Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E6-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio; Identifying Break-Even Point, Target Profit [LO 6-1, 6-2] Sandy Bank, Incorporated, makes one model of wooden

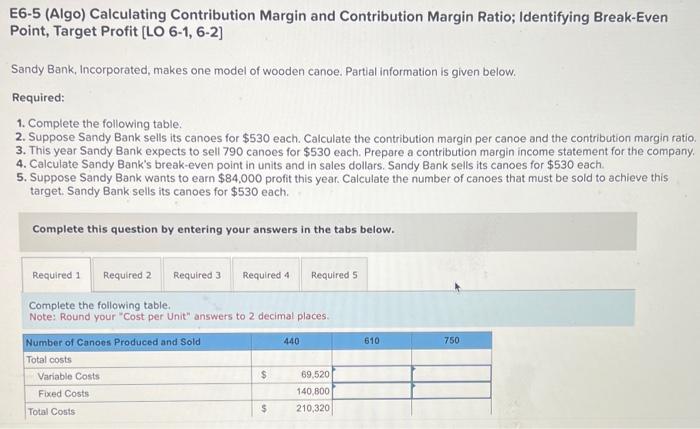

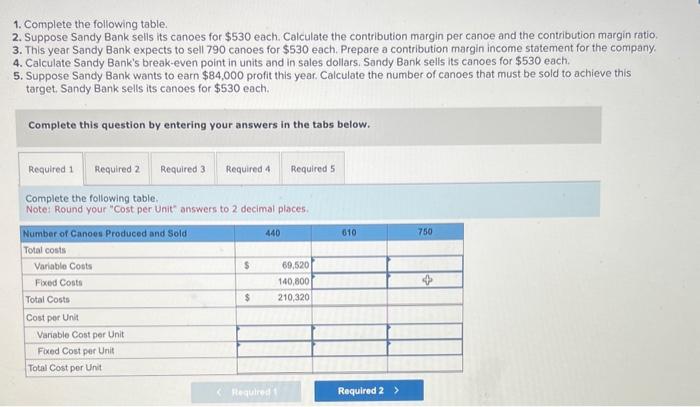

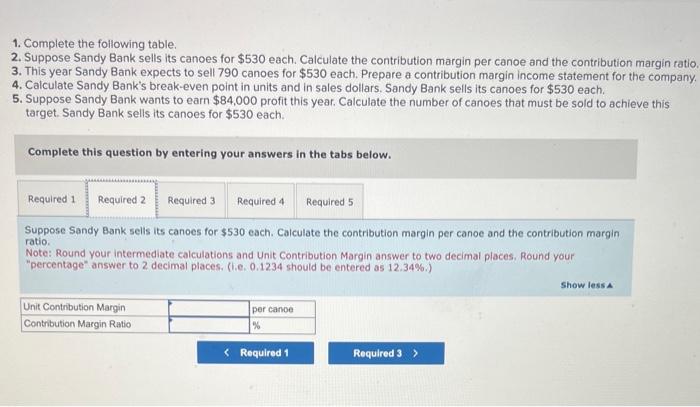

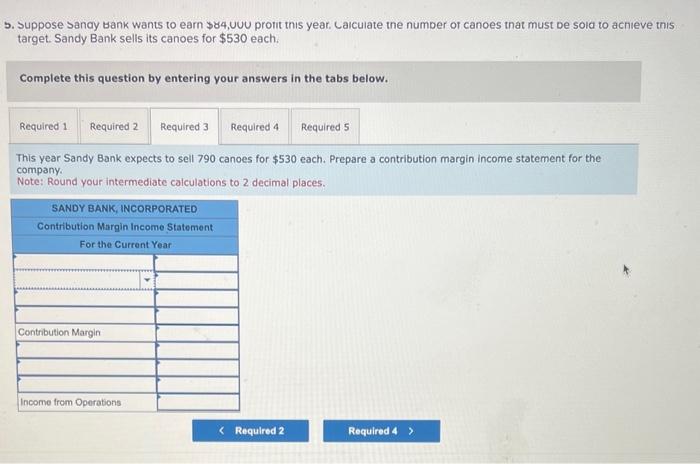

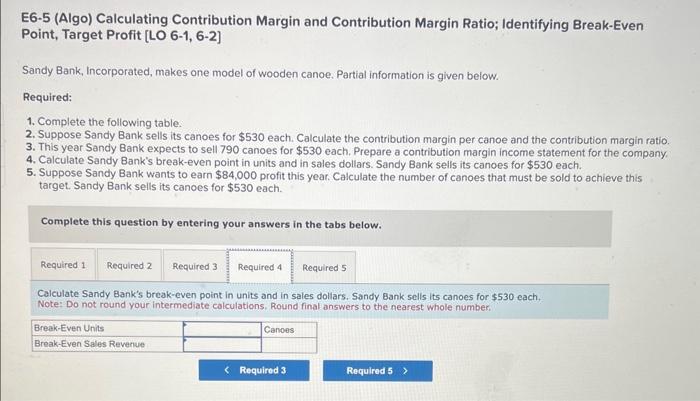

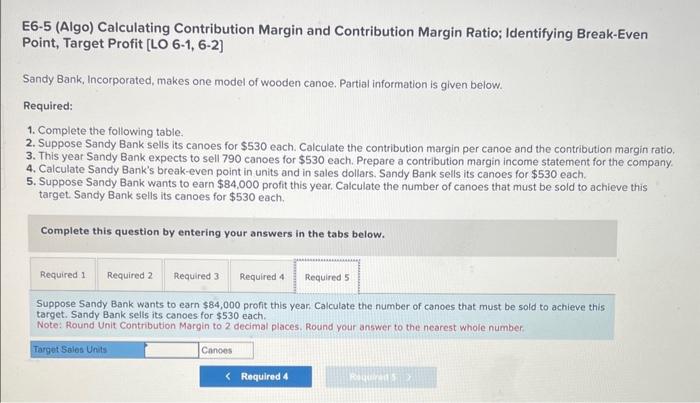

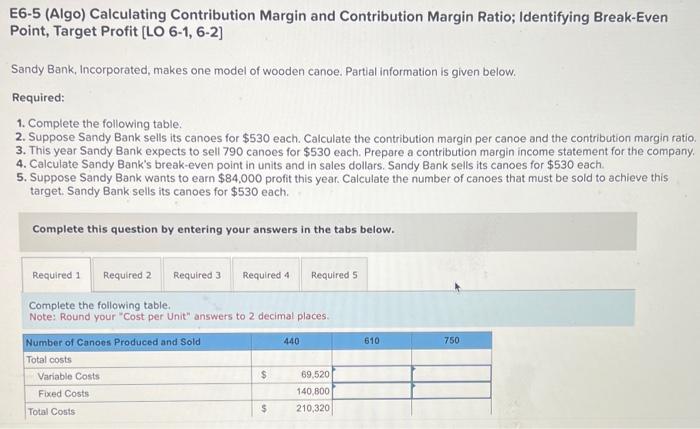

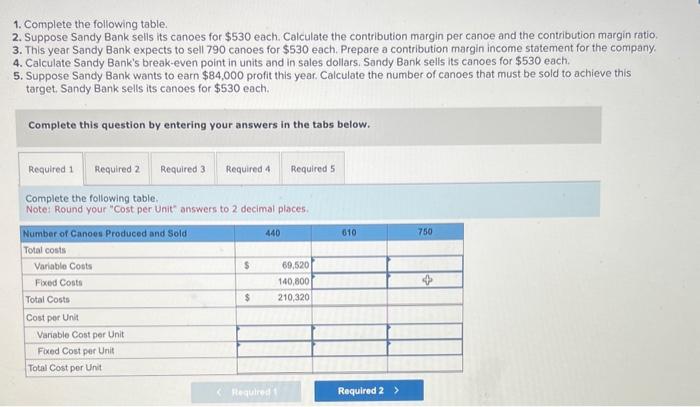

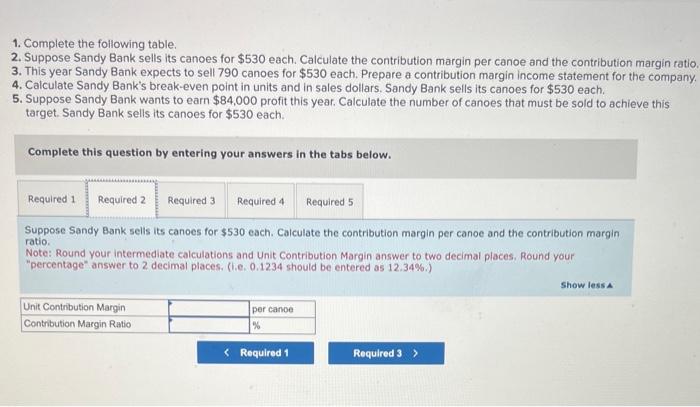

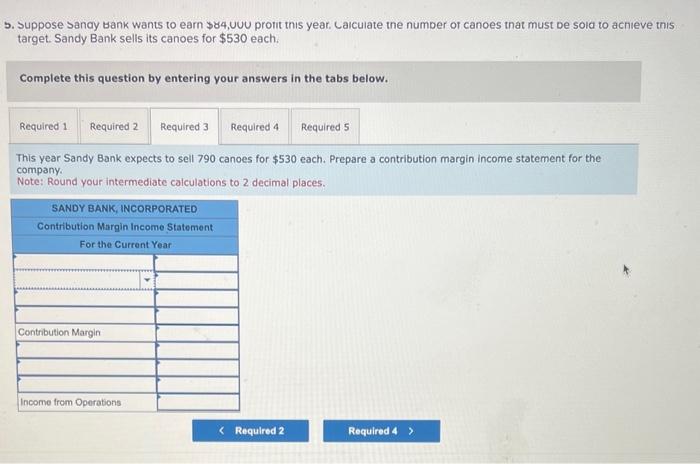

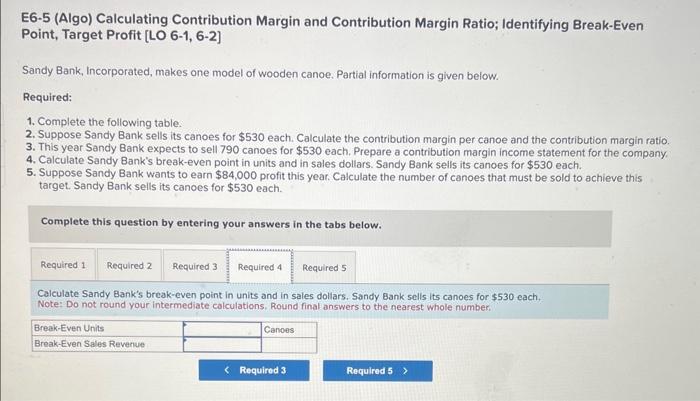

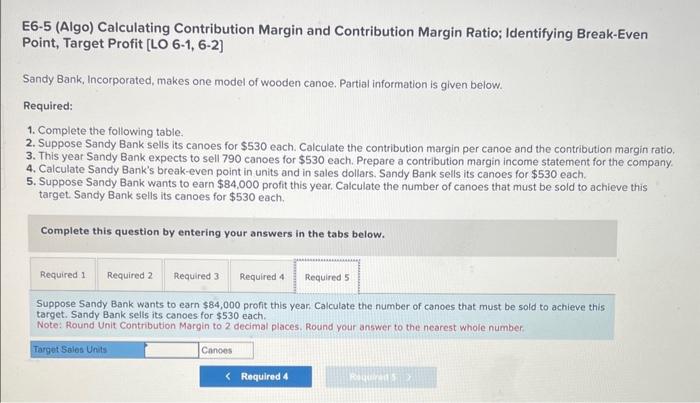

E6-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio; Identifying Break-Even Point, Target Profit [LO 6-1, 6-2] Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratic 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Complete the following table. Note: Round your "Cost per Unit" answers to 2 decimal places. 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Complete the following table. Notes Round your "Cost per Unit" answers to 2 decimal places. 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin rati 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the compan 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Suppose Sandy Bank selis its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio. Note: Round your intermediate calculations and Unit Contribution Margin answer to two decimal places. Round your "percentage" answer to 2 decimal