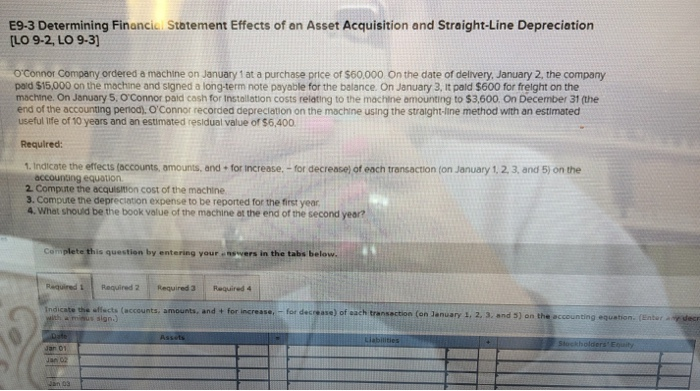

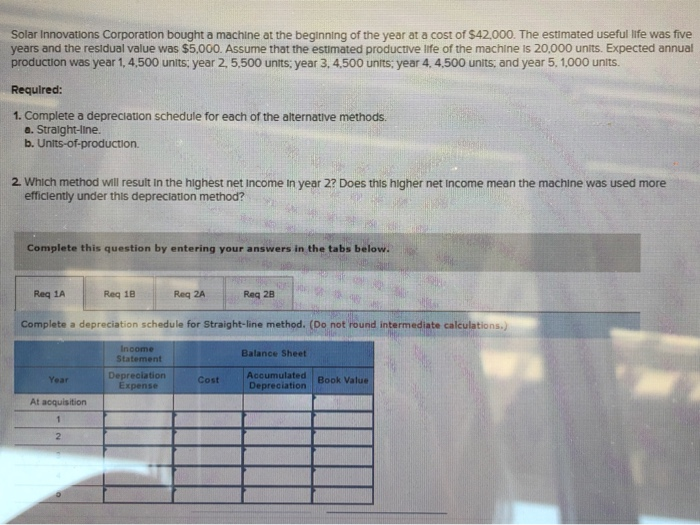

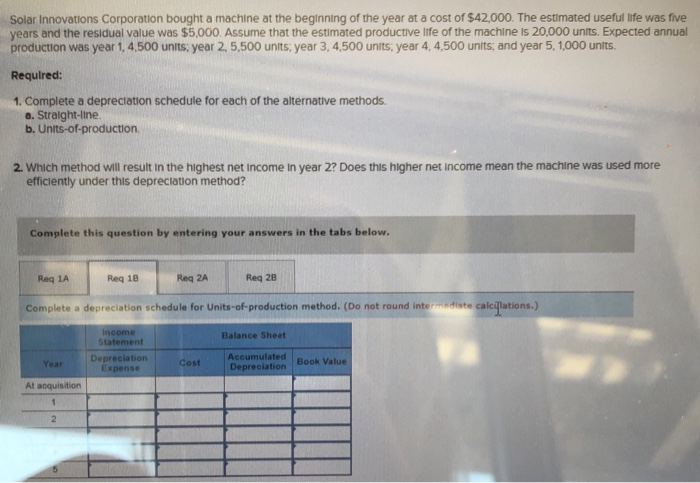

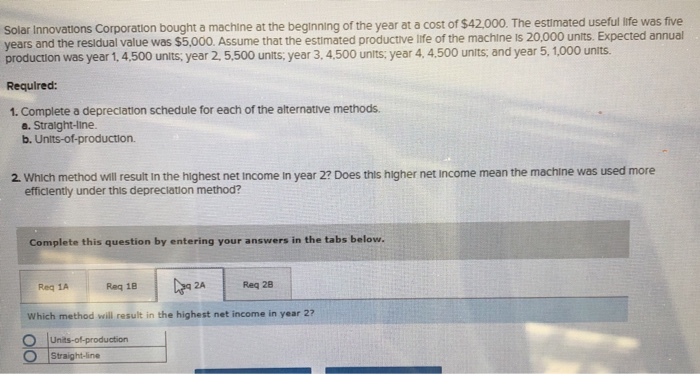

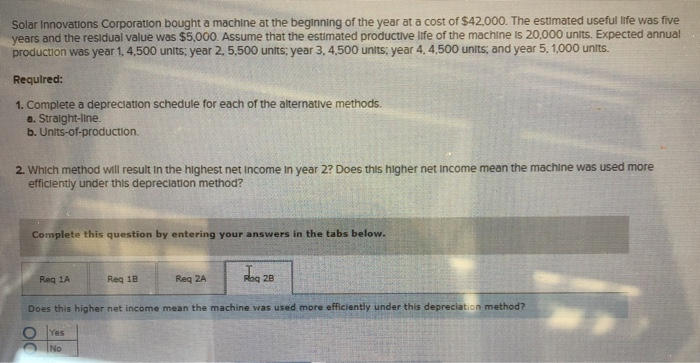

E9-3 Determining Financic Statement Effects of an Asset Acquisition and Straight-Line Depreciation [LO 9-2, LO 9-3] O'Connor Company ordered a machine on January 1 at a purchase price of $60.000. On the date of delivery, January 2, the company pard $15,000 on the machine and signed a long-term note payable for the balance. On January 3, it paid $600 for freight on the machine. On January 5, O'Connor paid cash for installation costs relating to the machine amounting to $3,600. On December 31 (the end of the accounting period). O'Connor recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $6,400. Required: 1. Indicate the effects accounts, amounts, and for increase. - for decrease of each transaction on January 1, 2, 3, and 5) on the accounting equation 2. Compute the acquisition cost of the machine 3. Compute the depreciation expense to be reported for the first year 4. What should be the book value of the machine at the end of the second year? Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required Indicate the acts (accounts, amounts and for increase - for decrease each transaction on January 1, 2, 3, and 5) on the accounting equation (inter d ec Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $42.000. The estimated useful life was five years and the residual value was $5,000. Assume that the estimated productive life of the machine is 20,000 units. Expected annual production was year 1,4,500 units: year 2,5,500 units: year 3,4,500 units: year 4.4,500 units, and year 5.1,000 units. Required: 1. Complete a depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production 2. Which method will result in the highest net income in year 2? Does this higher net income mean the machine was used more efficiently under this depreciation method? Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B - Req ZA Reg 28 Complete a depreciation schedule for Straight-line method. (Do not round intermediate calculations.) Income Statement Balance Sheet Depreciation Year Cost Accumulated Depreciation Book Value Expense At acquisition 2 Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $42,000. The estimated useful life was five years and the residual