Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E4.13 Please explain During the year ended July 30, 2016, Cisco Systems, Inc. acquired the following identifiable intangible assets through its purchase of two companies:

E4.13 Please explain

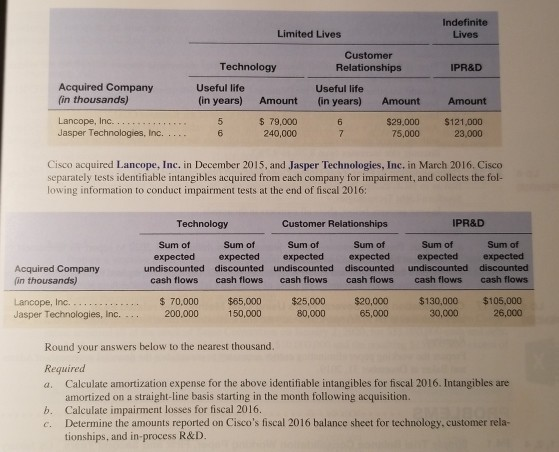

During the year ended July 30, 2016, Cisco Systems, Inc. acquired the following identifiable intangible assets through its purchase of two companies:

Please explain a, b, and c. Please explain Calculations needed.

Indefinite Lives Limited Lives Customer Relationships Technology IPR&D Acquired Company (in thousands) Useful life Useful life (in years) Amount (in years) Amount Amount Lancope, Inc. Jasper Technologies, Inc.. 79,000 240,000 $29,000 75,000 $121,000 23,000 Cisco acquired Lancope, Inc. in December 2015, and Jasper Technologies, Inc. in March 2016. Cisco separately tests identifiable intangibles acquired from each company for impairment, and collects the fol- lowing information to conduct impairment tests at the end of fiscal 2016: Technology IPR&D Customer Relationships Sum of Sum of Sum of Sum of Sum of Sum of expected expected expected expectedexpected expected undiscounted discounted undiscounted discounted undiscounted discounted cash flows cash flows cash flows cash flows cash flows cash flows Acquired Company in thousands) ..$ 70,000 $5,000 $25,000 $20,000 $130,000 $105,000 Lancope, Inc. Jasper Technologies, Inc. 26,000 200,000 150,000 80,000 65,000 30,000 Round your answers below to the nearest thousand. Required a. Calculate amortization expense for the above identifiable intangibles for fiscal 2016. Intangibles are amortized on a straight-line basis starting in the month following acquisition. b. Calculate impairment losses for fiscal 2016. c. Determine the amounts reported on Cisco's fiscal 2016 balance sheet for technology, customer rela- tionships, and in-process R&DStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started