Answered step by step

Verified Expert Solution

Question

1 Approved Answer

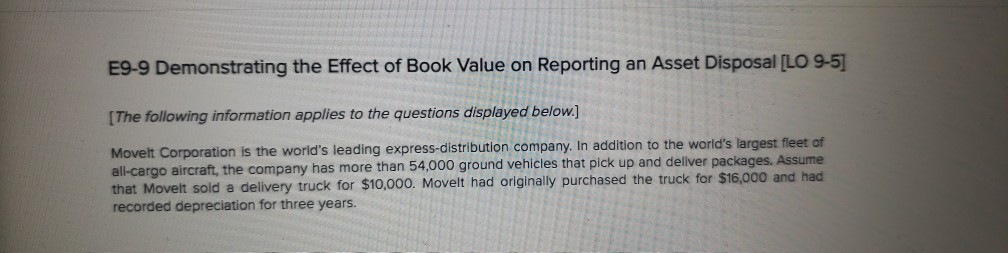

E9-9 Demonstrating the Effect of Book Value on Reporting an Asset Disposal [LO 9-5 [The following information applies to the questions displayed below] Movelt Corporation

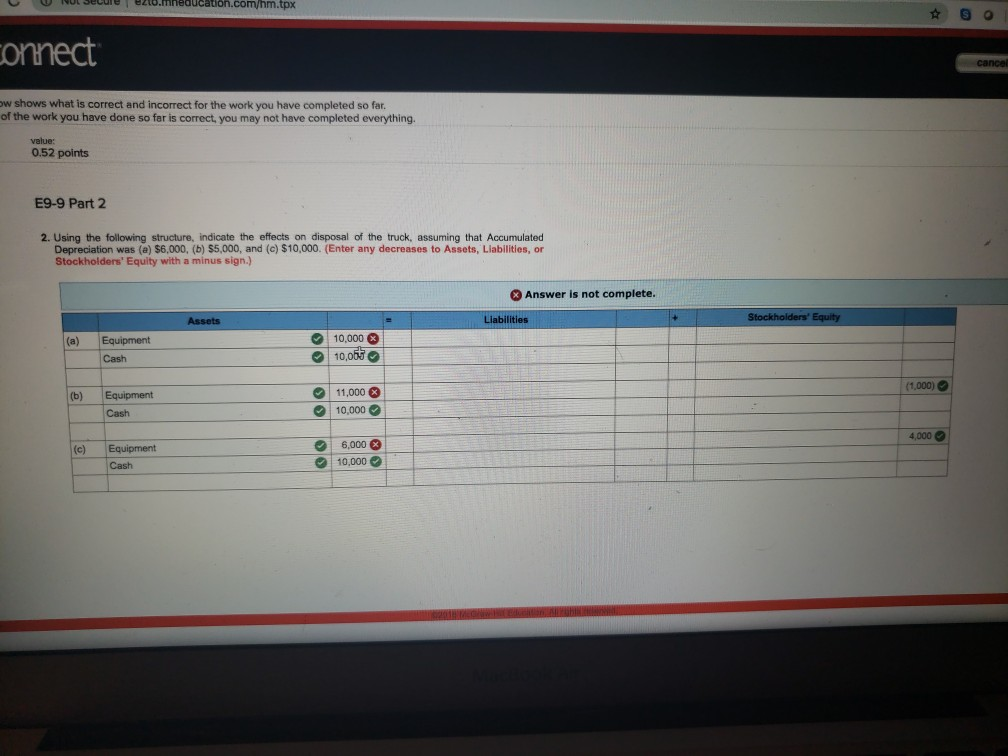

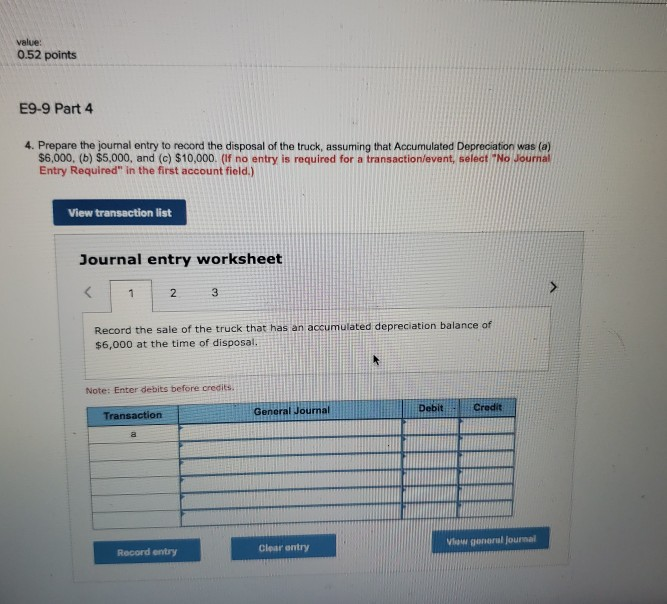

E9-9 Demonstrating the Effect of Book Value on Reporting an Asset Disposal [LO 9-5 [The following information applies to the questions displayed below] Movelt Corporation is the world's leading express-distribution company. In addition to the world's largest fleet of all-cargo aircraft, the company has more than 54,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $10,000. Movelt had originally purchased the truck recorded depreciation for three years e t ezto.mneducation.com/hm.tpx onnect cance ow shows what is correct and incorrect for the work you have completed so far. of the work you have done so far is correct, you may not have completed everything value: 0.52 points E9-9 Part 2 2. Using the following structure, indicate the effects on disposal of the truck, assuming that Accumulated Depreciation was (a) $6,000, (b) $5,000, and (c) $10,000. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) & Answer is not complete Assets (a) Equipment 10,000 Cash (1,000) 11,000 10,000 (b) Equipment Cash 4,000 el 6,0000 10,000 (c) Equipment Cash value: 0.52 points E9-9 Part 4 4. Prepare the journal entry to record the disposal of the truck, assuming that Accumulated Depreciation was (a) $6,000, (b) $5,000, and (c) $10,000. (If no entry is required for a transaction/event, select 7No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 Record the sale of the truck that has an accumulated depreciation balance of $6,000 at the time of disposal. Note: Enter debits before credits. General Journal DebitCredit Transaction w gonoral journal Clear entry Record entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started