Answered step by step

Verified Expert Solution

Question

1 Approved Answer

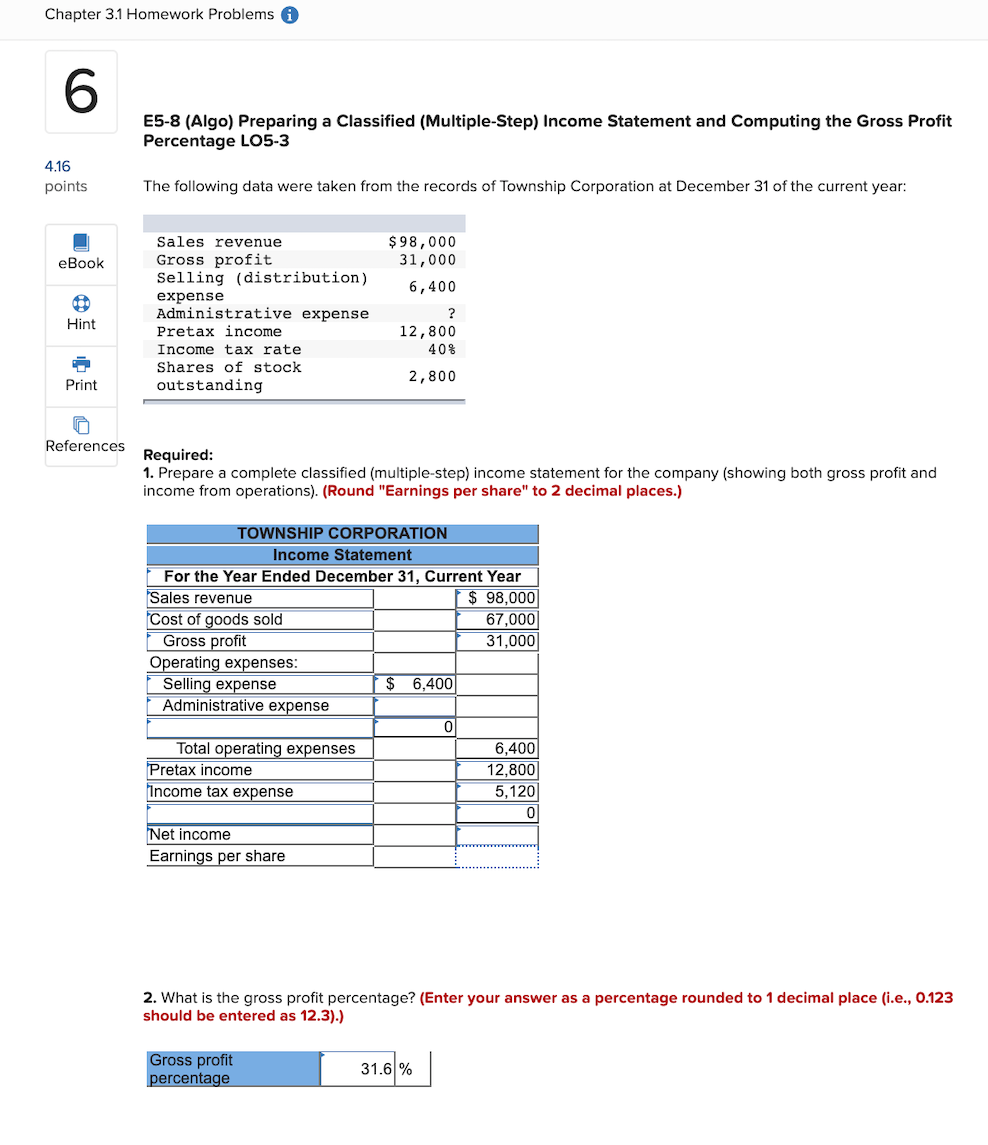

E5-8 (Algo) Preparing a Classified (Multiple-Step) Income Statement and Computing the Gross Profit Percentage LO5-3 need the Administrative expense Net income Earnings per share Chapter

E5-8 (Algo) Preparing a Classified (Multiple-Step) Income Statement and Computing the Gross Profit Percentage LO5-3

need the Administrative expense

Net income

Earnings per share

Chapter 3.1 Homework Problems E5-8 (Algo) Preparing a Classified (Multiple-Step) Income Statement and Computing the Gross Profit Percentage LO5-3 4.16 points The following data were taken from the records of Township Corporation at December 31 of the current year: eBook $ 98,000 31,000 6,400 Sales revenue Gross profit Selling (distribution) expense Administrative expense Pretax income Income tax rate Shares of stock outstanding Hint 12,800 408 2,800 Print References Required: 1. Prepare a complete classified (multiple-step) income statement for the company (showing both gross profit and income from operations). (Round "Earnings per share" to 2 decimal places.) TOWNSHIP CORPORATION Income Statement For the Year Ended December 31, Current Year Sales revenue $ 98,000 Cost of goods sold 67,000 Gross profit 31,000 Operating expenses: Selling expense $ 6,400 Administrative expense Total operating expenses Pretax income Income tax expense 6,400 12,800 5,120 Net income Earnings per share 2. What is the gross profit percentage? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 0.123 should be entered as 12.3).) Gross profit percentage 31.6%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started