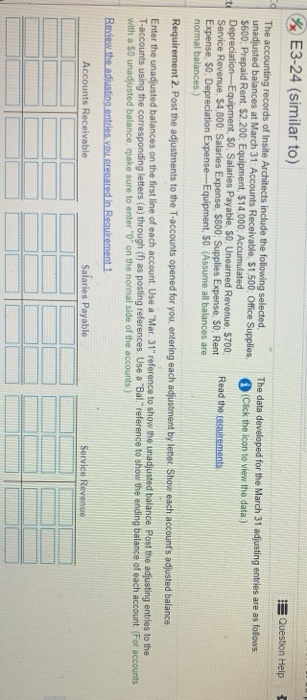

E3-24 (similar to) Question Help ed The accounting records of Insite Architects include the following selected The data developed for the March 31 adjusting entries are as follows unadjusted balances at March 31: Accounts Receivable, $1,500, Office Supplies, $600, Prepaid Rent, $2,200: Equipment, $14,000 Accumulated Click the icon to view the data.) te Depreciation Equipment, So Salaries Payable. So: Unearned Revenue, 5700 Service Revenue, 54,800: Salaries Expense 5800; Supplies Expense, SO. Rent Read the requirements Expense. 50: Depreciation Expense-Equipment, 50. (Assume all balances are normal balances) Requirement 2. Post the adjustments to the T-accounts opened for you entering each adjustment by letter Show each accounts adjusted balance Enter the unadjusted balances on the first line of each account. Use a "Mar. 31" reference to show the unadjusted balance Post the adjusting entries to the T-accounts using the corresponding letters (a) through (f) as posting references. Use a "Bal" reference to show the ending balance of each account (For accounts with a 50 unadjusted balance, make sure to enter "0" on the normal side of the accounts) Review the adjusting entries you, prepared in Resuirement 1 Accounts Receivable Salaries Payable Service Revenue E3-24 (similar to) Question Help ed The accounting records of Insite Architects include the following selected The data developed for the March 31 adjusting entries are as follows unadjusted balances at March 31: Accounts Receivable, $1,500, Office Supplies, $600, Prepaid Rent, $2,200: Equipment, $14,000 Accumulated Click the icon to view the data.) te Depreciation Equipment, So Salaries Payable. So: Unearned Revenue, 5700 Service Revenue, 54,800: Salaries Expense 5800; Supplies Expense, SO. Rent Read the requirements Expense. 50: Depreciation Expense-Equipment, 50. (Assume all balances are normal balances) Requirement 2. Post the adjustments to the T-accounts opened for you entering each adjustment by letter Show each accounts adjusted balance Enter the unadjusted balances on the first line of each account. Use a "Mar. 31" reference to show the unadjusted balance Post the adjusting entries to the T-accounts using the corresponding letters (a) through (f) as posting references. Use a "Bal" reference to show the ending balance of each account (For accounts with a 50 unadjusted balance, make sure to enter "0" on the normal side of the accounts) Review the adjusting entries you, prepared in Resuirement 1 Accounts Receivable Salaries Payable Service Revenue