Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E4-20 Differences in Accounting for Property Taxes between the General Fund and Governmental Activities [LO 4-1] During the current year, the City of Plattsburgh recorded

E4-20 Differences in Accounting for Property Taxes between the General Fund and Governmental Activities [LO 4-1]

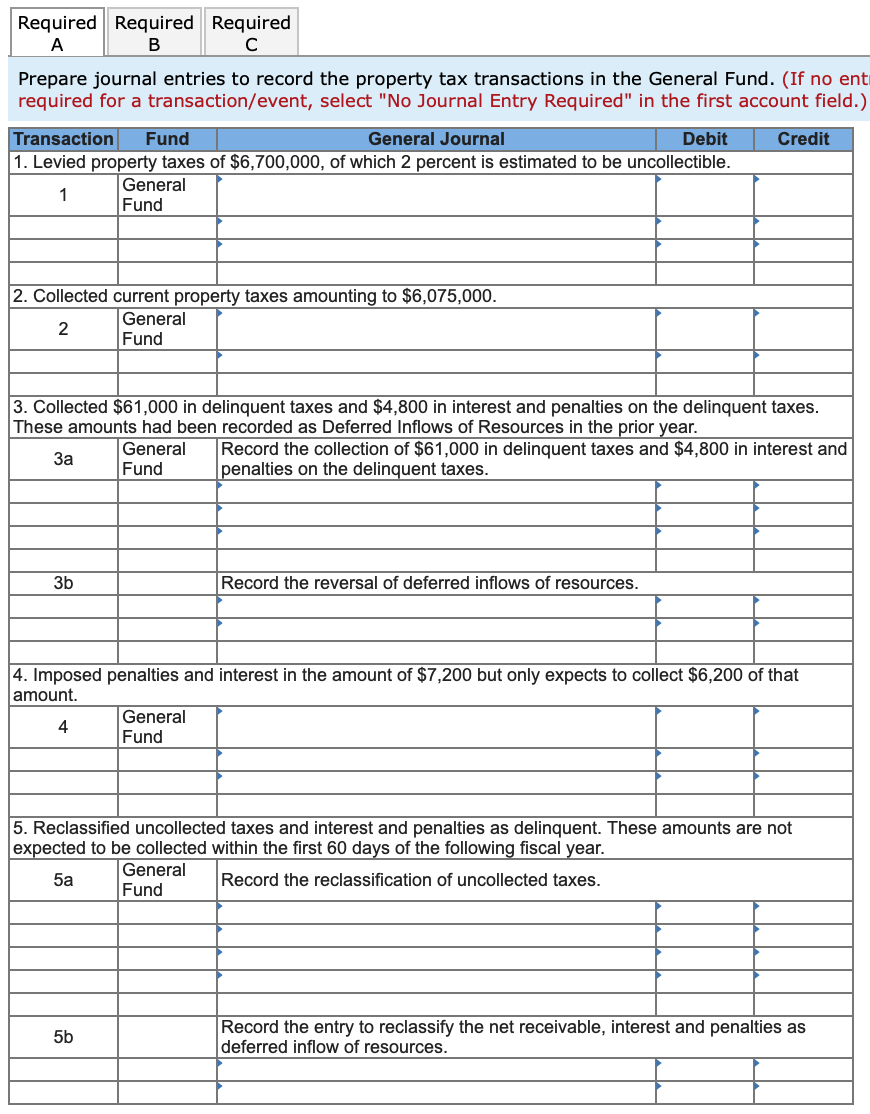

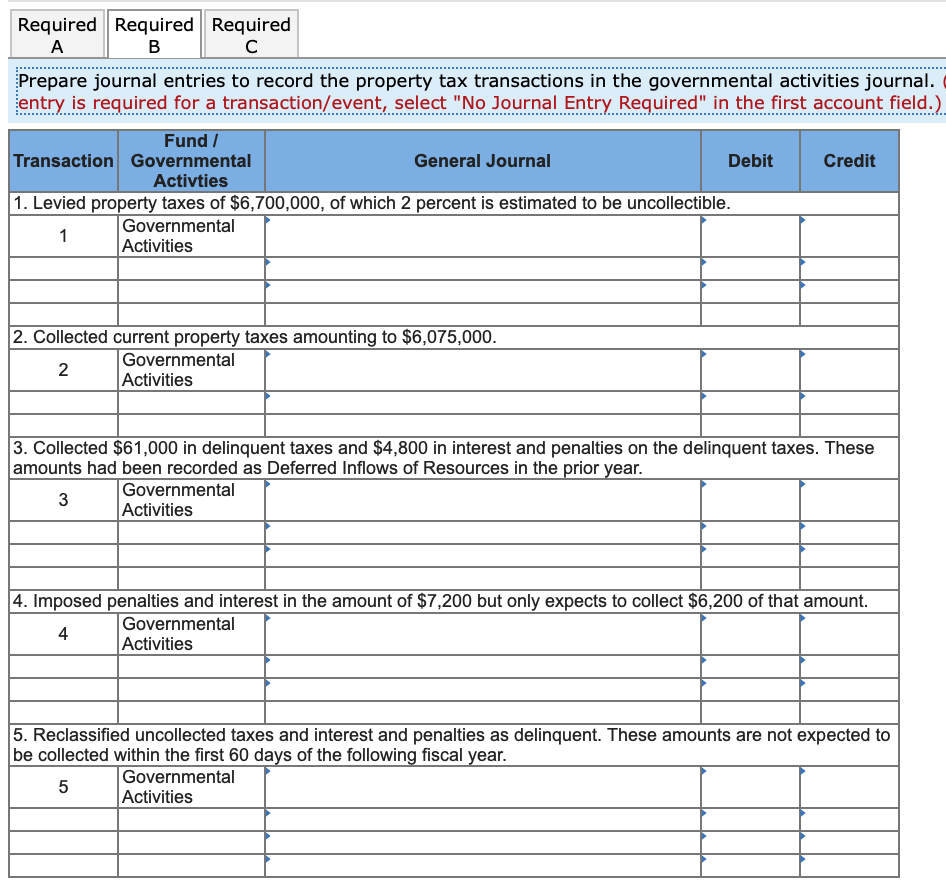

During the current year, the City of Plattsburgh recorded the following transactions related to its property taxes:

- Levied property taxes of $6,700,000, of which 2 percent is estimated to be uncollectible.

- Collected current property taxes amounting to $6,075,000.

- Collected $61,000 in delinquent taxes and $4,800 in interest and penalties on the delinquent taxes. These amounts had been recorded as Deferred Inflows of Resources in the prior year.

- Imposed penalties and interest in the amount of $7,200 but only expects to collect $6,200 of that amount.

- Reclassified uncollected taxes and interest and penalties as delinquent. These amounts are not expected to be collected within the first 60 days of the following fiscal year.

Required

- Prepare journal entries to record the property tax transactions in the General Fund.

-

- Prepare journal entries to record the property tax transactions in the governmental activities journal.

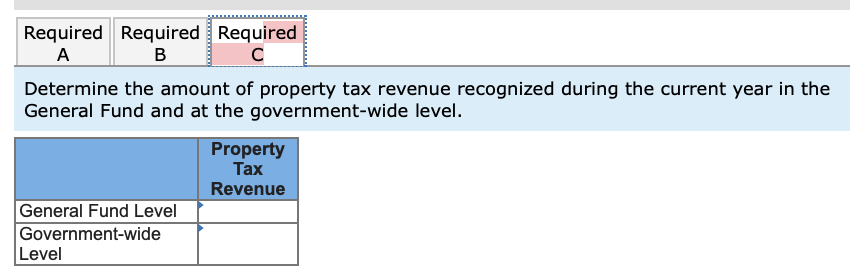

- Determine the amount of property tax revenue recognized during the current year in the General Fund and at the government-wide level.

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started