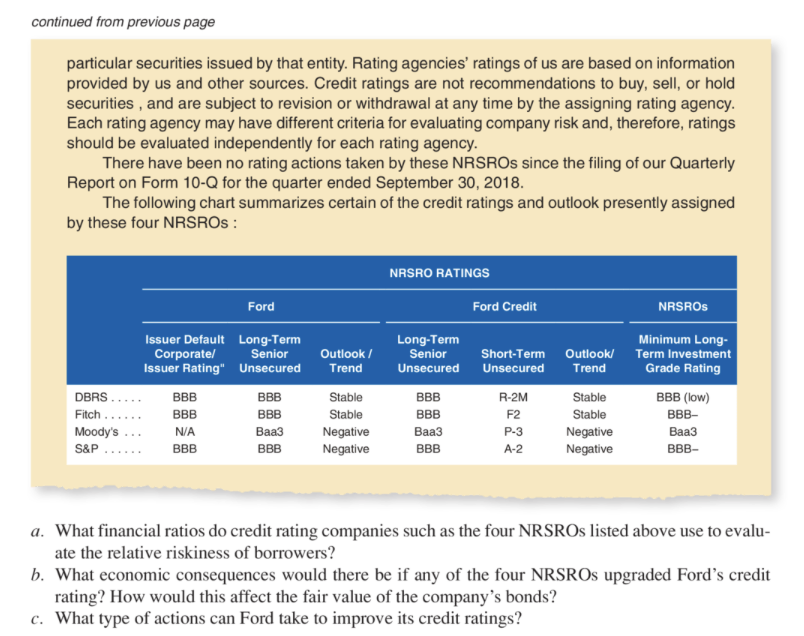

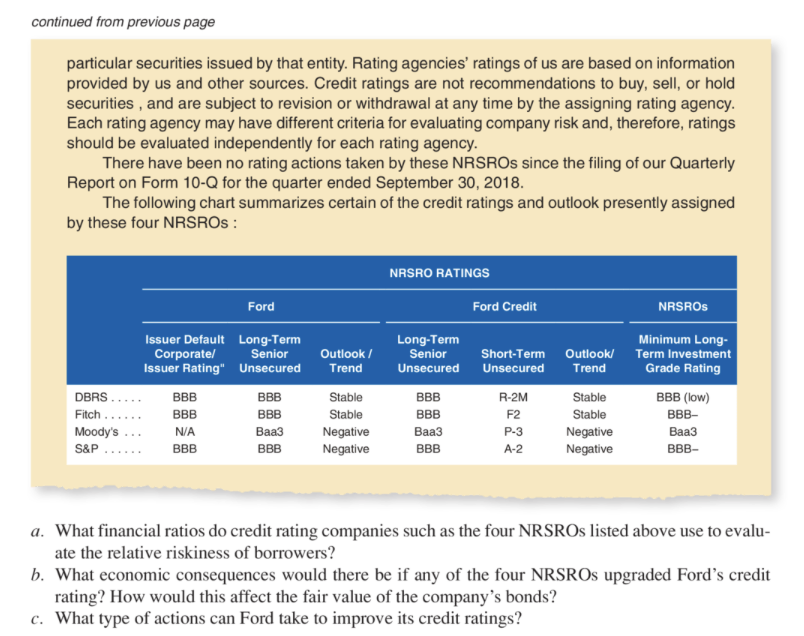

E7-33. Assessing the Effects of Bond Credit Rating Changes Ford Motor Co. reports the following information from the Risk Factors and the Management Discus- sion and Analysis sections of its 2018 10-K report. Credit Ratings Our short-term and long-term debt is rated by four credit rating agencies desig- nated as nationally recognized statistical rating organizations ("NRSROS) by the U.S. Securities and Exchange Commission: DBRS, Fitch, Moody's, and S&P Global Ratings. In several markets , locally-recognized rating agencies also rate us. A credit rating reflects an assessment by the rating agency of the credit risk associated with a corporate entity or continued continued from previous page particular securities issued by that entity. Rating agencies' ratings of us are based on information provided by us and other sources. Credit ratings are not recommendations to buy, sell, or hold securities , and are subject to revision or withdrawal at any time by the assigning rating agency. Each rating agency may have different criteria for evaluating company risk and, therefore, ratings should be evaluated independently for each rating agency. There have been no rating actions taken by these NRSROs since the filing of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2018. The following chart summarizes certain of the credit ratings and outlook presently assigned by these four NRSROS: NRSRO RATINGS Ford Issuer Default Long-Term Corporate Senior Issuer Rating" Unsecured Outlook / Trend Long-Term Senior Unsecured Ford Credit NRSROS Minimum Long- Short-Term Outlook/ Term Investment Unsecured Trend Grade Rating R-2M Stable BBB (low) F2 Stable BBB- P-3 Negative A-2 Negative BBB- DBRS... Fitch Moody's S&P BBB BBB NA BBB BBB BBB Baa3 BBB Stable Stable Negative Negative BBB BBB Baa3 BBB a. What financial ratios do credit rating companies such as the four NRSROs listed above use to evalu- ate the relative riskiness of borrowers? b. What economic consequences would there be if any of the four NRSROs upgraded Ford's credit rating? How would this affect the fair value of the company's bonds? c. What type of actions can Ford take to improve its credit ratings? E7-33. Assessing the Effects of Bond Credit Rating Changes Ford Motor Co. reports the following information from the Risk Factors and the Management Discus- sion and Analysis sections of its 2018 10-K report. Credit Ratings Our short-term and long-term debt is rated by four credit rating agencies desig- nated as nationally recognized statistical rating organizations ("NRSROS) by the U.S. Securities and Exchange Commission: DBRS, Fitch, Moody's, and S&P Global Ratings. In several markets , locally-recognized rating agencies also rate us. A credit rating reflects an assessment by the rating agency of the credit risk associated with a corporate entity or continued continued from previous page particular securities issued by that entity. Rating agencies' ratings of us are based on information provided by us and other sources. Credit ratings are not recommendations to buy, sell, or hold securities , and are subject to revision or withdrawal at any time by the assigning rating agency. Each rating agency may have different criteria for evaluating company risk and, therefore, ratings should be evaluated independently for each rating agency. There have been no rating actions taken by these NRSROs since the filing of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2018. The following chart summarizes certain of the credit ratings and outlook presently assigned by these four NRSROS: NRSRO RATINGS Ford Issuer Default Long-Term Corporate Senior Issuer Rating" Unsecured Outlook / Trend Long-Term Senior Unsecured Ford Credit NRSROS Minimum Long- Short-Term Outlook/ Term Investment Unsecured Trend Grade Rating R-2M Stable BBB (low) F2 Stable BBB- P-3 Negative A-2 Negative BBB- DBRS... Fitch Moody's S&P BBB BBB NA BBB BBB BBB Baa3 BBB Stable Stable Negative Negative BBB BBB Baa3 BBB a. What financial ratios do credit rating companies such as the four NRSROs listed above use to evalu- ate the relative riskiness of borrowers? b. What economic consequences would there be if any of the four NRSROs upgraded Ford's credit rating? How would this affect the fair value of the company's bonds? c. What type of actions can Ford take to improve its credit ratings