Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E9-14 Computing and Interpreting the Fixed Asset Turnover Ratio from a Financial Analysts Perspective [LO 9-7] The following data were included in a recent Papaya

E9-14 Computing and Interpreting the Fixed Asset Turnover Ratio from a Financial Analysts Perspective [LO 9-7]

| The following data were included in a recent Papaya Inc. annual report (in millions): |

| 2010 | 2011 | 2012 | 2013 | |||||

| Net revenue | $77,225 | $128,119 | $179,500 | $183,910 | ||||

| Net property, plant, and equipment | 4,910 | 8,880 | 15,570 | 15,400 | ||||

| Required: |

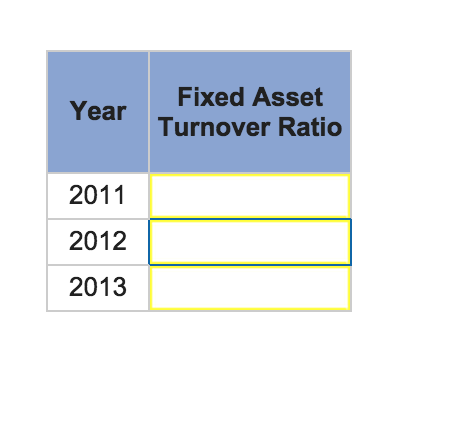

| 1. | Compute Papaya's fixed asset turnover ratio for 2011, 2012, and 2013. (Do not round intermediate calculations. Round your answers to 1 decimal place.)

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started