value was $5,000. Assume that the estimated productive life of the machine is 20,000 units. Expected annual production was year 1.4,500 units year 2,5,500 units, year 3,4,500 units, year 4,4,500 units, and year 5, 1,000 units. Required: 1. Complete a depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production 2. Which method will result in the highest net income in year 2? Does this higher net Income mean the machine was used more efficiently under this depreciation method? Complete this question by entering your answers in the tabs below. Req LA Req 18 Red 2A Reg 20 Complete a depreciation schedule for Units-of-production method. (Do not round intereste calcations.) Balance Sheet Statement Depreciation Accumulated Yea Cost Book Value Depreciation acquisition Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $42,000. The estimated useful life was five years and the residual value was $5,000. Assume that the estimated productive life of the machine is 20,000 units. Expected annual production was year 1, 4,500 units year 2,5,500 units, year 3,4,500 units year 4,4,500 units, and year 5.1,000 units Required: 1. Complete a depreciation schedule for each of the alternative methods. a. Straight-line b. Units-of-production 2. Which method will result in the highest net income in year 2? Does this higher net income mean the machine was used more efficiently under this depreciation method? Complete this question by entering your answers in the tabs below. Reg 1A Reg 18 1 DBA Reg 28 Which method will result in the highest net income in year 2? Units-of-production Straight-line O Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $42,000. The estimated useful life was five years and the residual value was $5,000. Assume that the estimated productive life of the machine is 20,000 units. Expected annual production was year 1, 4,500 units, year 2.5,500 units, year 3,4,500 units year 4,4,500 units, and year 5, 1,000 units. Required: 1. Complete a depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. 2. Which method will result in the highest net income in year 2? Does this higher net income mean the machine was used more efficiently under this depreciation method? Complete this question by entering your answers in the tabs below. Reg 1A Reg 18 Req 2A og 2 Does this higher net income mean the machine was used more efficiently under this depreciation method