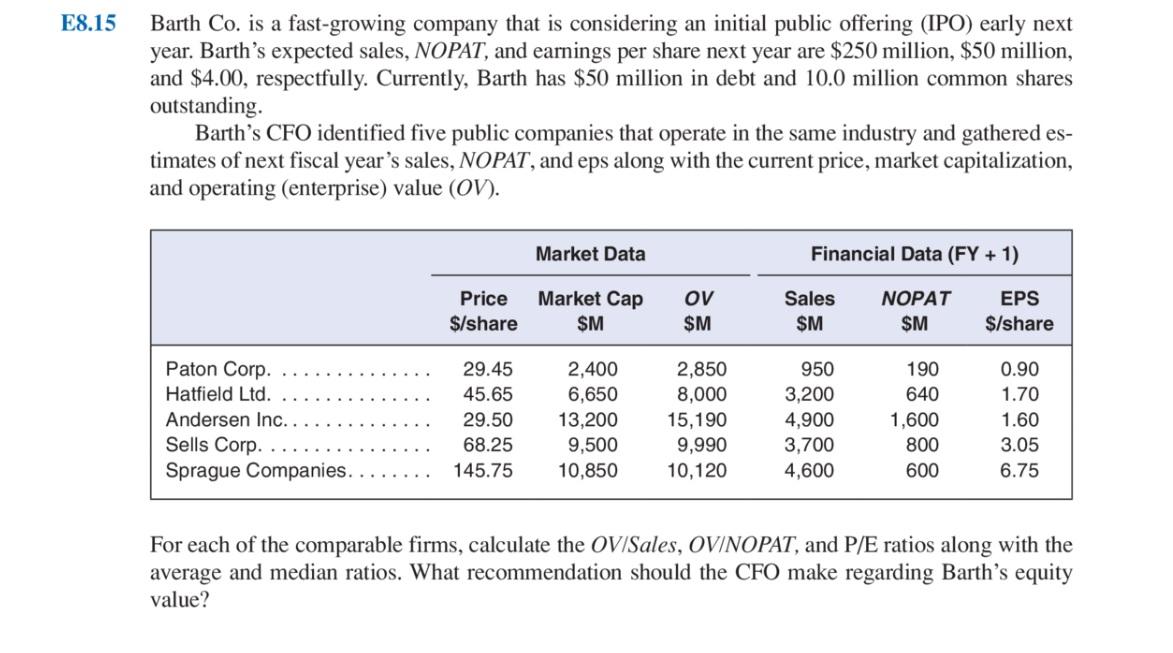

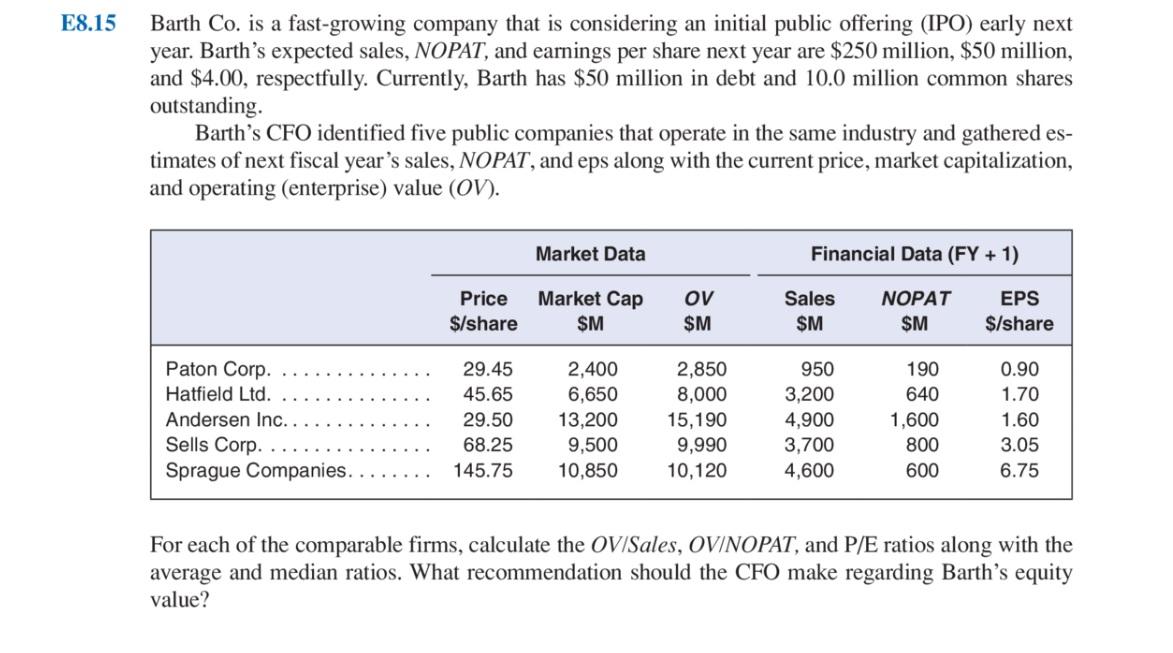

E8.15 Barth Co. is a fast-growing company that is considering an initial public offering (IPO) early next year. Barth's expected sales, NOPAT, and earnings per share next year are $250 million, $50 million, and $4.00, respectfully. Currently, Barth has $50 million in debt and 10.0 million common shares outstanding. Barth's CFO identified five public companies that operate in the same industry and gathered es- timates of next fiscal year's sales, NOPAT, and eps along with the current price, market capitalization, and operating (enterprise) value (OV). Market Data Financial Data (FY + 1) Price $/share Market Cap $M OV $M Sales $M NOPAT $M EPS $/share Paton Corp. Hatfield Ltd. Andersen Inc. Sells Corp. Sprague Companies... 29.45 45.65 29.50 68.25 145.75 2,400 6,650 13,200 9,500 10,850 2,850 8,000 15,190 9,990 10,120 950 3,200 4,900 3,700 4,600 190 640 1,600 800 600 0.90 1.70 1.60 3.05 6.75 For each of the comparable firms, calculate the OV/Sales, OV/NOPAT, and P/E ratios along with the average and median ratios. What recommendation should the CFO make regarding Barth's equity value? E8.15 Barth Co. is a fast-growing company that is considering an initial public offering (IPO) early next year. Barth's expected sales, NOPAT, and earnings per share next year are $250 million, $50 million, and $4.00, respectfully. Currently, Barth has $50 million in debt and 10.0 million common shares outstanding. Barth's CFO identified five public companies that operate in the same industry and gathered es- timates of next fiscal year's sales, NOPAT, and eps along with the current price, market capitalization, and operating (enterprise) value (OV). Market Data Financial Data (FY + 1) Price $/share Market Cap $M OV $M Sales $M NOPAT $M EPS $/share Paton Corp. Hatfield Ltd. Andersen Inc. Sells Corp. Sprague Companies... 29.45 45.65 29.50 68.25 145.75 2,400 6,650 13,200 9,500 10,850 2,850 8,000 15,190 9,990 10,120 950 3,200 4,900 3,700 4,600 190 640 1,600 800 600 0.90 1.70 1.60 3.05 6.75 For each of the comparable firms, calculate the OV/Sales, OV/NOPAT, and P/E ratios along with the average and median ratios. What recommendation should the CFO make regarding Barth's equity value