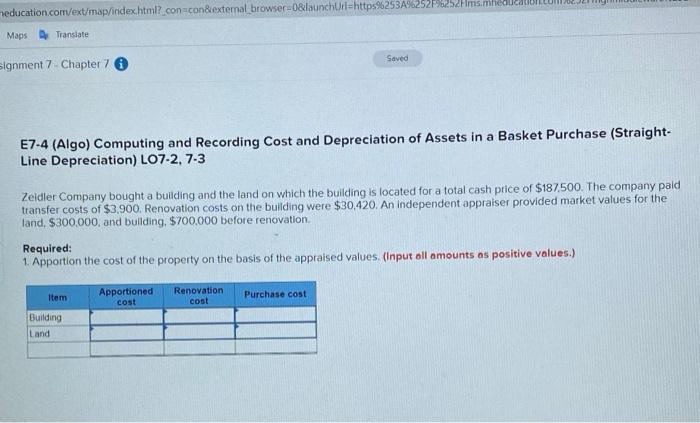

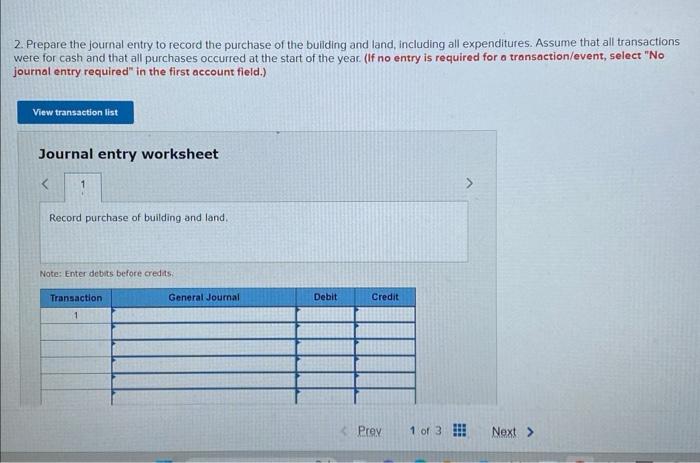

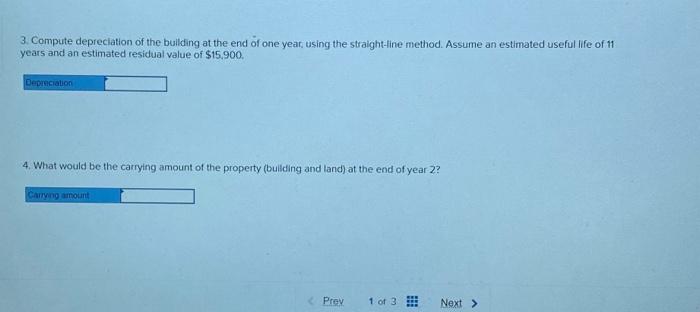

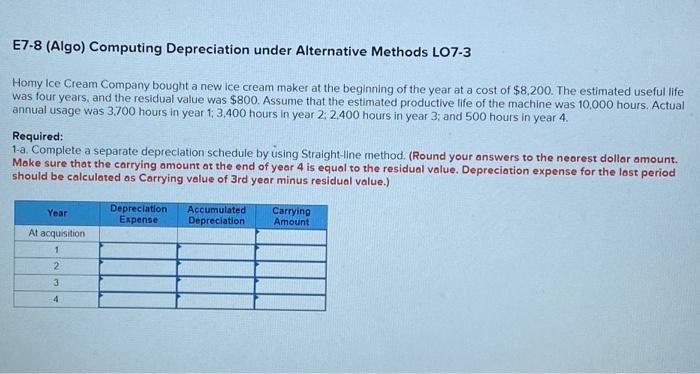

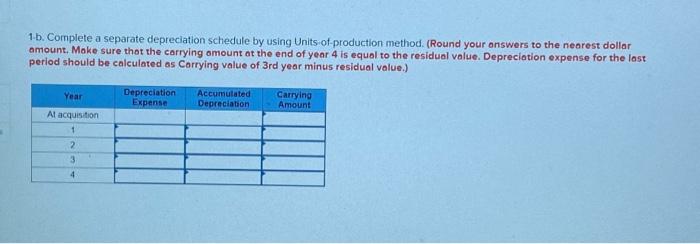

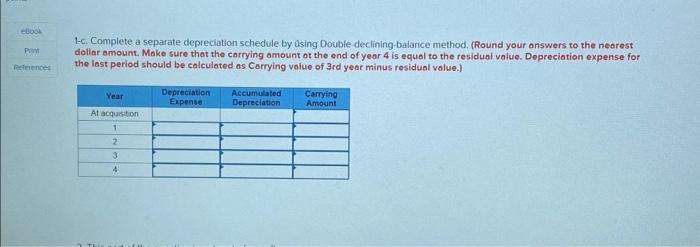

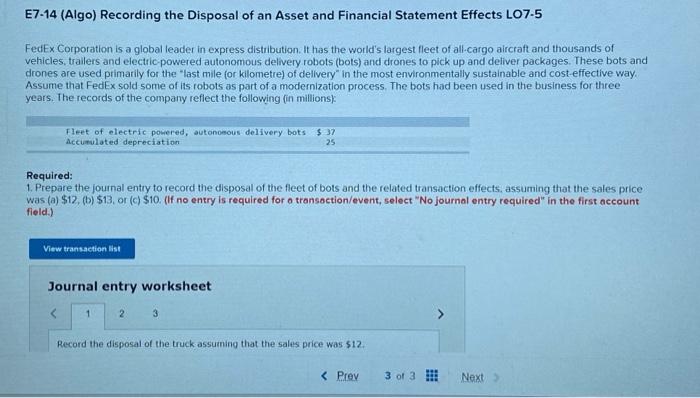

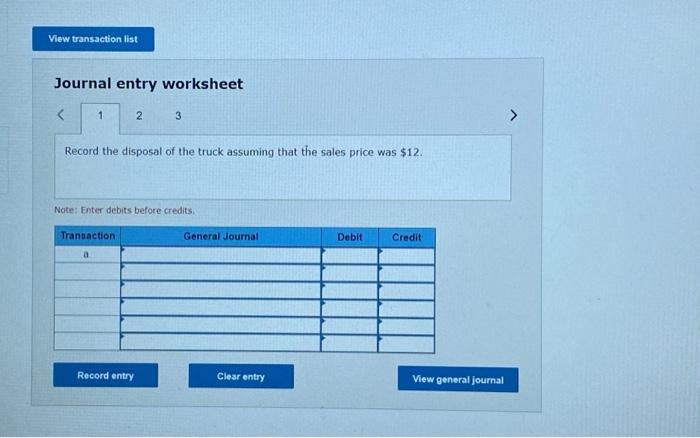

E7-4 (Algo) Computing and Recording Cost and Depreciation of Assets in a Basket Purchase (StraightLine Depreciation) LO7-2, 7-3 Zeidler Company bought a bulling and the land on which the bulling is located for a total cash price of $187,500. The company paid transfer costs of $3,900. Renovation costs on the building were $30,420. An independent appraiser provided market values for the land, $300,000, and bullding, $700,000 before renovation. Required: 1. Apportion the cost of the property on the basis of the appraised values. (Input all amounts as positive values.) 2. Prepare the journal entry to record the purchase of the buliding and land, including all expenditures. Assume that all transactions were for cash and that all purchases occurred at the start of the year. (If no entry is required for o transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 3. Compute depreciation of the buliding at the end of one year, using the straight-line method. Assume an estimated useful life of 11 years and an estimated residual value of $15,900. 4. What would be the carrying amount of the property (bullding and land) at the end of year 2 ? E7-8 (Algo) Computing Depreciation under Alternative Methods LO7-3 Homy Ice Cream Company bought a new ice cream maker at the beginning of the year at a cost of $8,200. The estimated useful life was four years, and the residual value was $800. Assume that the estimated productive life of the machine was 10,000 hours. Actual annual usage was 3,700 hours in year 1; 3,400 hours in year 2;2,400 hours in year 3; and 500 hours in year 4 . Required: 1-a. Complete a separate depreclation schedule by using Straight-line method. (Round your onswers to the nearest dollar amount. Make sure that the carrying amount at the end of year 4 is equal to the residual value. Depreciation expense for the last period should be calculated as Carrying value of 3rd year minus residual value.) 