places. (i.e. 0.1234 should be entered as 12.34%.) b. Suppose Sancy bank wants to earn $84,00 proit this year. Laiculate the number of canoes that must be sola to acnieve tnis target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company. Note: Round your intermediate calculations to 2 decimal places. E6-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio; Identifying Break-Even Point, Target Profit [LO 6-1, 6-2] Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Calculate Sandy Bank's break-even point in units and in sales doliars. Sandy Bank sells its canoes for $530 each. Note: Do not round your intermediate calculations. Round final answers to the nearest whole number. E6-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio; Identifying Break-Even Point, Target Profit [LO 6-1, 6-2] Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio, 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank selts its canoes for $530 each. Note: Round Unit Contribution Margin to 2 decimal places. Round your answer to the nearest whole number

E6-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio; Identifying Break-Even Point, Target Profit [LO 6-1, 6-2] Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratic 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Complete the following table. Note: Round your "Cost per Unit" answers to 2 decimal places. 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Complete the following table. Notes Round your "Cost per Unit" answers to 2 decimal places. 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin rati 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the compan 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Suppose Sandy Bank selis its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio. Note: Round your intermediate calculations and Unit Contribution Margin answer to two decimal places. Round your "percentage" answer to 2 decimal places. (i.e. 0.1234 should be entered as 12.34%.) b. Suppose Sancy bank wants to earn $84,00 proit this year. Laiculate the number of canoes that must be sola to acnieve tnis target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company. Note: Round your intermediate calculations to 2 decimal places. E6-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio; Identifying Break-Even Point, Target Profit [LO 6-1, 6-2] Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Calculate Sandy Bank's break-even point in units and in sales doliars. Sandy Bank sells its canoes for $530 each. Note: Do not round your intermediate calculations. Round final answers to the nearest whole number. E6-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio; Identifying Break-Even Point, Target Profit [LO 6-1, 6-2] Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio, 3. This year Sandy Bank expects to sell 790 canoes for $530 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $530 each. Complete this question by entering your answers in the tabs below. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank selts its canoes for $530 each. Note: Round Unit Contribution Margin to 2 decimal places. Round your answer to the nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started