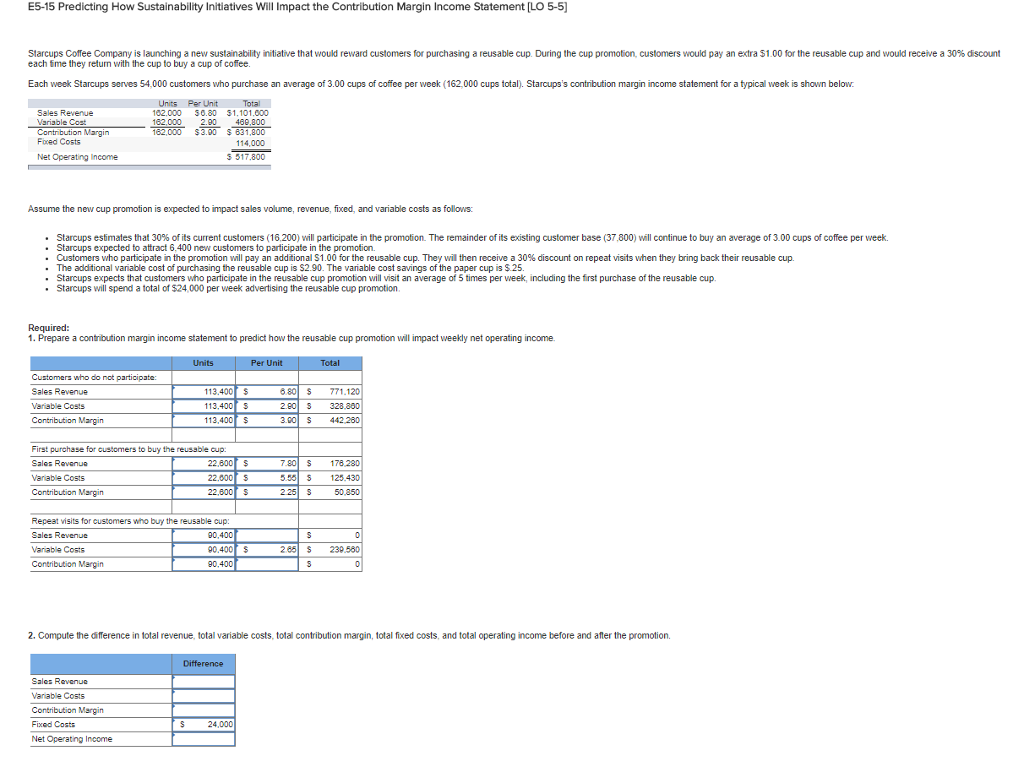

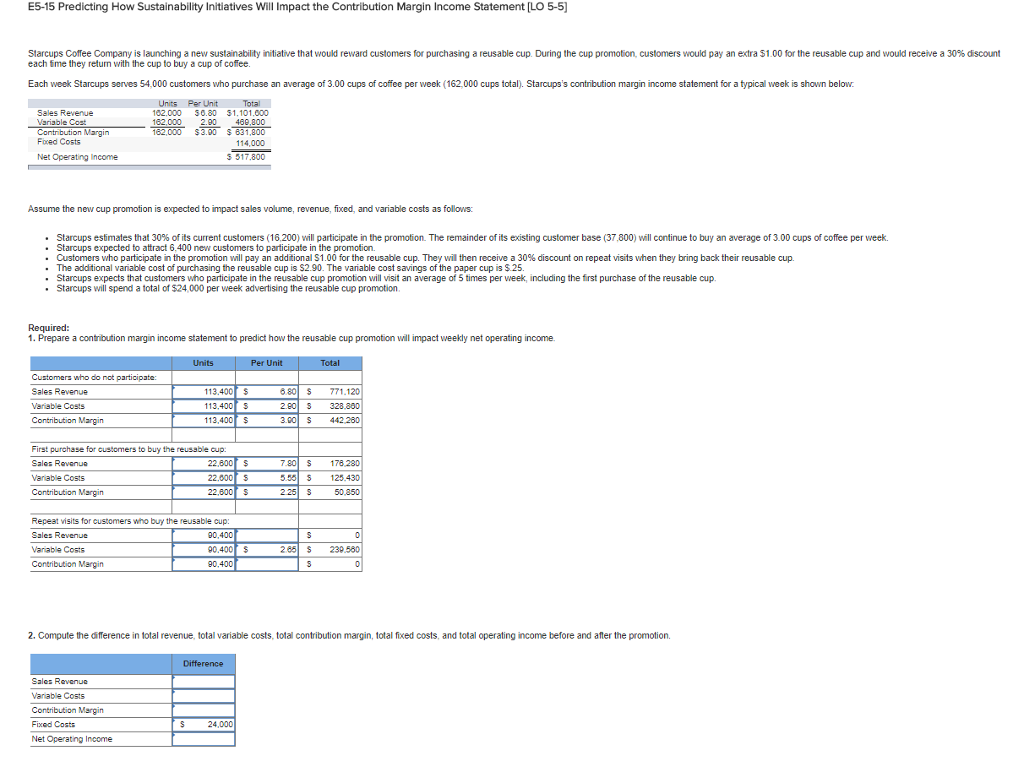

E5-15 Predicting How Sustainability Initiatives Will Impact the Contribution Margin Income Statement [LO 5-5 e that would reward customers for purchasing a reusable cup. During the cup promotion customers would pay an extra $1 00 fo the reusable cup and would receive a 30% discount Starc ps Coffee Company is launching a new sustainability initial each tme they return with the cup to buy a cup of coffee Each week Starcups serves 54,000 customers who purchase an average of 3.00 cups of coffee per week (162 000 cups total). Starcups's contribution margin income statement for a typical week is shown below Units Per UnitTotal Sales Revenue ariable Cost Contribution Margin Fored Costs 02,000 0.0 1.101.000 2.90 469,800 162,000 $3.90 631,800 114,000 517.800 Net Operating Income Assume the new cup promotion is expected to impact sales volume, revenue, ficed, and variable costs as follows: Starcups estimates that 30% of its current customers 16.200) ill participate in the promotion. The remainder of its existing customer base 37.000 will continue to buy an average of 3.00 cups of coffee per week. Starcups expected to attract 6,400 new customers to participate in the promotion. Customers who participate n te promotion will pay an additional S1.00 for the reusable cup. They wil then receive a 30% discount on repeat visits when they bring back their reusable cup The additional variable cost of purchasing the reusable cup is S2.90. The variable cost savings of the paper cup is S 25 Starcups expects that customers who participate in the reusable cup promotion will visit an average of 5 times per week, including the first purchase of the reusable cup . Starcups will spend a total of $24,000 per week advertising the reusable cup promotion Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income Customers who do not participate: Sales Revenue Variable Costs Contribution Margin 113.400 S 113.400s 113,400 S 771.120 280 328.800 S 442 260 First purchase for customers to buy the reusable cup: Sales Ravenue Varable Costs Contribution Margin 22,800 S 22.000 S 22,600 S S 178 280 5.55 5 125.430 225 S Repeat visits for customers who buy the reusable cup: Sales Revenue Variable Costs Contribution Margin 90,400 90.400$ 90.400 286 S 239560 2. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating income before and after the promotion. Sales Revenue Varable Costs Contribution Margin Fixed Costs Net Operating Income 24,000