Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E8-14 Recording the Disposal of an Asset and Financial Statement Effects LO8-5 Please answer all questions in the pictures :) E8-14 Recording the Disposal of

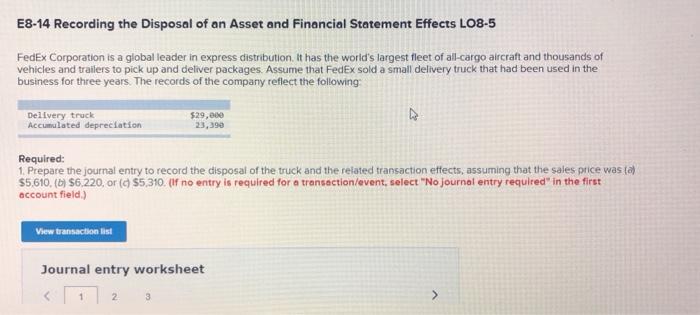

E8-14 Recording the Disposal of an Asset and Financial Statement Effects LO8-5

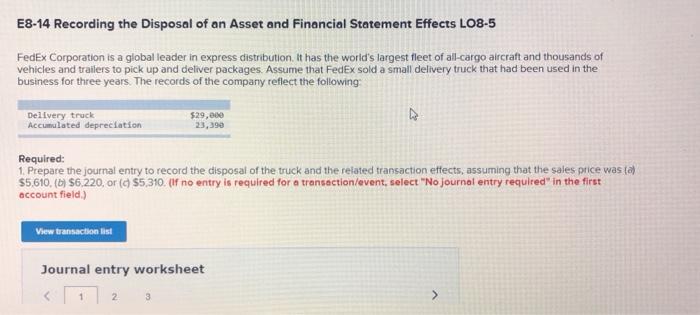

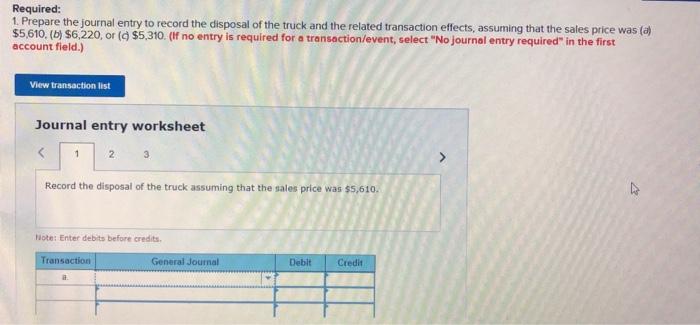

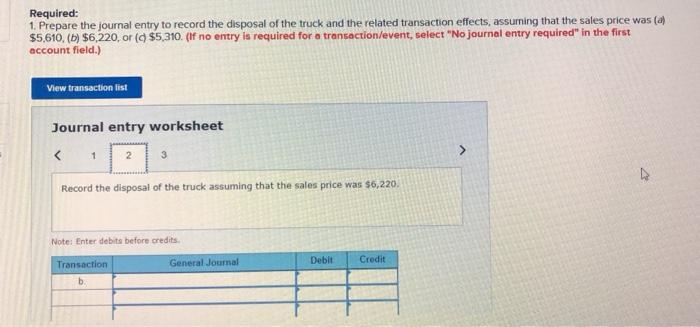

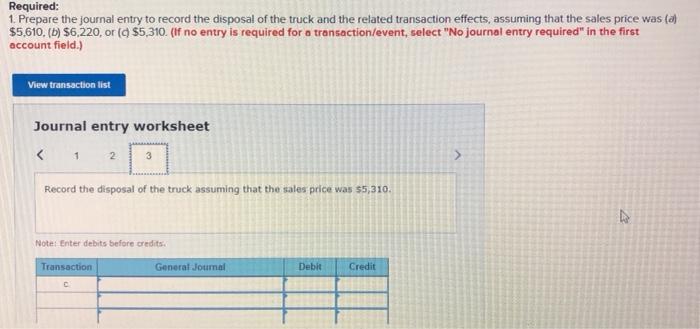

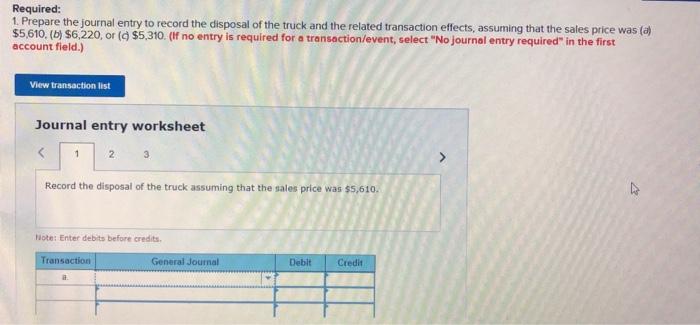

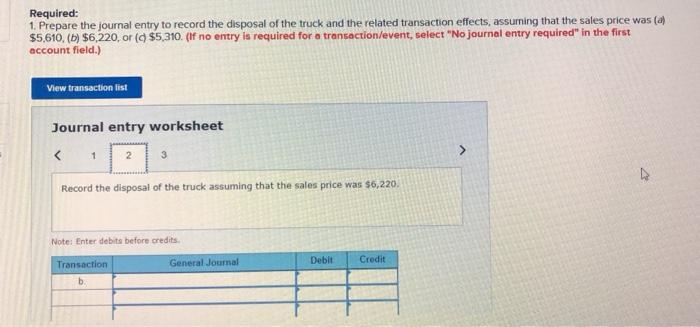

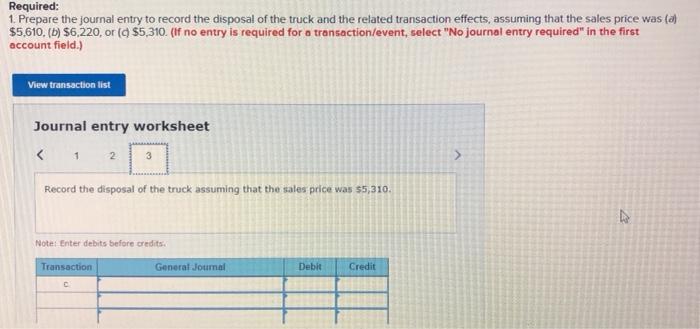

E8-14 Recording the Disposal of an Asset and Financial Statement Effects LO8-5 FedEx Corporation is a global leader in express distribution. It has the world's largest fleet of all-cargo alrcraft and thousands of vehicles and trailers to pick up and deliver packages. Assume that FedEx sold a small delivery truck that had been used in the business for three years. The records of the company reflect the following Delivery truck Accumulated depreciation $29,000 23,390 Required: 1. Prepare the journal entry to record the disposal of the truck and the related transaction effects, assuming that the sales price was a $5,610, (6) $6.220, or (a $5,310. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Required: 1. Prepare the journal entry to record the disposal of the truck and the related transaction effects, assuming that the sales price was (a) $5,610, (6) $6,220, or ($5,310. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the disposal of the truck assuming that the sales price was $5,610. Hote: Enter debits before credits Transaction General Journal Debit Credit Required: 1. Prepare the journal entry to record the disposal of the truck and the related transaction effects, assuming that the sales price was (a) $5,610, (6) $6,220, or ($5,310. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet >

Please answer all questions in the pictures :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started