Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each item below describes an amount(s) not reflected in the financial statements of Drake Company. Select from the option list provided the amount, if

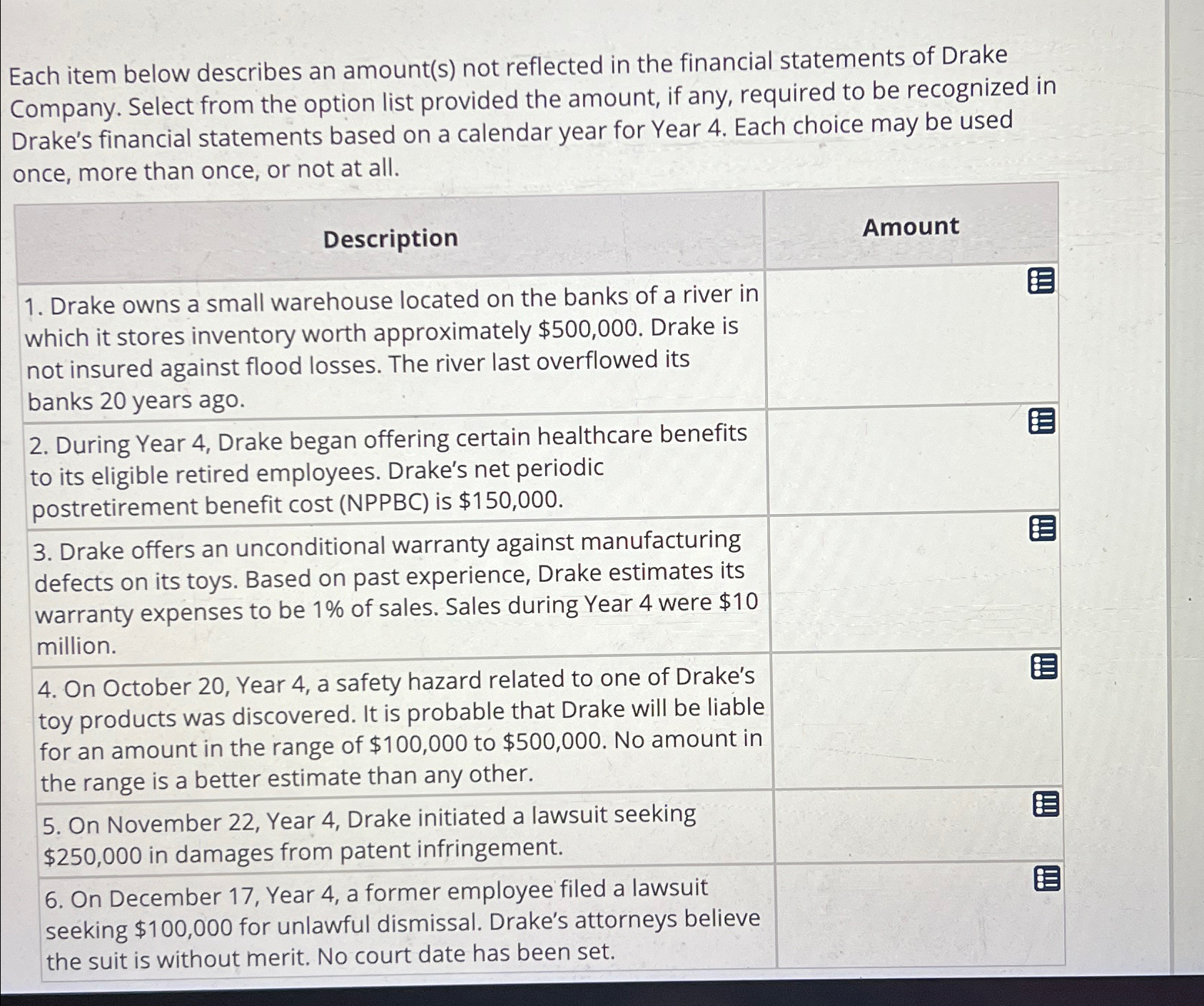

Each item below describes an amount(s) not reflected in the financial statements of Drake Company. Select from the option list provided the amount, if any, required to be recognized in Drake's financial statements based on a calendar year for Year 4. Each choice may be used once, more than once, or not at all. Description 1. Drake owns a small warehouse located on the banks of a river in which it stores inventory worth approximately $500,000. Drake is not insured against flood losses. The river last overflowed its banks 20 years ago. 2. During Year 4, Drake began offering certain healthcare benefits to its eligible retired employees. Drake's net periodic postretirement benefit cost (NPPBC) is $150,000. 3. Drake offers an unconditional warranty against manufacturing defects on its toys. Based on past experience, Drake estimates its warranty expenses to be 1% of sales. Sales during Year 4 were $10 million. 4. On October 20, Year 4, a safety hazard related to one of Drake's toy products was discovered. It is probable that Drake will be liable for an amount in the range of $100,000 to $500,000. No amount in the range is a better estimate than any other. 5. On November 22, Year 4, Drake initiated a lawsuit seeking $250,000 in damages from patent infringement. 6. On December 17, Year 4, a former employee filed a lawsuit seeking $100,000 for unlawful dismissal. Drake's attorneys believe the suit is without merit. No court date has been set. Amount E !!! !!!

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The amounts that should be recognized in Drake Companys financial statements for Year 4 are a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started