Answered step by step

Verified Expert Solution

Question

1 Approved Answer

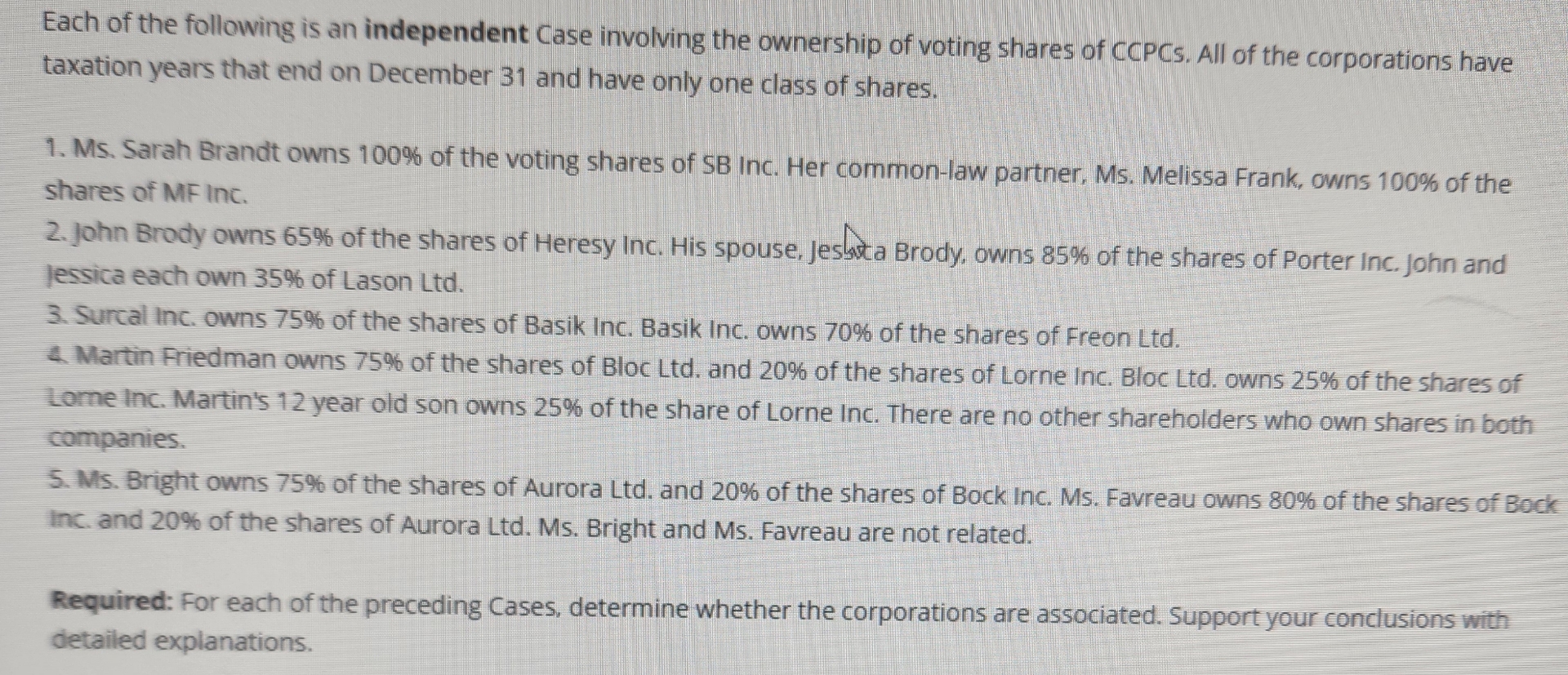

Each of the following is an independent Case involving the ownership of voting shares of CCPCs. All of the corporations have taxation years that

Each of the following is an independent Case involving the ownership of voting shares of CCPCs. All of the corporations have taxation years that end on December 31 and have only one class of shares. 1. Ms. Sarah Brandt owns 100% of the voting shares of SB Inc. Her common-law partner, Ms. Melissa Frank, owns 100% of the shares of MF Inc. 2. John Brody owns 65% of the shares of Heresy Inc. His spouse, Jesta Brody, owns 85% of the shares of Porter Inc. John and Jessica each own 35% of Lason Ltd. 3. Surcal Inc. owns 75% of the shares of Basik Inc. Basik Inc. owns 70% of the shares of Freon Ltd. 4. Martin Friedman owns 75% of the shares of Bloc Ltd. and 20% of the shares of Lorne Inc. Bloc Ltd. owns 25% of the shares of Lome Inc. Martin's 12 year old son owns 25% of the share of Lorne Inc. There are no other shareholders who own shares in both companies. 5. Ms. Bright owns 75% of the shares of Aurora Ltd. and 20% of the shares of Bock Inc. Ms. Favreau owns 80% of the shares of Bock Inc. and 20% of the shares of Aurora Ltd. Ms. Bright and Ms. Favreau are not related. Required: For each of the preceding Cases, determine whether the corporations are associated. Support your conclusions with detailed explanations.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether the corporations in each case are associated we need to consider the concept of associated corporations as defined in the Canadia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started