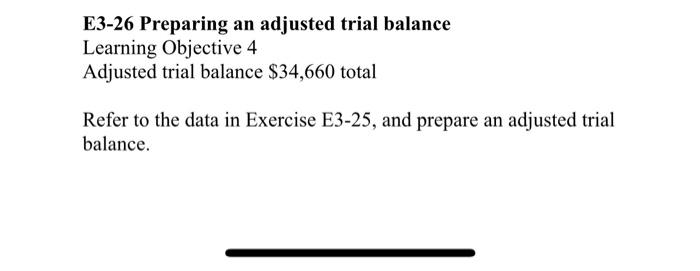

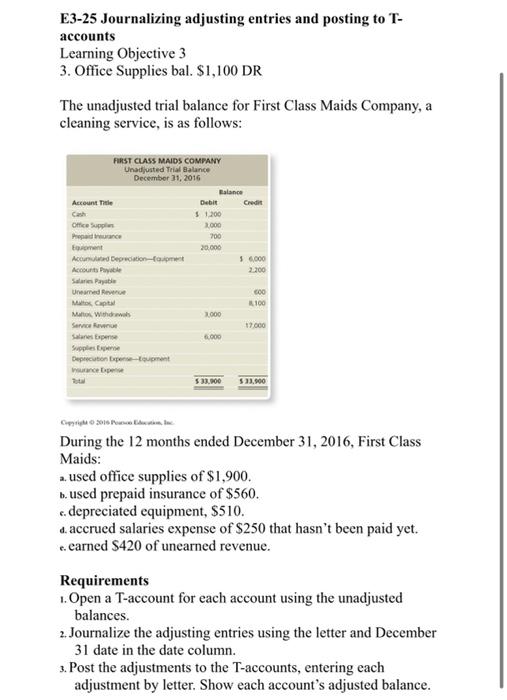

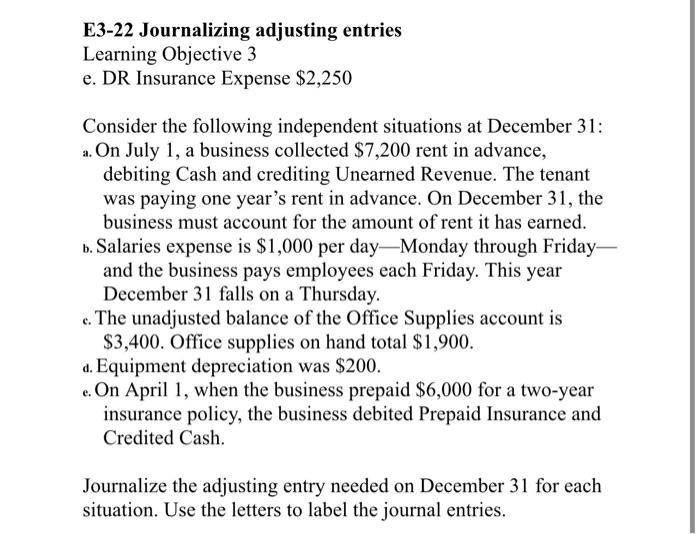

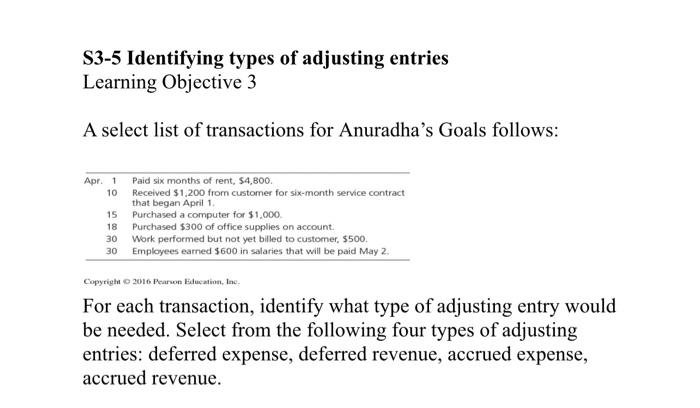

E3-26 Preparing an adjusted trial balance Learning Objective 4 Adjusted trial balance $34,660 total Refer to the data in Exercise E3-25, and prepare an adjusted trial balance. E3-25 Journalizing adjusting entries and posting to T accounts Learning Objective 3 3. Office Supplies bal. $1,100 DR The unadjusted trial balance for First Class Maids Company, a cleaning service, is as follows: During the 12 months ended December 31, 2016, First Class Maids: a. used office supplies of $1,900. b. used prepaid insurance of $560. c. depreciated equipment, $510. d. accrued salaries expense of $250 that hasn't been paid yet. c. earned $420 of unearned revenue. Requirements 1. Open a T-account for each account using the unadjusted balances. 2. Journalize the adjusting entries using the letter and December 31 date in the date column. 3. Post the adjustments to the T-accounts, entering each adjustment by letter. Show each account's adjusted balance. E3-22 Journalizing adjusting entries Learning Objective 3 e. DR Insurance Expense $2,250 Consider the following independent situations at December 31: a. On July 1, a business collected $7,200 rent in advance, debiting Cash and crediting Unearned Revenue. The tenant was paying one year's rent in advance. On December 31, the business must account for the amount of rent it has earned. b. Salaries expense is $1,000 per day-Monday through Fridayand the business pays employees each Friday. This year December 31 falls on a Thursday. c. The unadjusted balance of the Office Supplies account is $3,400. Office supplies on hand total $1,900. d. Equipment depreciation was $200. e. On April 1, when the business prepaid $6,000 for a two-year insurance policy, the business debited Prepaid Insurance and Credited Cash. Journalize the adjusting entry needed on December 31 for each situation. Use the letters to label the journal entries. S3-5 Identifying types of adjusting entries Learning Objective 3 A select list of transactions for Anuradha's Goals follows: For each transaction, identify what type of adjusting entry would be needed. Select from the following four types of adjusting entries: deferred expense, deferred revenue, accrued expense, accrued revenue