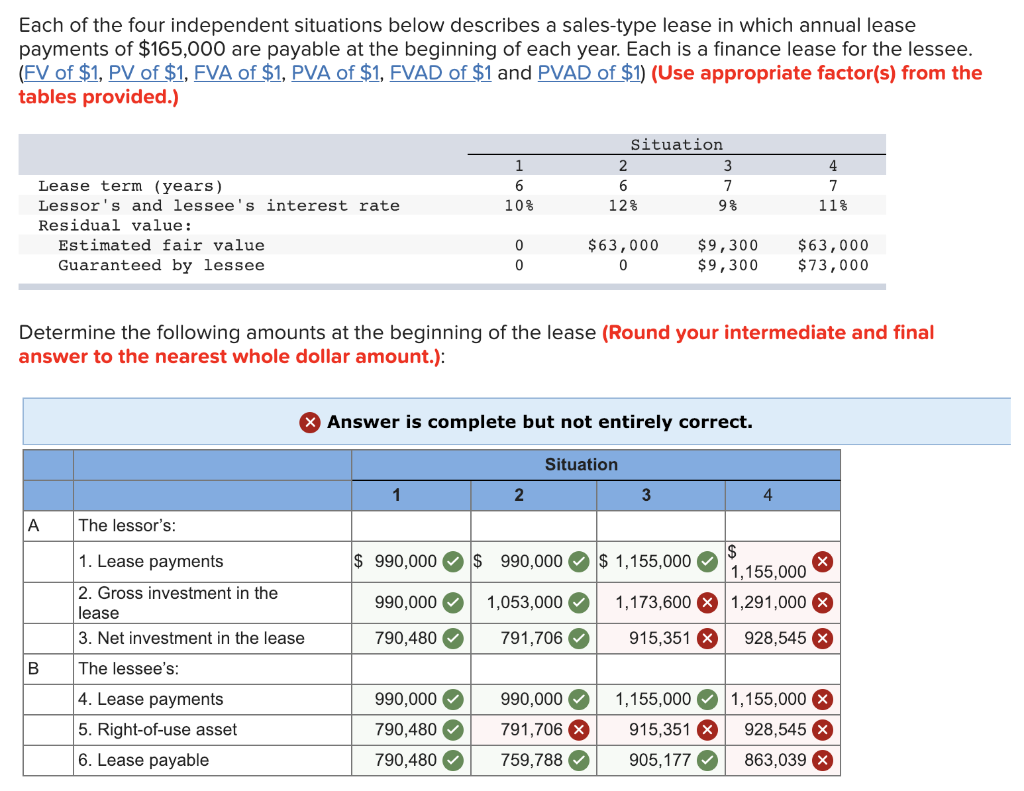

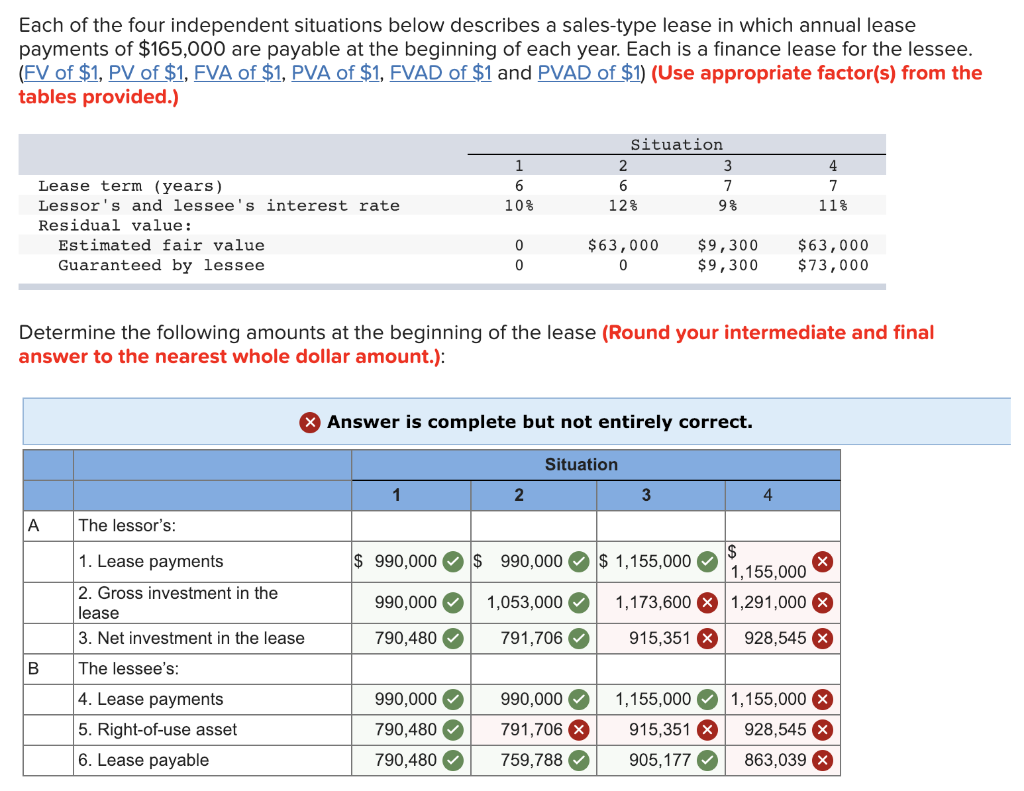

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $165,000 are payable at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation 2 Lease term (years) Lessor's and lessee's interest rate Residual value: 10% 12% 9% 11% Estimated fair value Guaranteed by lessee $63,000 $9,300 $63,000 $9,300 $73,000 Determine the following amounts at the beginning of the lease (Round your intermediate and final answer to the nearest whole dollar amount.) Answer is complete but not entirely correct. Situation 2 3 A The lessor's: $ 990,000 990,0001,155,000 1. Lease payments 2. Gross investment in the lease 3. Net investment in the lease 1,155,000 990,0001,053,0001,173,6001,291,000 790,480 791,706915,351 928,545 B The lessee's: 4. Lease payments 5. Right-of-use asset 6. Lease payable 990,000 990,0001,155,000 1,155,000 928,545 790,480 759,788905,177863,039 790,480 791,706 915,351 Each of the four independent situations below describes a sales-type lease in which annual lease payments of $165,000 are payable at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation 2 Lease term (years) Lessor's and lessee's interest rate Residual value: 10% 12% 9% 11% Estimated fair value Guaranteed by lessee $63,000 $9,300 $63,000 $9,300 $73,000 Determine the following amounts at the beginning of the lease (Round your intermediate and final answer to the nearest whole dollar amount.) Answer is complete but not entirely correct. Situation 2 3 A The lessor's: $ 990,000 990,0001,155,000 1. Lease payments 2. Gross investment in the lease 3. Net investment in the lease 1,155,000 990,0001,053,0001,173,6001,291,000 790,480 791,706915,351 928,545 B The lessee's: 4. Lease payments 5. Right-of-use asset 6. Lease payable 990,000 990,0001,155,000 1,155,000 928,545 790,480 759,788905,177863,039 790,480 791,706 915,351