Answered step by step

Verified Expert Solution

Question

1 Approved Answer

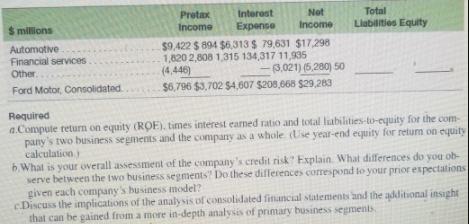

Selected balance sheet and income statement information from Ford motor Company and its two principal business segments, Automotive and financial services for 2016 follows: Total

Selected balance sheet and income statement information from Ford motor Company and its two principal business segments, Automotive and financial services for 2016 follows:

Total Interest Expense Pretax Not Income Liabilities Equity $ millions Income Automotive Financial services $9,422 $ 894 $6,313 $ 79,631 $17,298 1,820 2,808 1,315 134,317 11,935 (4,446) 3,021) (5,280) 50 Other. Ford Motor, Consolidated. $6,796 $3,702 S4,607 $208,668 $29,283 a.Compute return on equity (ROE), times interest earned ratio and total labilities-to-equity for the com- pany's two business segments and the company as a whole (Use year-end equity for return on equity calculation 6.What is your overall assessment of the company's credit risk" Explain What differences do you ob- serve between the two business segments" Do these diflerences correspond to your prior expectations given each company's business model? cDiscuss the implications of the analy sis of consolidated financial statements and the additional insight that can be gained from a more in-depth analysis of primary business segments Required

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Return on equity is computed as net income divided by the amount of shareholders equity It is a meas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started