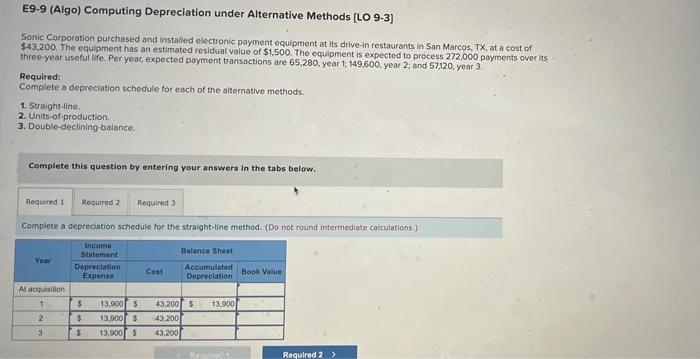

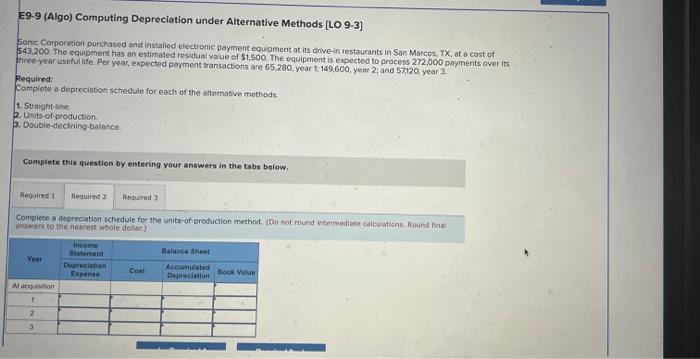

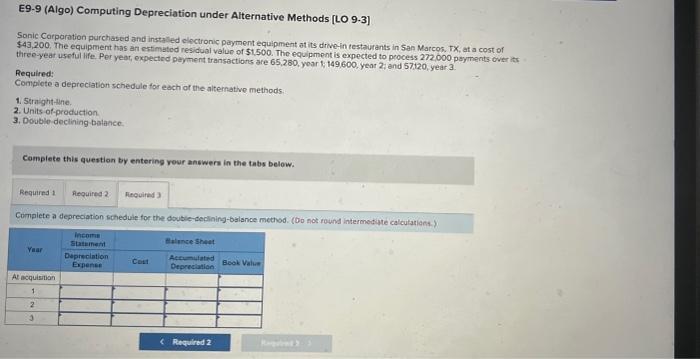

E9.9 (Algo) Computing Depreciation under Alternative Methods [LO 9-3] Sonic Corporation purchased and instalied electronic payment equipment at its drive-in restourants in Sin Marcos, TX, at a cost of $43,200. The equipment has an estimated residual value of $1,500. The equipment is expected to process 272,000 payments over its three-year useful ife. Per year, expected payment transactions are 65,280, year 1,149,600, year 2; and 57,120, year 3. Required: Complete a depreciation schedule for each of the aiternative methods. 1. Straight-ine. 2. Units-of-production. 3. Double-declining balance. Complete this question by entering your answers in the tabs below. Complete a depreciation schedule for the straight-line method. (Do not round intermediate calculations:) E9.9 (Algo) Computing Depreciation under Alternative Methods [LO 9-3] Sonc Corporation purchased and instalied electronic payment equioment at its arive-in restaurants in San Marcos. TX, at a cost of 543,200 The equipment has an estimated residual value of $1,500. The equipment is expected to process 272,000 payments aver its hree.year useful life. Per year, expected payment transactions, are 65,280 , year t:149,600, year 2; and 57120 , year 3 . Required Complete o depreciation schedule for eoch of the alternatwo methods. 1. Straight-line. 2. Unite of-production. 3. Double-decining-bulance: Complete this question by entering your answers in the tabs balow. Complete a depreciation chedule for the units-of-groduction method. (Oo not round whemediate calculatisns. Round final andwons to the neices whoie doiar.) E9-9 (Algo) Computing Depreciation under Alternative Methods [LO 9-3] Sonic Corporation purchased and installed clectronic payment equipment at its dive-in eestaurants in San Marcon, TX, at a cost of $43,200. The equipment has an estimated residual value of 51,500 . The equipment is expected to process 272,000 payments over its three-year useful life. Per year, expected payment transections are 65,280, yoar 8;149,600, year 2 , and 57120, year 3 Required: Complete a depreciation schedule for each of the alternathe methods. 1. Stright-Hine. 2. Units of-proctuction 3. Doublo dectining bolance. Camplete this question by entering rowr answern in the tabs below. Compiete a depreciation schedule for the doubie-declining-balance method. (bo not round intermedyte calculatian4.)