Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E7.5 Please solve a and b. b. the translation gain or loss for 2020. Assume net million Assuming Costco Canada Translation and Remeasurement Gains and

E7.5 Please solve a and b.

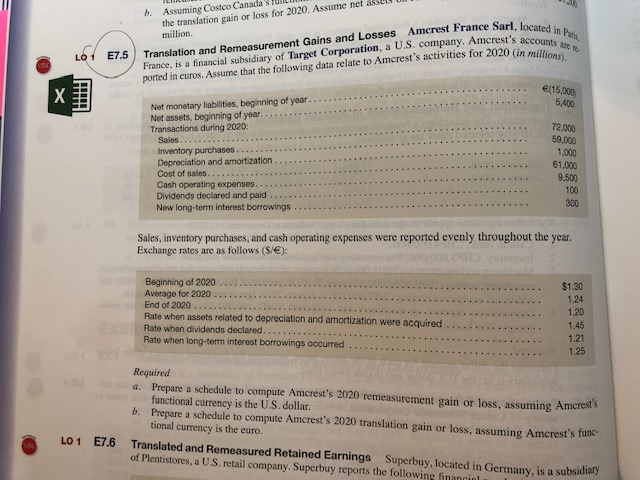

b. the translation gain or loss for 2020. Assume net million Assuming Costco Canada Translation and Remeasurement Gains and Losses Amcrest France Sarl, located in Pas, France, is a financial subsidiary of Target Corporation, a U.S. company. Amcrest's accounts are te ported in euros. Assume that the following data relate to Amcrest's activities for 2020 (in millions). E7.5 LO f e15,000 5,400 X Net monetary liablities, beginning of year Net assets, beginning of year. Transactions during 2020 Sales. 72,000 59,000 1,000 61,000 9,500 Inventory purchases Depreciation and amortization Cost of sales... Cash operating expenses. Dividends declared and paid New long-term interest borrowings 100 300 Sales, inventory purchases, and cash operating expenses were reported evenly throughout the year. Exchange rates are as follows (S/E): Beginning of 2020 Average for 2020 End of 2020 Rate when assets related to depreciation and amortization were acquired Rate when dividends declared. Rate when long-term interest borrowings cccurred $1.30 1.24 1.20 1.45 1.21 1.25 Required a. Prepare a schedule to compute Amcrest's 2020 remeasurement gain or loss, assuming Amcrest's functional currency is the U.S. dollar. b. Prepare a schedule to compute Amcrest's 2020 translation gain or loss, assuming Amcrest's func- tional currency is the euro. E7.6 LO 1 Translated and Remeasured Retained Earnings Superbuy, located in Germany, is a subsidiary of Plentistores, a US. retail company. Superbuy reports the following financiol ww b. the translation gain or loss for 2020. Assume net million Assuming Costco Canada Translation and Remeasurement Gains and Losses Amcrest France Sarl, located in Pas, France, is a financial subsidiary of Target Corporation, a U.S. company. Amcrest's accounts are te ported in euros. Assume that the following data relate to Amcrest's activities for 2020 (in millions). E7.5 LO f e15,000 5,400 X Net monetary liablities, beginning of year Net assets, beginning of year. Transactions during 2020 Sales. 72,000 59,000 1,000 61,000 9,500 Inventory purchases Depreciation and amortization Cost of sales... Cash operating expenses. Dividends declared and paid New long-term interest borrowings 100 300 Sales, inventory purchases, and cash operating expenses were reported evenly throughout the year. Exchange rates are as follows (S/E): Beginning of 2020 Average for 2020 End of 2020 Rate when assets related to depreciation and amortization were acquired Rate when dividends declared. Rate when long-term interest borrowings cccurred $1.30 1.24 1.20 1.45 1.21 1.25 Required a. Prepare a schedule to compute Amcrest's 2020 remeasurement gain or loss, assuming Amcrest's functional currency is the U.S. dollar. b. Prepare a schedule to compute Amcrest's 2020 translation gain or loss, assuming Amcrest's func- tional currency is the euro. E7.6 LO 1 Translated and Remeasured Retained Earnings Superbuy, located in Germany, is a subsidiary of Plentistores, a US. retail company. Superbuy reports the following financiol wwStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started