1.b. Complete a separate depreciation schedule by using Units of-production method. (Round your onswers to the neorest dollar amount. Make sure thot the carrying omount at the end of year 4 is equal to the residual value. Depreciation expense for the last period should be calculated as Corrying value of 3 rd year minus residual value.) 1-c. Complete a separate depreciation schedule by sing Double declining-balance method. (Round your answers to the nearest dollar amount. Make sure that the carrying omount at the end of year 4 is equal to the residual value. Depreciation expense for the last period should be calculated as Corrying value of 3rd year minus residual value.) E7-14 (Algo) Recording the Disposal of an Asset and Financial Statement Effects LO7.5 FedEx Corporation is a global leader in express distribution. It has the world's largest fleet of all-cargo aircraft and thousands of vehicles, trailers and electric-powered autonomous delivery robots (bots) and drones to pick up and deliver packages. These bots and drones are used primarily for the "last mile (or kilometre) of delivery" in the most environmentally sustainable and cost-effective way. Assume that FedEx sold some of its robots as part of a modernization process, The bots had been used in the business for three years. The records of the company reflect the following (in millions): Required: 1. Prepare the journal entry to record the disposal of the fleet of bots and the related transaction effects, assuming that the sales price was (a) \$12. (b) \$13, or (c) \$10. (If no entry is required for o tronsoction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the disposal of the truck assuming that the sales price was $12. Journal entry worksheet Record the disposal of the truck assuming that the sales price was $12. Note: Enter debits before credits