Question

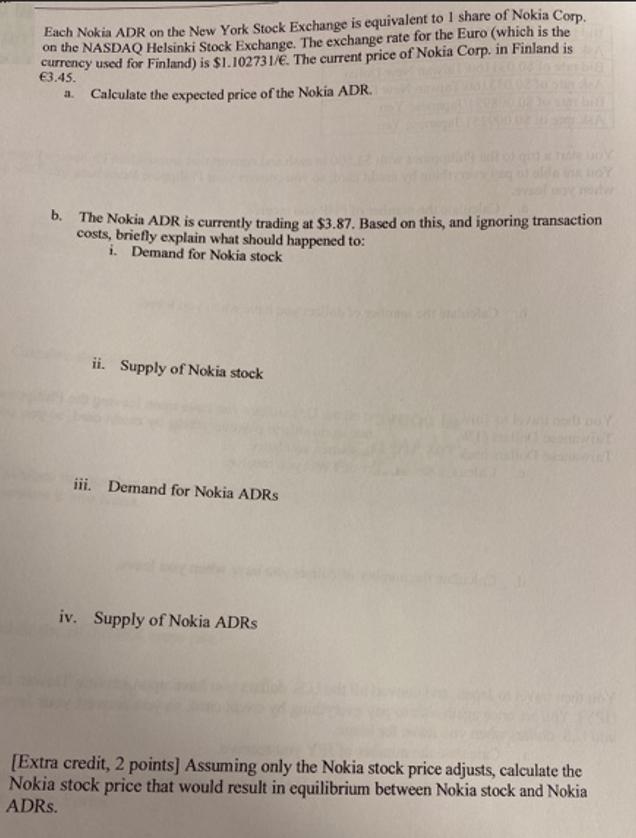

Each Nokia ADR on the New York Stock Exchange is equivalent to I share of Nokia Corp. on the NASDAQ Helsinki Stock Exchange. The

Each Nokia ADR on the New York Stock Exchange is equivalent to I share of Nokia Corp. on the NASDAQ Helsinki Stock Exchange. The exchange rate for the Euro (which is the currency used for Finland) is $1.102731/E. The current price of Nokia Corp. in Finland is 3.45. Calculate the expected price of the Nokia ADR. a. b. The Nokia ADR is currently trading at $3.87. Based on this, and ignoring transaction costs, briefly explain what should happened to: i. Demand for Nokia stock ii. Supply of Nokia stock iii. Demand for Nokia ADRS iv. Supply of Nokia ADRS [Extra credit, 2 points] Assuming only the Nokia stock price adjusts, calculate the Nokia stock price that would result in equilibrium between Nokia stock and Nokia ADRS.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Price of Nokia ADR Stock price in Finland Exchange Rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Accounting

Authors: Timothy Doupnik, Hector Perera

4th edition

77862201, 978-0077760298, 77760298, 978-0077862206

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App