Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E4-1 2017 ended December 31, BE4-10 (L05,6) Using the information from BE4-9, prepare a retained earnings statement for the year ended December 31, 2017. Assume

E4-1

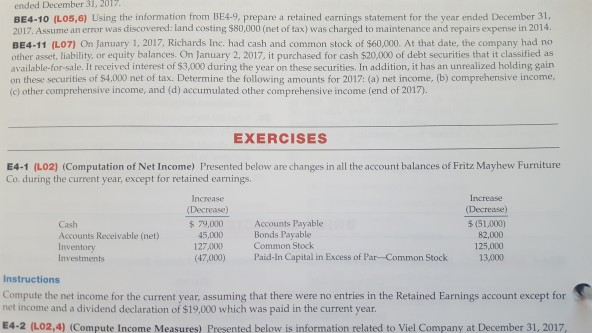

2017 ended December 31, BE4-10 (L05,6) Using the information from BE4-9, prepare a retained earnings statement for the year ended December 31, 2017. Assume an error was discovered: land costing $80,000 (net of tax) was charged to maintenance and repairs expense in 2014 4-11 (LO7) On anuary 1, 2017, Richards Inc. had cash and common stock of $60,000. At that date, the company hadno other asset, liability, or equity balances. On January 2, 2017, it purchased for cash $20,000 of debt securities that it classified as available-for-sale. It received interest of $3,000 during the year on these securities. In addition, it has an unrealized holding gain on these securities of $4,000 net of tax. Determine the following amounts for 2017: (a) net income, (b) comprehensive income (c) other comprehensive income, and (d) accumulated other comprehensive income (end of 2017). EXERCISES E4-1 (L02) (Computation of Net Income) Presented below are changes in all the account balances of Fritz Mayhew Furniture Co. during the current year, except for retained earnings Increase (Decrease) $ 79,000 45,000 127,000 Increase Accounts Payable Bonds Payable Common Stock $(51,000) 82,000 125,000 13,000 Cash Accounts Receivable (net) Investments (47,000) Paid-In Capital in Excess of Par Common Stock Instructions Compute the net income for the current year, assuming that there were no entries in the Retained Earnings account except for net income and a dividend declaration of $19,000 which was paid in the current year E4-2 (L02,4) (Compute Income Measures) Presented below is information related to Viel Company at December 31, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started