Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E9-29 Instructions (a) Assume that FrameBody has excess capacity and is able to meet all of the cycle division's needs. If the cyele d s

E9-29

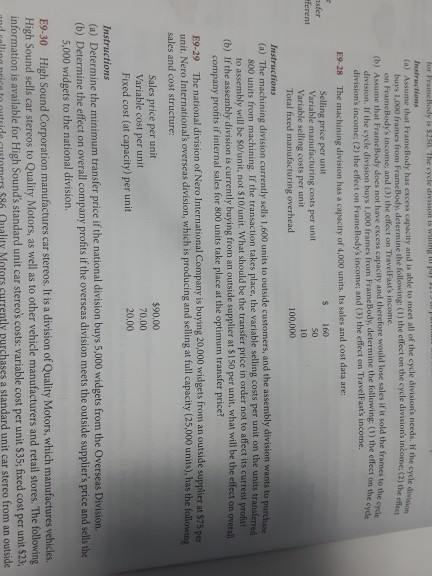

Instructions (a) Assume that FrameBody has excess capacity and is able to meet all of the cycle division's needs. If the cyele d s 1,000 frames from FrameBody, determine the following: (1) the effect on the cycle division's income; (2)th effece if it sold the frames to the cwct FrameBody's income; and (3) the effect on TravelFast's (b) Assume that FrameBody does not have excess capacity and therefore would lose sales division. If the cycle division buys 1,000 frames from Frame Body, determine the following: ( division's income: (2) the effect on FrameBody's income; and (3) the effect on TravelFast's income. The machining division has a capacity of 4,000 units. Its sales and cost data are: Selling price per unit Variable manufacturing costs per unit Variable selling costs per unit Total fixed manufacturing overhead E9-28 S 160 ferent 100,000 Instructions (a) The machining division currently sells 1,600 units to outside customers, and the assembly division wants to purchase 800 units from machining. If the transaction takes place, the variable selling costs per unit on the units trans to assembly will be $0/unit, not $10/unit. What should be the transfer price in order not to affect its current (b) If the assembly division is currently buying from an outside supplier at $150 per unit, what will be the effect o company profits if internal sales for 800 units take place at the optimum transfer price? E9-29 The national division of Nero International Company is buying 20,000 widgets from an outside supplier at $7 unit. Nero International's overseas division, which is producing and selling at full capacity (25,000 units), has the foll sales and cost structure Sales price per unit Variable cost per unit Fixed cost (at capacity) per unit $90.00 70.00 20.00 Instructions (a) Determine the minimum transfer price if the national division buys 5,000 widgets from the Overseas Division. (b) Determine the effect on overall company profits if the overseas division meets the outside supplier's price and sells the 5,000 widgets to the national divisiorn. E9-30 High Sound Corporation manufactures car stereos. It is a division of Quality Motors, which manufactures vehicles. High Sound sells car stereos to Quality Motors, as well as to other vehicle manufacturers and retail stores. The following information is available for High Sound's standard unit car stereo's costs: variable cost per unit $35; fixed cost per unit $23 side customers 586 Quality Motors currently purchases a standard unit car stereo from an outsideStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started