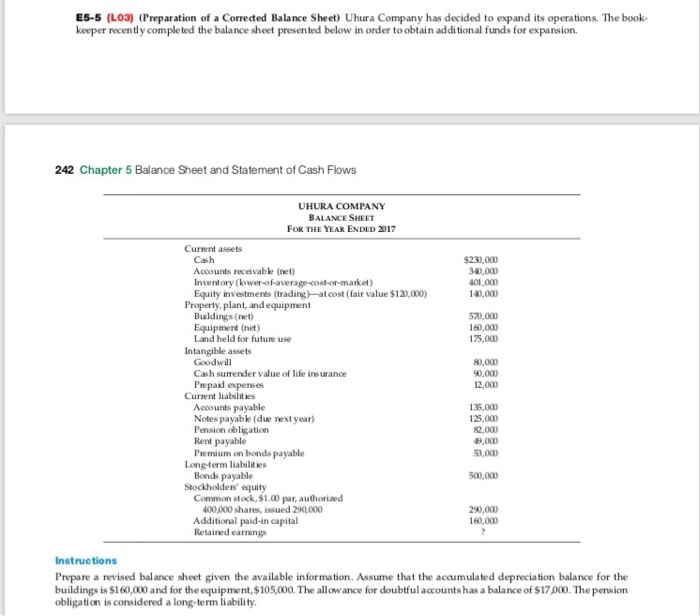

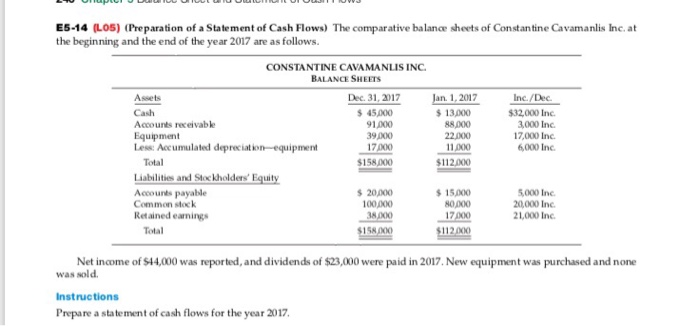

E5-5 (L03) (Preparation of a Corrected Balance Sheet) Uhura Company has decided to expand its operations. The book keeper recently completed the balance sheet presented below in order to obtain additional funds for expansion 242 Chapter 5 Balance Sheet and Statement of Cash Flows UHURA COMPANY BALANCE SHEET FOR THE YEAR ENDED 2017 $230,000 30. 400.00 140,000 520,000 160,000 175,000 0.00 90.000 12.000 Current assets Cash Accounts receivable (net) Inventory (lower-of-average-cost-or-market) Equity investments (trading at cost (fair value $120,000) Property, plant, and equipment Buildings (net) Equipment (net) Land held for future use Intangible assets Goodwill Cash sumender value of life insurance Prepaid expenses Current liabilities Accounts payable Notes payable (due next year) Pension obligation Rent payable Premium on bonds payable Long-term liabilities Bonds payable Stockholders' equity Common stock, $1.00 par, authorized 400,000 shares, issued 290,000 Additional paid-in capital Retained earnings 135.00 125.000 82,000 29.000 53,000 500,000 290,000 160,000 Instructions Prepare a revised balance sheet given the available information. Assume that the accumulated depreciation balance for the buildings is $160,000 and for the equipment, $105,000. The allowance for doubtful accounts has a balance of $17.000. The pension obligation is considered a long-term liability, E5-14 (L05) (Preparation of a Statement of Cash Flows) The comparative balance sheets of Constantine Cavamanlis Inc. at the beginning and the end of the year 2017 are as follows. CONSTANTINE CAVAMANLIS INC. BALANCE SHEETS Inc./Dec. Assets Cach Accounts receivable Equipment Less: Accumulated depreciation equipment Total Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total Dec 31, 2017 $ 45,000 91.00 39.000 17 $158.00 Jan 1, 2017 $ 13,000 88,000 22.000 110 $112.000 $32,000 Inc 3.000 Inc 17,000 Inc 6,000 Inc $ 20,000 100,000 38.000 $158.000 $ 15,000 80,000 17000 $112.000 5000 Inc 20,000 Inc 21,000 Inc Net income of $44,000 was reported, and dividends of $23,000 were paid in 2017. New equipment was purchased and none was sold. Instructions Prepare a statement of cash flows for the year 2017