Answered step by step

Verified Expert Solution

Question

1 Approved Answer

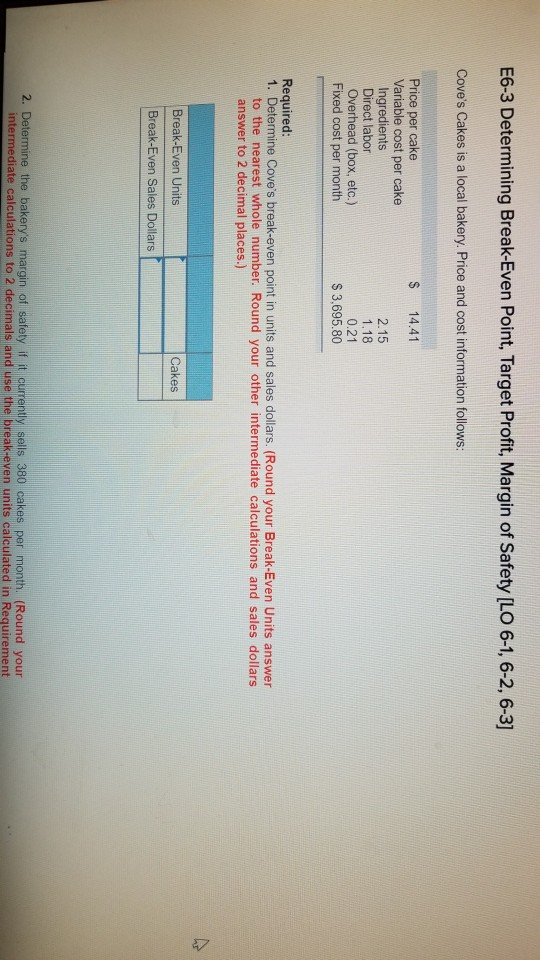

E6-3 Determining Break-Even Point, Target Profit, Margin of Safety [LO 6-1, 6-2, 6-3] Cove's Cakes is a local bakery. Price and cost information follows S

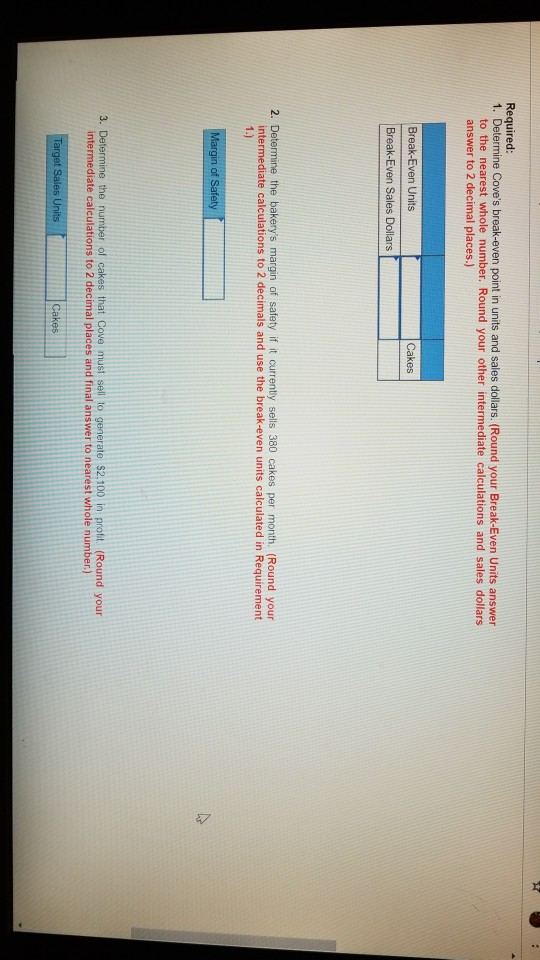

E6-3 Determining Break-Even Point, Target Profit, Margin of Safety [LO 6-1, 6-2, 6-3] Cove's Cakes is a local bakery. Price and cost information follows S 14.41 Price per cake Variable cost per cake 2.15 1.18 0.21 $ 3,695.80 Ingredients Direct labor Overhead (box, etc.) Fixed cost per month Required 1. Determine Cove's break-even point in units and sales dollars. (Round your Break-Even Units answer to the nearest whole number. Round your other intermediate calculations and sales dollars answer to 2 decimal places.) Break-Even Units Break-Even Sales Dollars Cakes urrenty sells 380 cakes per month. (Round your intermediate calculations to 2 decimals and use the break-even units calculated in Requirement 2. Determine the bakery's margin of safety if it o Required 1. Determine Cove's break-even point in units and sales dollars. (Round your Break-Even Units answer to the nearest whole number. Round your other intermediate calculations and sales dollars answer to 2 decimal places.) Cakes Break-Even Units Break-Even Sales Dolars 2. Determine the bakerys margin of safety if it currently sells 380 cakes per month. (Round your intermediate calculations to 2 decimals and use the break-even units calculated in Requirement of 3. Determine the number of cakes that Cove must sell to generate $2,100 in profit. (Round your intermediate calculations to 2 decimal places and final answer to nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started