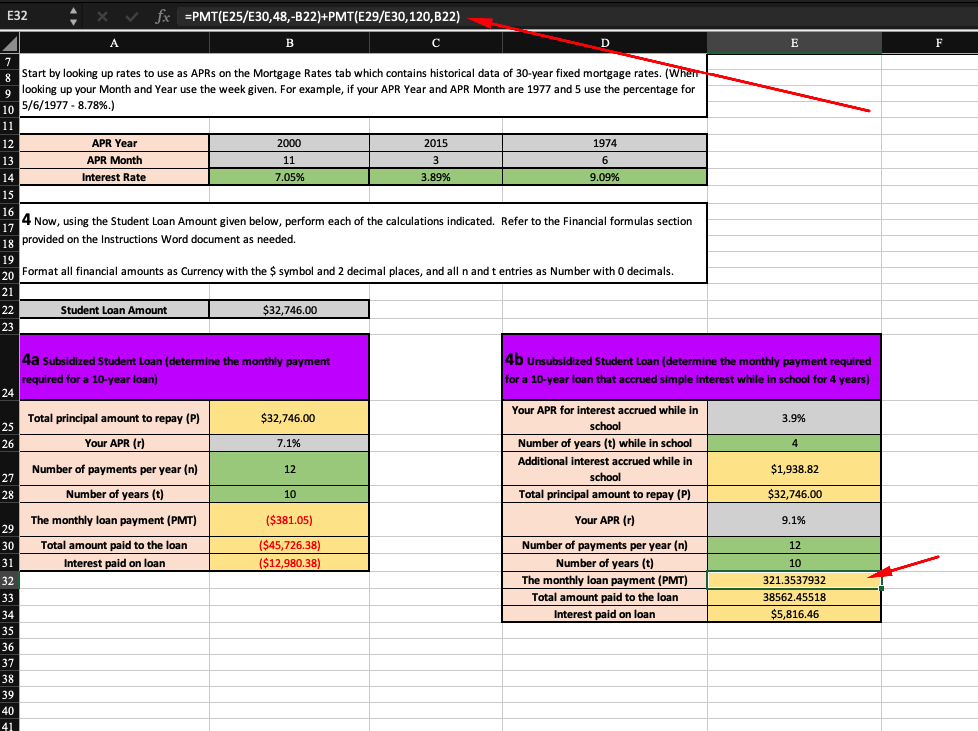

E32 fx =PMT(E25/E30,48,-B22)+PMT(E29/E30,120,B22) B E F 8 9 Start by looking up rates to use as APRS on the Mortgage Rates tab which contains

