Answered step by step

Verified Expert Solution

Question

1 Approved Answer

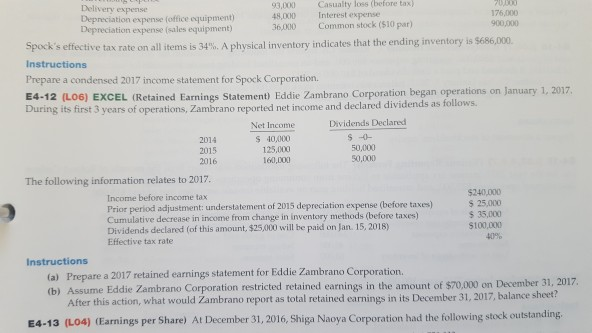

E4-12 very expense Depreciation expense (office equipment) Depreciation expense (sales equipment) 93,000 Casualty loss (before tax) 8,000Interest expense 36,000 Common stock ($10 par) 176,000 900,000

E4-12

very expense Depreciation expense (office equipment) Depreciation expense (sales equipment) 93,000 Casualty loss (before tax) 8,000Interest expense 36,000 Common stock ($10 par) 176,000 900,000 Spock's effective tax rate on all items is 34%. A physical inventory indicates that the ending inventory is S68600 Instructions Prepare a condensed 2017 income statement for Spock Corporation. E4-12 (LO6) EXCEL (Retained Earnings Statement) Eddie Zambrano Corporation began operations on January 1, 2017 During its first 3 years of operations, Zambrano re ported net income and declared dividends as follows. N'et home Dx-idenads Decdhrnd 2014 2015 2016 $ 40,000 125,000 160,000 50,000 50,000 The following information relates to 2017. Income before income tax 5240,000 $ 25,000 $ 35,000 100,000 40% Prior period adjustment: understatement of 2015 depreciation expense (before taxes) Cum ulative decrease in income from change in inventory methods (before taxes) Dividends declared (of this amount, $25,000 will be paid on Jan 15, 2018) Effective tax rate Instructions (a) Prepare a 2017 retained earnings statement for Eddie Zambrano Corporation. (b) Assume Eddie Zambrano Corporation restricted retained earnings in the amount of $70,000 on December 31, 2017 After this action, what would Zambrano report as total retained earnings in its December 31, 2017, balance sheet? E4-13 (L04) (Earnings per Share) At December 31, 2016, Shiga Naoya Corporation had the following stock outstandingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started