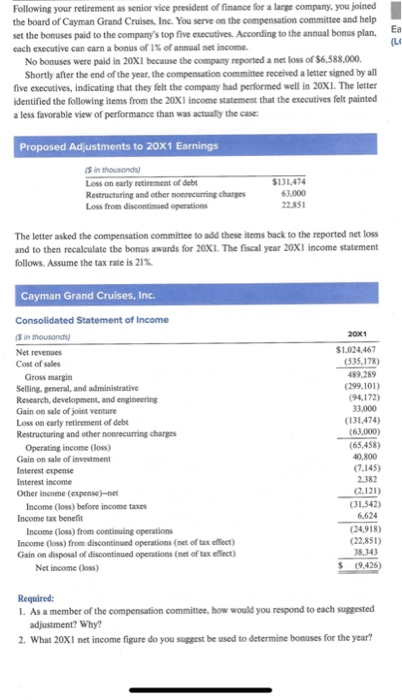

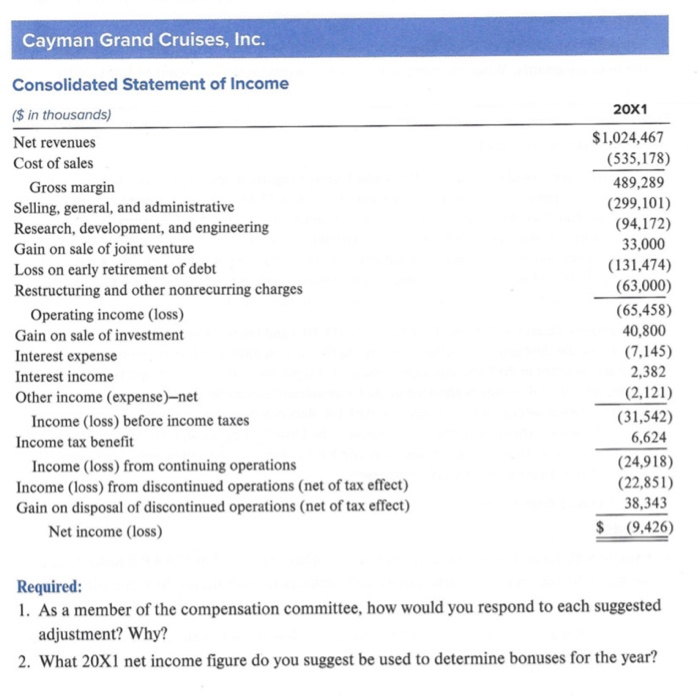

Ea (LA Following your retirement as senior vice president of finance for a large company, you joined the board of Cayman Grand Cruises, Inc. You serve on the compensation committee and help set the bonuses paid to the company's top five executives. According to the annual bonus plan, cach executive can earn a bonus of 1% of annual net income. No bonuses were paid in 20x1 because the company reported a net loss of $6,588.000 Shortly after the end of the year, the compensation committee received a letter signed by all five executives, indicating that they felt the company had performed well in 20X1. The letter identified the following items from the 20X1 income statement that the executives felt painted a less favorable view of performance than was actually the case: Proposed Adjustments to 20x1 Earnings $ in thousands Loss on cartyretirement of debt Restructuring and other nonrecurring charges Loss from discontinued operations $131.474 63.000 22.851 The letter asked the compensation committee to add these items back to the reported net loss and to then recalculate the bonus awards for 20X1. The fiscal year 20X1 income statement follows. Assume the tax rate is 21%. Cayman Grand Cruises, Inc. Consolidated Statement of Income is in thousands Net revenues Cost of sales Gross margin Selling general, and administrative Research, development, and engineering Gain on sale of joint venture Loss on early retirement of debt Restructuring and other nonrecurring charges Operating income (loss) Gain on sale of investment Interest expense Interest income Other income (expense)-net Income (loss) before income taxes Income tax benefit Income (loss) from continuing operations Income (loss) from discontinued operations (net of tax effect) Gain on disposal of discontinued operations (net of tax effect) Net income (loss) 20x1 $1,024 467 (535.178) 489.289 (299,101) (94.172) 33.000 (131.474) (63,000) (65.458) 40,800 (7.145) 2.382 (2.121) (31.542) 6,624 (24.918) (22,851) 38.343 (9.426 Required: 1. As a member of the compensation committee, how would you respond to each suggested adjustment? Why? 2. What 20XI net income figure do you suggest be used to determine bonuses for the year? Cayman Grand Cruises, Inc. Consolidated Statement of Income ($ in thousands) Net revenues Cost of sales Gross margin Selling, general, and administrative Research, development, and engineering Gain on sale of joint venture Loss on early retirement of debt Restructuring and other nonrecurring charges Operating income (loss) Gain on sale of investment Interest expense Interest income Other income (expense)-net Income (loss) before income taxes Income tax benefit Income (loss) from continuing operations Income (loss) from discontinued operations (net of tax effect) Gain on disposal of discontinued operations (net of tax effect) Net income (loss) 20X1 $1,024,467 (535,178) 489,289 (299,101) (94,172) 33,000 (131,474) (63,000) (65,458) 40,800 (7,145) 2,382 (2,121) (31,542) 6,624 (24,918) (22,851) 38,343 $ (9,426) Required: 1. As a member of the compensation committee, how would you respond to each suggested adjustment? Why? 2. What 20X1 net income figure do you suggest be used to determine bonuses for the year