Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e-5 Lord Mahr works as a currency speculator for Grace Investment of Washington DC. Her latest speculative position is to profit from her expectation that

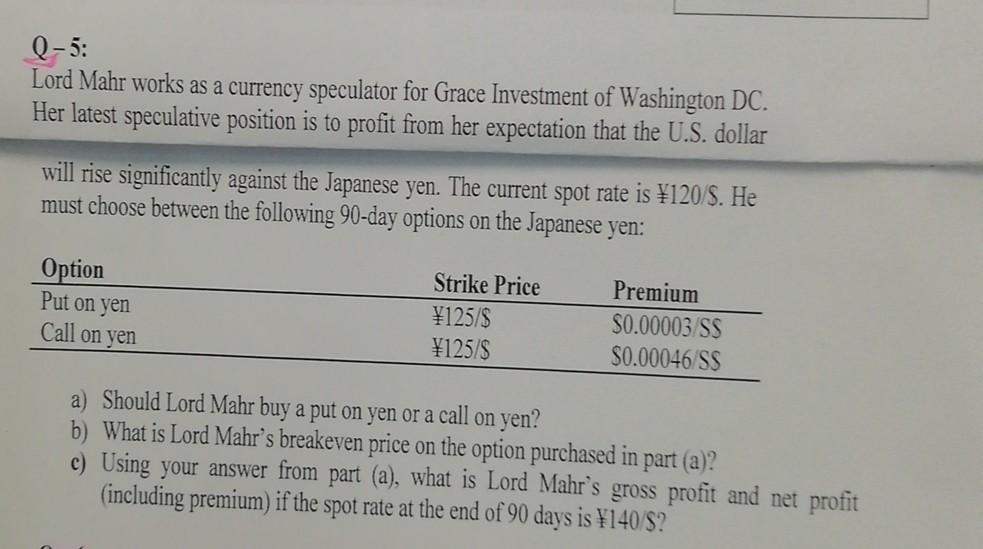

e-5 Lord Mahr works as a currency speculator for Grace Investment of Washington DC. Her latest speculative position is to profit from her expectation that the U.S. dollar will rise significantly against the Japanese yen. The current spot rate is 120/$. He must choose between the following 90-day options on the Japanese yen: Option Put on yen Call on yen Strike Price 125/$ 125/$ Premium $0.00003/SS $0.00046/SS a) Should Lord Mahr buy a put on yen or a call on yen? b) What is Lord Mahr's breakeven price on the option purchased in part (a)? c) Using your answer from part (a), what is Lord Mahr's gross profit and net profit (including premium) if the spot rate at the end of 90 days is 140/$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started