Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EA LO 2-3 Which of the following is not part of the five specific tests? a. Support test. b. Age test. c. Gross income test.

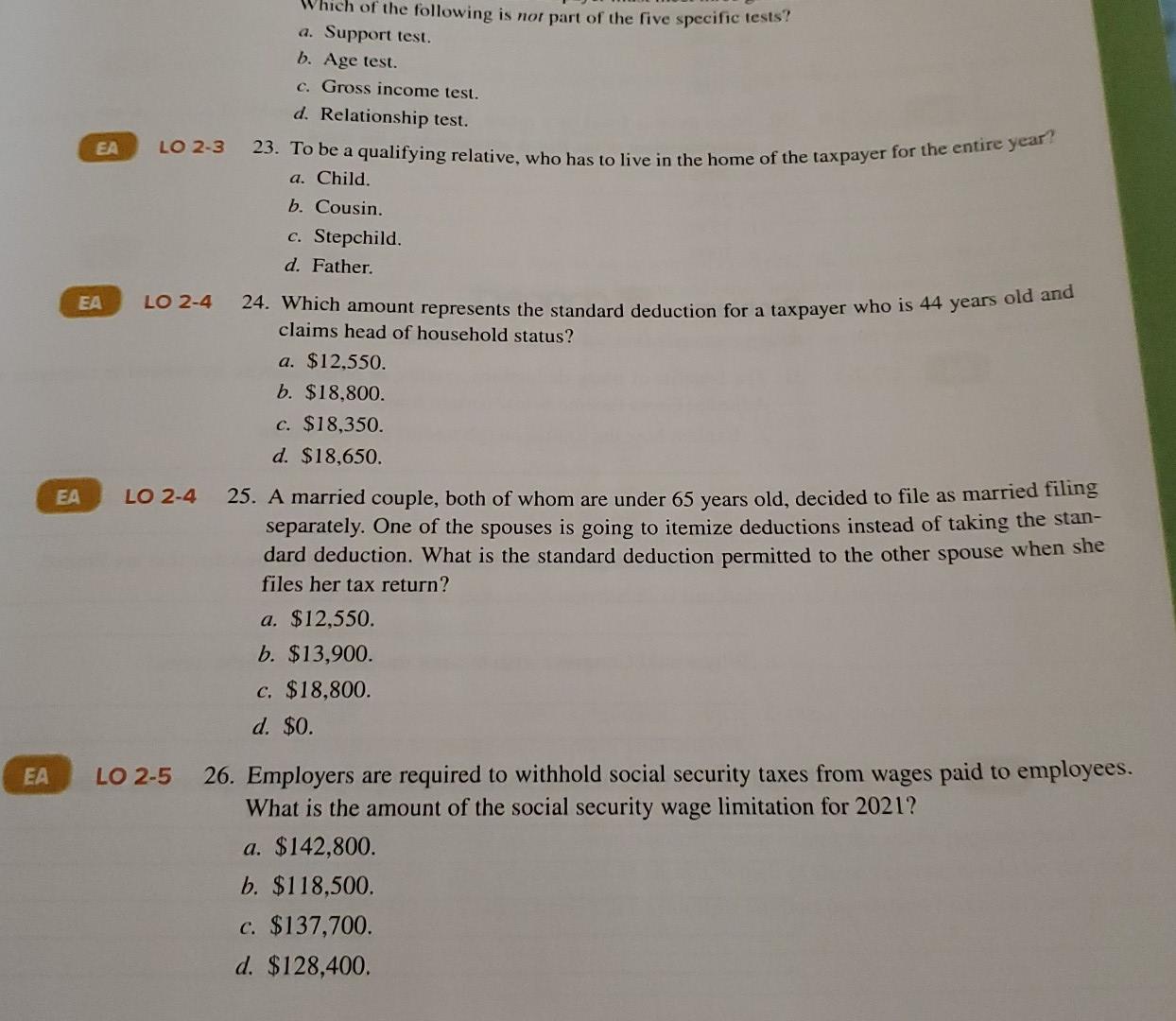

EA LO 2-3 Which of the following is not part of the five specific tests? a. Support test. b. Age test. c. Gross income test. d. Relationship test. 23. To be a qualifying relative, who has to live in the home of the taxpayer for the entire year! a. Child b. Cousin. c. Stepchild. d. Father. 24. Which amount represents the standard deduction for a taxpayer who is 44 years old and claims head of household status? a. $12,550. b. $18,800. c. $18,350. d. $18,650. EA LO 2-4 EA LO 2-4 25. A married couple, both of whom are under 65 years old, decided to file as married filing separately. One of the spouses is going to itemize deductions instead of taking the stan- dard deduction. What is the standard deduction permitted to the other spouse when she files her tax return? a. $12,550. b. $13,900. c. $18,800. d. $0. EA LO 2-5 26. Employers are required to withhold social security taxes from wages paid to employees. What is the amount of the social security wage limitation for 2021? a. $142,800. b. $118,500. c. $137,700. d. $128,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started