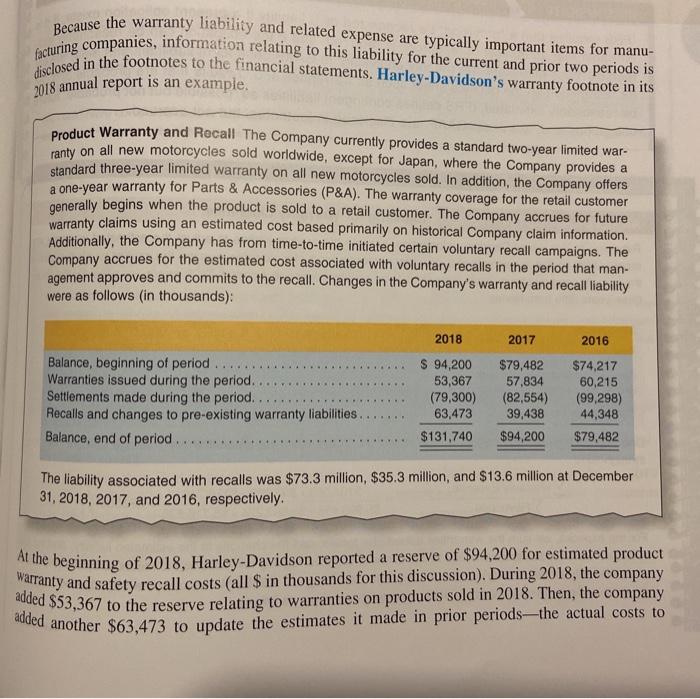

E7-29. Recording and Analyzing Warranty Accrual and Payment Refer to the discussion of and excerpt from the Harley-Davidson Inc. warranty reserve on page 7-6 to answer the following questions. a. Using the financial statement effects template, record separately the 2018 warranty liability transac- tions relating to the (1) "Warranties issued during the period." (2) "Recalls and changes to preexisting warranty obligations," and (3) "Settlements made during the period." b. Does the level of Harley-Davidson's warranty accrual appear to be reasonable? Because the warranty liability and related expense are typically important items for manu- facturing companies, information relating to this liability for the current and prior two periods is disclosed in the footnotes to the financial statements. Harley-Davidson's warranty footnote in its 2018 annual report is an example. Product Warranty and Recall The Company currently provides a standard two-year limited war- ranty on all new motorcycles sold worldwide, except for Japan, where the Company provides a standard three-year limited warranty on all new motorcycles sold. In addition, the Company offers a one-year warranty for Parts & Accessories (P&A). The warranty coverage for the retail customer generally begins when the product is sold to a retail customer. The Company accrues for future warranty claims using an estimated cost based primarily on historical Company claim information Additionally, the Company has from time-to-time initiated certain voluntary recall campaigns. The Company accrues for the estimated cost associated with voluntary recalls in the period that man- agement approves and commits to the recall. Changes in the Company's warranty and recall liability were as follows (in thousands): 2018 2017 2016 Balance, beginning of period .... Warranties issued during the period. Settlements made during the period.. Recalls and changes to pre-existing warranty liabilities Balance, end of period. $ 94,200 53,367 (79,300) 63,473 $131,740 $79,482 57.834 (82,554) 39,438 $94,200 $74,217 60,215 (99,298) 44,348 $79,482 . The liability associated with recalls was $73.3 million, $35.3 million, and $13.6 million at December 31, 2018, 2017, and 2016, respectively. At the beginning of 2018, Harley-Davidson reported a reserve of $94,200 for estimated product warranty and safety recall costs (all $ in thousands for this discussion). During 2018, the company added $53,367 to the reserve relating to warranties on products sold in 2018. Then, the company added another $63,473 to update the estimates it made in prior periodsthe actual costs to E7-29. Recording and Analyzing Warranty Accrual and Payment Refer to the discussion of and excerpt from the Harley-Davidson Inc. warranty reserve on page 7-6 to answer the following questions. a. Using the financial statement effects template, record separately the 2018 warranty liability transac- tions relating to the (1) "Warranties issued during the period." (2) "Recalls and changes to preexisting warranty obligations," and (3) "Settlements made during the period." b. Does the level of Harley-Davidson's warranty accrual appear to be reasonable? Because the warranty liability and related expense are typically important items for manu- facturing companies, information relating to this liability for the current and prior two periods is disclosed in the footnotes to the financial statements. Harley-Davidson's warranty footnote in its 2018 annual report is an example. Product Warranty and Recall The Company currently provides a standard two-year limited war- ranty on all new motorcycles sold worldwide, except for Japan, where the Company provides a standard three-year limited warranty on all new motorcycles sold. In addition, the Company offers a one-year warranty for Parts & Accessories (P&A). The warranty coverage for the retail customer generally begins when the product is sold to a retail customer. The Company accrues for future warranty claims using an estimated cost based primarily on historical Company claim information Additionally, the Company has from time-to-time initiated certain voluntary recall campaigns. The Company accrues for the estimated cost associated with voluntary recalls in the period that man- agement approves and commits to the recall. Changes in the Company's warranty and recall liability were as follows (in thousands): 2018 2017 2016 Balance, beginning of period .... Warranties issued during the period. Settlements made during the period.. Recalls and changes to pre-existing warranty liabilities Balance, end of period. $ 94,200 53,367 (79,300) 63,473 $131,740 $79,482 57.834 (82,554) 39,438 $94,200 $74,217 60,215 (99,298) 44,348 $79,482 . The liability associated with recalls was $73.3 million, $35.3 million, and $13.6 million at December 31, 2018, 2017, and 2016, respectively. At the beginning of 2018, Harley-Davidson reported a reserve of $94,200 for estimated product warranty and safety recall costs (all $ in thousands for this discussion). During 2018, the company added $53,367 to the reserve relating to warranties on products sold in 2018. Then, the company added another $63,473 to update the estimates it made in prior periodsthe actual costs to