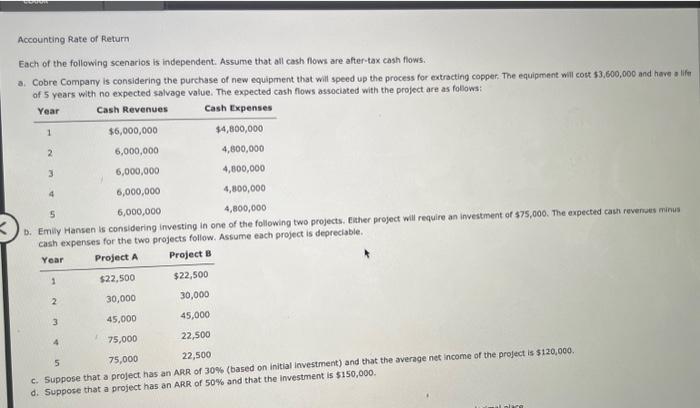

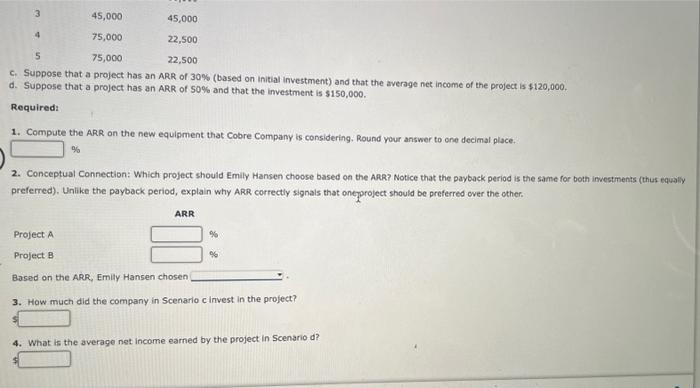

Each of the following scenarios is independent. Assume that all cash flowi are after-tax cash flows. a. Cobre Company is considering the purchase of new equipment that will speed up the process for extracting copper. The equipment will cokt 53,600,000 and have o life of 5 years with no expected salvage value. The expected cash flows associated with the project are as follows: b. Emily Hansen is considering investing in one of the following two projects. Eather project will require an invetument of s75,000. The expected caun reverizes munnus eash expenses for the two projects follow. Assume each project is depreciable. c. Suppose that a project has an ArR or su\% (based on initial investment) and that the average net income of the project is 5120,000. d. Suppose that a project has an ARR of 50% and that the investment is $150,000. c. Suppose that a project has an ARR of 30% (based on initial investment) and that the average net income of the project is $120,000. d. Suppose that a project has an ARR of 50% and that the investment is $150,000. Required: 1. Compute the ARR on the new equipment that Cobre Company is considering. Round your answer to one decimal place. % 2. Conceptual Connection: Which project should Emily Hansen choose based on the ARR? Notice that the payback period is the same for both investments (thus equally preferred). Unlike the payback period, explain why ARR correctly signals that ontpproject should be preferred over the other. Based on the ARR, Emily Hansen chosen 3. How much did the company in Scenario c invest in the project? 4. What is the average net income earned by the project in Scenario d? Each of the following scenarios is independent. Assume that all cash flowi are after-tax cash flows. a. Cobre Company is considering the purchase of new equipment that will speed up the process for extracting copper. The equipment will cokt 53,600,000 and have o life of 5 years with no expected salvage value. The expected cash flows associated with the project are as follows: b. Emily Hansen is considering investing in one of the following two projects. Eather project will require an invetument of s75,000. The expected caun reverizes munnus eash expenses for the two projects follow. Assume each project is depreciable. c. Suppose that a project has an ArR or su\% (based on initial investment) and that the average net income of the project is 5120,000. d. Suppose that a project has an ARR of 50% and that the investment is $150,000. c. Suppose that a project has an ARR of 30% (based on initial investment) and that the average net income of the project is $120,000. d. Suppose that a project has an ARR of 50% and that the investment is $150,000. Required: 1. Compute the ARR on the new equipment that Cobre Company is considering. Round your answer to one decimal place. % 2. Conceptual Connection: Which project should Emily Hansen choose based on the ARR? Notice that the payback period is the same for both investments (thus equally preferred). Unlike the payback period, explain why ARR correctly signals that ontpproject should be preferred over the other. Based on the ARR, Emily Hansen chosen 3. How much did the company in Scenario c invest in the project? 4. What is the average net income earned by the project in Scenario d