Answered step by step

Verified Expert Solution

Question

1 Approved Answer

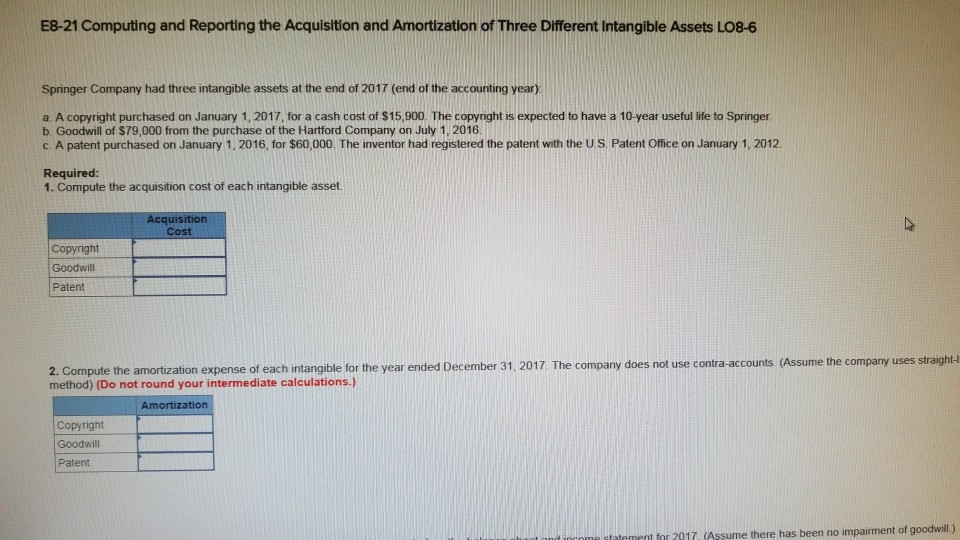

E8-21 Computing and Reporting the Acquisition and Amortization of Three Different Intangible Assets LO8-6 Springer Company had three intangible assets at the end of 2017

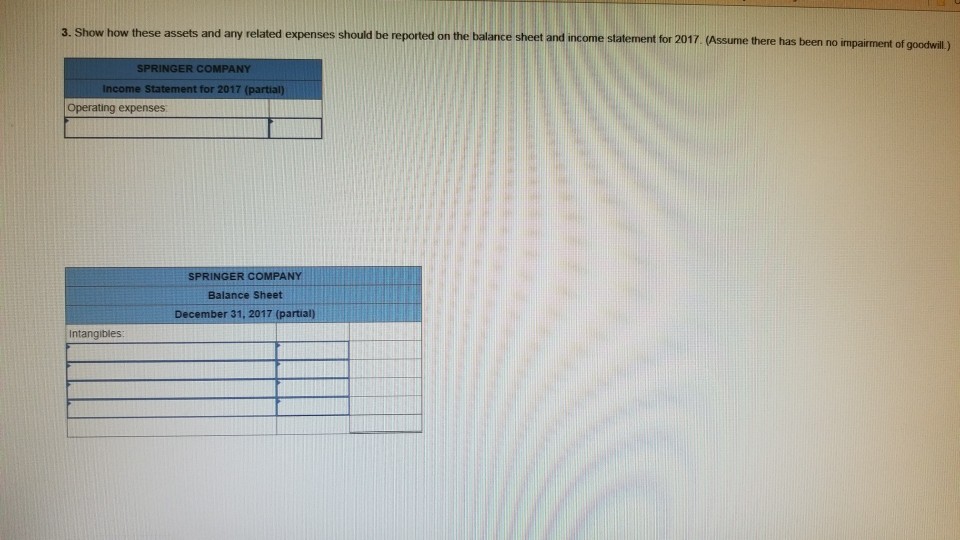

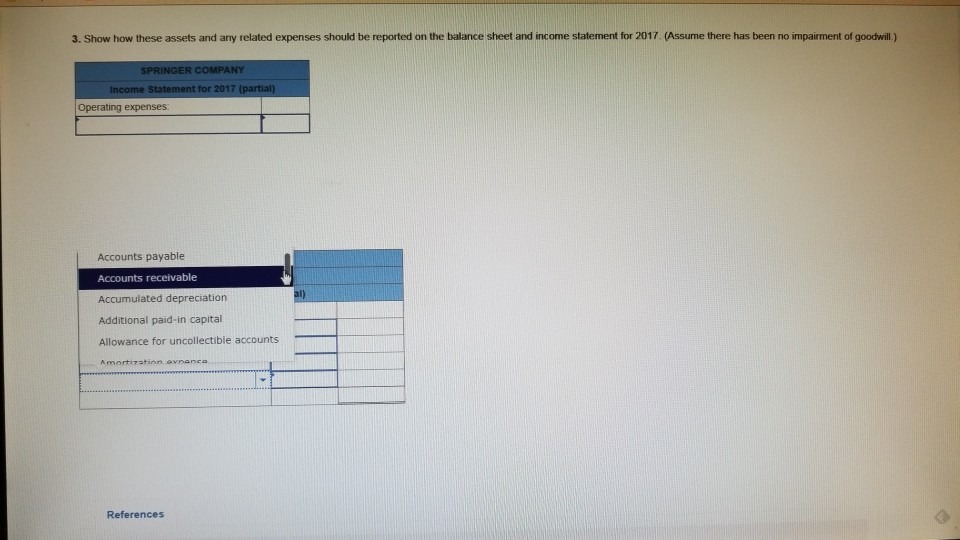

E8-21 Computing and Reporting the Acquisition and Amortization of Three Different Intangible Assets LO8-6 Springer Company had three intangible assets at the end of 2017 (end of the accounting year) a A copyright purchased on January 1, 2017, for a cash cost of S1 900 The copyr ght is expected to have a ?-year use ite to Springer: b. Goodwill of $79,000 from the purchase of the Hartford Company on July 1, 2016 c. A patent purchased on January 1, 2016, for $60,000. The inventor had registered the patent with the U.S. Patent Office on January 1, 2012. Required: t. Compute the acquisition cost of each intangibie asset. ul Goodwill 2. Compute the amortization expense of each intangible for the year ended December 31, 2017 The company does not use contra-acounts (Assume the company uses straight- method) (Do not round your intermediate calculations ) Amortization Copyright Goodwill Patent statement for 2017. (Assume there has been no impairment of goodwill.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started