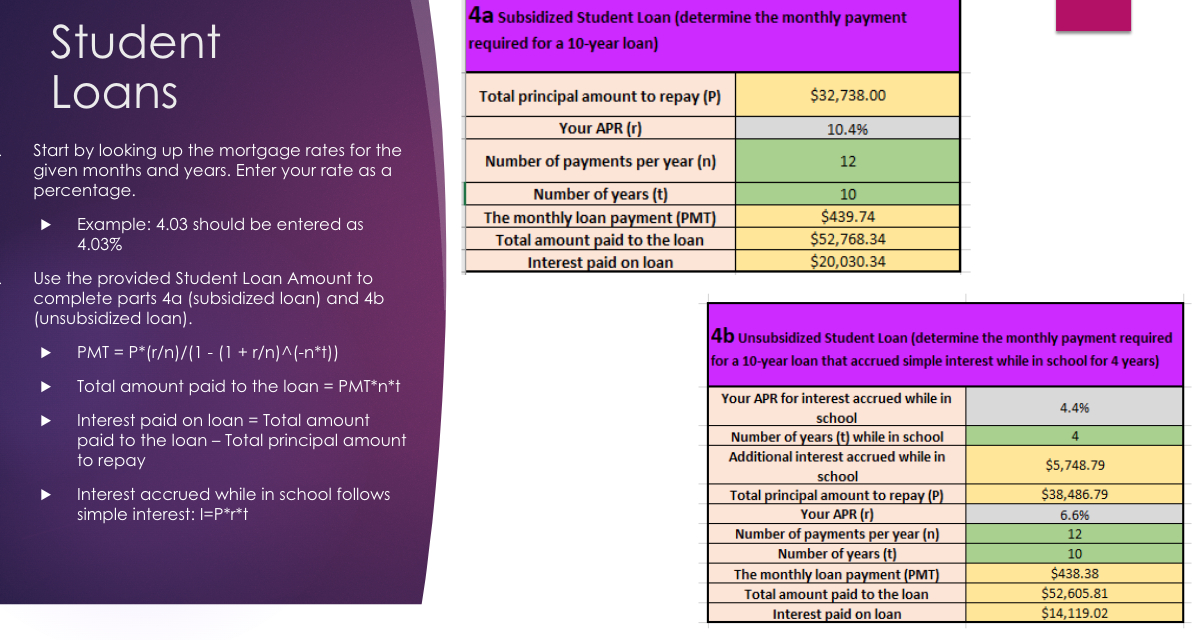

E32 fx =PMT(E25/E30,48,-B22)+PMT(E29/E30,120,B22) B E F 8 9 Start by looking up rates to use as APRS on the Mortgage Rates tab which contains historical data of 30-year fixed mortgage rates. (When looking up your Month and Year use the week given. For example, if your APR Year and APR Month are 1977 and 5 use the percentage for 10 5/6/1977-8.78%.) 11 12 APR Year 13 APR Month 14 Interest Rate 2000 11 7.05% 2015 3 3.89% 1974 6 9.09% 15 16 17 4 Now, using the Student Loan Amount given below, perform each of the calculations indicated. Refer to the Financial formulas section 18 provided on the Instructions Word document as needed. 19 20 Format all financial amounts as Currency with the $ symbol and 2 decimal places, and all n and t entries as Number with 0 decimals. 21 22 Student Loan Amount $32,746.00 23 4a Subsidized Student Loan (determine the monthly payment required for a 10-year loan) 24 Total principal amount to repay (P) $32,746.00 25 26 Your APR (r) 7.1% Number of payments per year (n) 12 27 28 Number of years (t) 10 The monthly loan payment (PMT) ($381.05) 29 30 Total amount paid to the loan ($45,726.38) 31 Interest paid on loan ($12,980.38) 32 33 34 35 36 37 38 39 40 41 4b Unsubsidized Student Loan (determine the monthly payment required for a 10-year loan that accrued simple interest while in school for 4 years) Your APR for interest accrued while in school Number of years (t) while in school Additional interest accrued while in school Total principal amount to repay (P) Your APR (r) Number of payments per year (n) Number of years (t) The monthly loan payment (PMT) Total amount paid to the loan Interest paid on loan 3.9% 4 $1,938.82 $32,746.00 9.1% 12 10 321.3537932 38562.45518 $5,816.46 Student Loans Start by looking up the mortgage rates for the given months and years. Enter your rate as a percentage. Example: 4.03 should be entered as 4.03% Use the provided Student Loan Amount to complete parts 4a (subsidized loan) and 4b (unsubsidized loan). PMT P*(r/n)/(1 - (1 + r/n)^(-n*t)) Total amount paid to the loan = PMT*n*t Interest paid on loan = Total amount paid to the loan - Total principal amount to repay Interest accrued while in school follows simple interest: I=P*r*t 4a Subsidized Student Loan (determine the monthly payment required for a 10-year loan) Total principal amount to repay (P) Your APR (r) Number of payments per year (n) Number of years (t) The monthly loan payment (PMT) Total amount paid to the loan Interest paid on loan $32,738.00 10.4% 12 10 $439.74 $52,768.34 $20,030.34 4b Unsubsidized Student Loan (determine the monthly payment required for a 10-year loan that accrued simple interest while in school for 4 years) Your APR for interest accrued while in school Number of years (t) while in school Additional interest accrued while in school Total principal amount to repay (P) Your APR (r) Number of payments per year (n) Number of years (t) 4.4% 4 $5,748.79 $38,486.79 6.6% 12 10 The monthly loan payment (PMT) Total amount paid to the loan Interest paid on loan $438.38 $52,605.81 $14,119.02

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started