Answered step by step

Verified Expert Solution

Question

1 Approved Answer

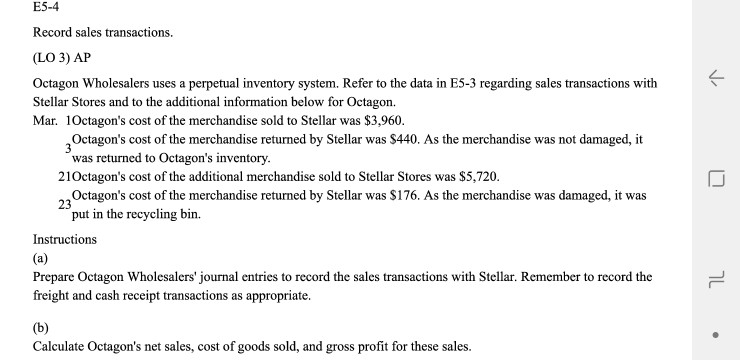

E5-4 Record sales transactions (LO 3) AP Octagon Wholesalers uses a perpetual inventory system. Refer to the data in ES-3 regarding sales transactions with Stellar

E5-4 Record sales transactions (LO 3) AP Octagon Wholesalers uses a perpetual inventory system. Refer to the data in ES-3 regarding sales transactions with Stellar Stores and to the additional information below for Octagon. Mar. 1Octagon's cost of the merchandise sold to Stellar was $3,960. 3Octagon's cost of the merchandise returned by Stellar was $440. As the merchandise was not damaged, it was returned to Octagon's inventory. 21Octagon's cost of the additional merchandise sold to Stellar Stores was $5,720. Octagon's cost of the merchandise returned by Stellar was S176. As the merchandise was damaged, it was put in the recycling bin. 23 Instructions Prepare Octagon Wholesalers' journal entries to record the sales transactions with Stellar. Remember to record the freight and cash receipt transactions as appropriate. Calculate Octagon's net sales, cost of goods sold, and gross profit for these sales. E5-4 Record sales transactions (LO 3) AP Octagon Wholesalers uses a perpetual inventory system. Refer to the data in ES-3 regarding sales transactions with Stellar Stores and to the additional information below for Octagon. Mar. 1Octagon's cost of the merchandise sold to Stellar was $3,960. 3Octagon's cost of the merchandise returned by Stellar was $440. As the merchandise was not damaged, it was returned to Octagon's inventory. 21Octagon's cost of the additional merchandise sold to Stellar Stores was $5,720. Octagon's cost of the merchandise returned by Stellar was S176. As the merchandise was damaged, it was put in the recycling bin. 23 Instructions Prepare Octagon Wholesalers' journal entries to record the sales transactions with Stellar. Remember to record the freight and cash receipt transactions as appropriate. Calculate Octagon's net sales, cost of goods sold, and gross profit for these sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started